Plans and Features

From retirement plan design to onboarding to bundled recordkeeping and third-party administration (TPA) services, Paychex takes care of the details so you can focus on working with your clients.

Why Paychex for Financial Advisors?

In today’s changing regulatory landscape, we offer products and solutions designed to help you and your clients manage fiduciary risk, with expert service to foster success.

- Bundled payroll and retirement integration

- Standalone plans

- Third-party administration (TPA)

- Traditional 401(K), Safe Harbor, SIMPLE IRA and more

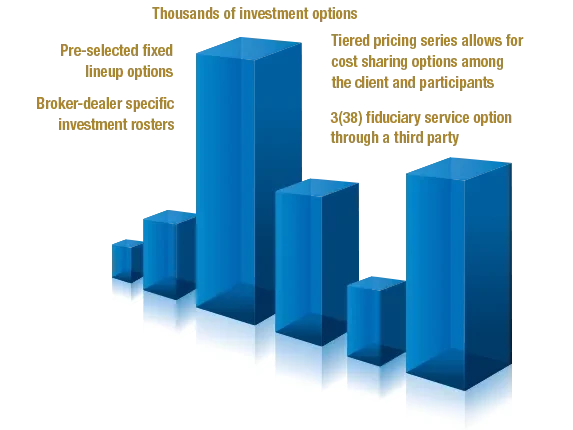

- Thousands of investment options to choose from

Partner with Paychex

Make Retirement Easier for Your Clients

As the nation’s number one recordkeeper*, Paychex offers a wide range of traditional 401(k) and Safe Harbor plans, 403(b), profit-sharing plans, and more. Completely investment-neutral, we have thousands of investment options to choose from. Plus, tiered pricing for cost-sharing options, 3(38) investor management, online auto-enrollment and more.

Seamless Recordkeeping & TPA Services

All-in-one bundled payroll integration service offers Paychex clients a greater level of convenience. We also provide recordkeeping and third-party administration (TPA) services, bundled or standalone.

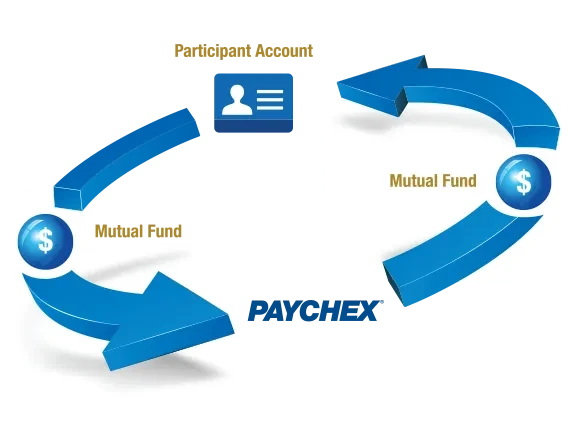

Fairness, Transparency, and No Hidden Fees

Our fee-levelized 401(k) feature ensures unbiased investment options and fee transparency. Paychex does not keep the revenue-sharing payments, or “concessions”, that mutual funds routinely give to recordkeepers and TPAs. Instead, payments go to the participants.

Online Plan Management - Access Plans from Anywhere

See all your Paychex plans and total AUM in one place — and on the go — via desktop, tablet, or smartphone. Plus, manage your clients’ plans and investments and access your full book of business with Paychex in our easy-to-use Advisor Console.

Plan Set-Up with Hassle-free Onboarding

Since Paychex onboards thousands of 401(k) plans each year, we know how to make the process of starting or converting a retirement plan smooth and trouble-free. A dedicated implementation manager will guide plan sponsors through onboarding, enrollment, training and more.

Fiduciary Solutions for Every Type of Client

3(38) Investment Management

A third-party 3(38) fiduciary assumes responsibility for all investment activities. They have full discretion to choose, manage, or remove investments within the employee benefit plan.

3(21) Investment Guidance

A third-party fiduciary provides a list of appropriate investments for you and your client to choose from.

3(16) Plan Administration

The third-party 3(16) fiduciary is responsible for day-to-day administration, including filing Form 5500, monitoring plan operations, distributing annual notices, and approving distributions, and loan requests.

Custodial and Trust Services

This Paychex solution offers the safekeeping of assets, including reconciliation and reporting.

Fee-Levelized 401(k)

This feature ensures unbiased investment options, no hidden fees, and equalization of fees for all participants.

See our fiduciary checklist to see if your clients have everything they need to be a plan sponsor.

Partner with Paychex

With Paychex in your corner, you’ll be able to advise more and administer less. Talk to us about our full spectrum of retirement products and solutions.