A Simple Approach to Payroll, HR, and Benefits

Hire, pay, manage, and retain employees with confidence.

Why Approximately 740,000 Businesses Use Paychex

Featured solutions to help you manage payroll, HR, benefits, and more.

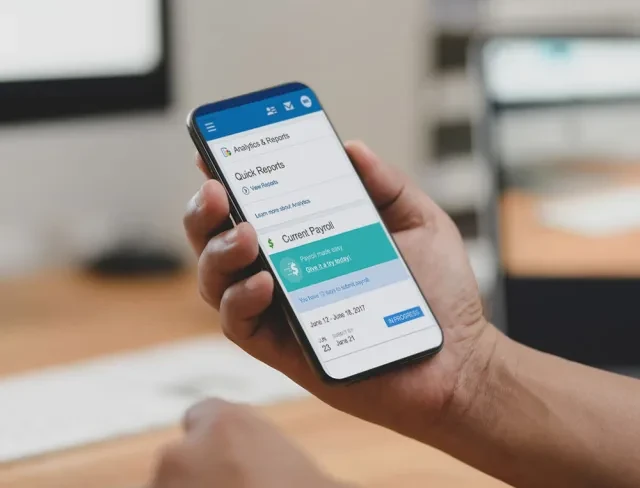

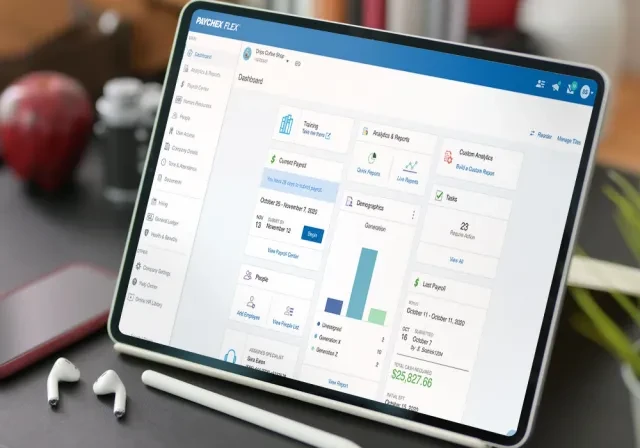

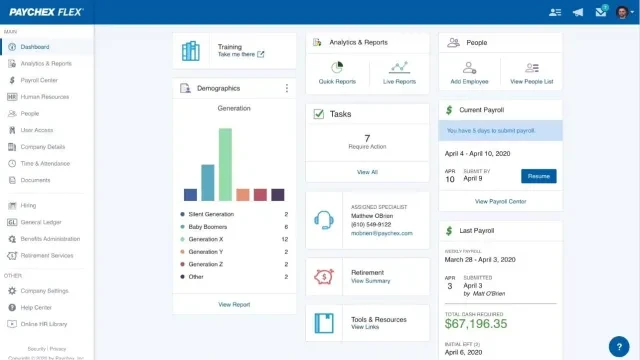

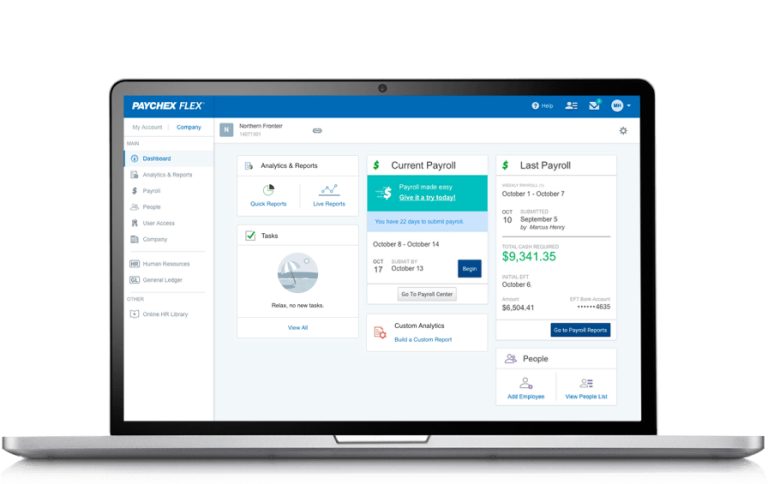

One Platform for Your HR, Payroll, and Benefits

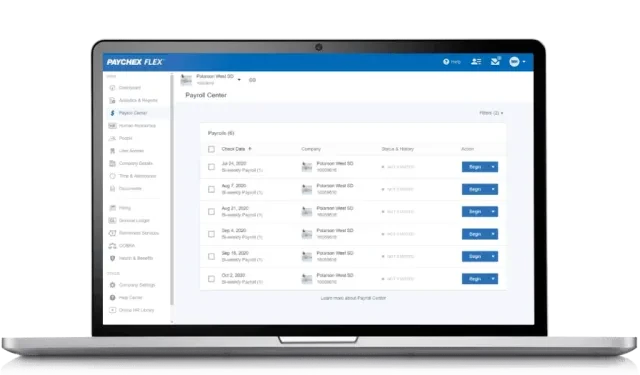

Pay Employees Your Way and Automate Tax Payments

- Enables faster, more accurate payroll processing

- Calculates, files, and submits your payroll taxes

- Simplifies HR & benefits with payroll integration

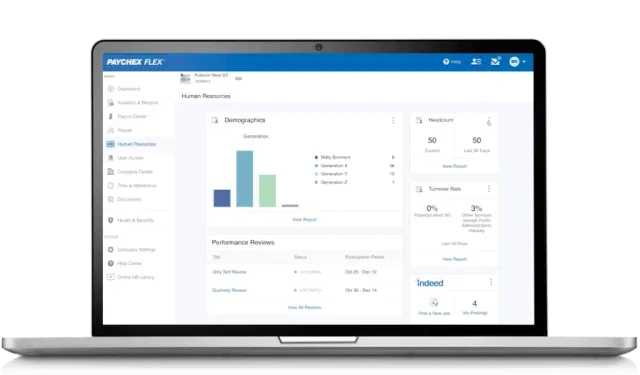

Hire, Onboard, Manage, and Develop Productive Employees

- Single solution for recruiting to retirement

- Dedicated HR professionals

- In-app help, chat, and phone support, 24/7

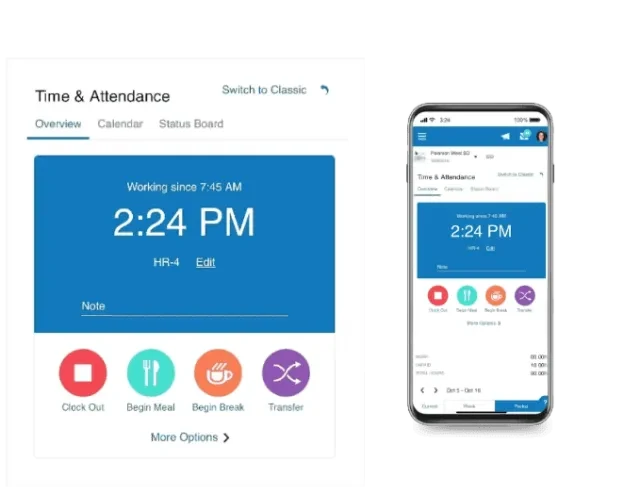

Track Employee Time and Maximize Payroll Accuracy

- Automate time tracking: improve speed & accuracy

- Improve productivity: Track actual employee hours

- Enter time anywhere: office, online & smartwatch

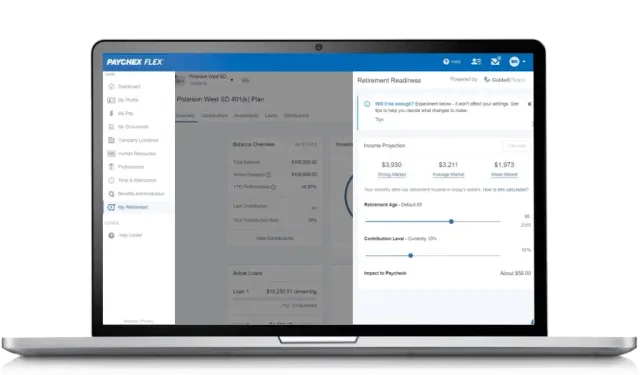

Help Employees Save for Retirement and Reduce Taxable Income

- Top 401(k) recordkeeper: more plan experience1

- Easy plan set up for you + employees

- Simple to switch retirement plan to Paychex

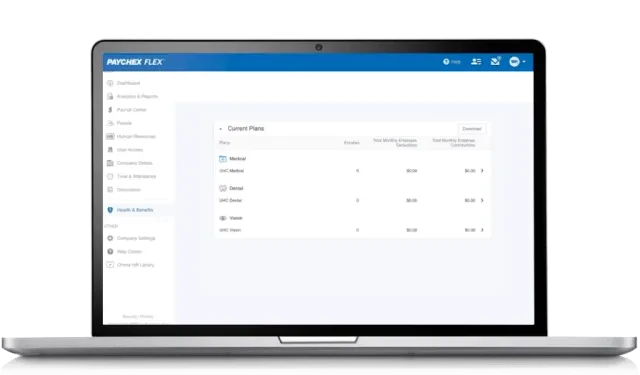

Offer Health, Dental, Vision and More to Recruit & Retain Employees

- Partnering with top-tier national/regional carriers

- Offers benefits employees & families value most

- Decades of experience

HR and Payroll Solutions by Business Size

Find the Right Solution

Answer a few short questions, and we’ll recommend the right services for your business.

Hear From Some of Our Customers

If you are looking to outsource, Paychex can help you manage HR, payroll, benefits, and more.

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."

“Being able to promote the jobs that we have with the different platforms that Paychex has, to get our jobs out there and recruit more people, they’ve made the onboarding process a lot easier for us to hire as quickly as possible.”

“In working with Paychex, it has given me the freedom to work on the business knowing that our payroll is being taken care of and being managed day to day, and I don’t have to worry about it, which is beautiful.”

“We had a different kind of workers' compensation program and I found out very early on that when you don't have an eye on it right throughout the year, it can add up. [Now] we know exactly what we're paying at the end of the year and it's honestly helped us so much for our budgeting.”

"In order for my business to do well, I basically have to pay lots of attention to the quality, the training, the employees. So, considering all of this, I am very happy I am with Paychex because they are making it easy for me."

You Drive Auto Stays on Growth Fast Track with Help from Paychex HR

“Honestly, the best part of (having a dedicated HR Professional) is that he’s doing what’s best for your business, taking in the whole picture, asking what our opinion is, what we would like to have done. He feels like he’s part of the team, and we feel like he’s part of the team.”

— Tony Caldwell, Co-founder and VP of Operations, You Drive Auto