- Beneficios para empleados

- Artículo

- Lectura de 6 minutos

- Last Updated: 01/12/2026

The Tax Savings of Offering a Retirement Plan

Table of Contents

Whether you have employees or work alone, you can reap significant tax savings by offering a qualified retirement plan. Tax savings benefit the employer, employee, and self-employed individual. You can get a general idea of the overall tax savings using an online calculator, taking into account such variables as state and local income tax rates, as well as contribution amounts. The following explains how tax savings are derived.

Overview of Tax Savings

There are two basic aspects to tax savings related to retirement plans:

- Tax savings for making contributions

- Tax savings from deferring tax on earnings

There is also the opportunity to create tax-free income (explained later).

Tax Savings for Making Contributions

Employers, employees, and self-employed individuals reap tax savings from contributing to a qualified retirement plan.

Deductible contributions. Employers contributing to qualified retirement plans can deduct the contributions. The deduction reduces the employer's taxable income. For a self-employed individual, contributions for his or her employees are deductible from business income. Contributions for self-employed individuals' own accounts are also deductible, but only as an adjustment to gross income. While not taken as a business expense, self-employed persons are effectively sheltering their profits in a retirement savings plan by making contributions to their plans.

Salary reduction contributions. An employee is not taxed on salary reduction contributions to 401(k), SIMPLE IRA, and other similar plans. For example, in 2026, an employee with a 401(k) can contribute up to $24,500 ($32,500 if age 50 or older by year-end and $35,750 for individuals ages 60-63). The contribution reduces the compensation on which income tax is paid.

Employment taxes. There are no Social Security or Medicare (FICA) taxes on employer contributions. This includes employer-matching and non-elective contributions to employees' 401(k) and SIMPLE IRA accounts. However, employees' salary reduction contributions, while exempt from income tax withholding, are subject to FICA taxes on both the employee and employer.

Deferral of Tax

Tax deferral means that taxes need not be paid until distributions are received. Deferral allows for greater investment growth within the account because the funds are not diminished annually for taxes that would otherwise be paid on a taxable account.

For example, if an employee contributed $5,000 via a salary reduction contribution per year and did not touch it for 30 years rather than taking the compensation as taxable income, the savings would be more than $28,000 in taxable income during that period ($943/year for 30 years) based on a 22 percent income tax bracket. [These calculations are based on our retirement calculator.]

Of course, there will be a day of reckoning tax-wise when distributions are taken, but under the rules for required minimum distributions (RMDs), the distributions generally don't have to begin until age 73 or retirement (if later and the plan allows it). What's more, the distributions can be spread out over a lifetime. For many who take distributions in retirement, they find themselves in lower tax brackets than in the years in which they received the contributions and investment earnings on those contributions. While there is no guarantee that employees will be in lower tax brackets (future tax reform could change tax brackets), it is unlikely that many will be in higher tax brackets.

Designated Roth Accounts

If you have a 401(k) plan, you can permit employee contributions to a designated Roth account. These are similar – but not identical – to Roth IRAs. Contributions are made by employees on an after-tax basis (no employer contributions can be made to these accounts), but distributions can become entirely tax-free. Employers can match on Roth deferrals.

Contributions to designated Roth accounts do not have income limitations, as in the case of Roth IRAs. Thus, even high-income participants can use designated Roth accounts to create tax-free income for the future.

Tax Credit for Starting a Plan

One of the main reasons small-business owners give for not offering retirement plans, according to Paychex representatives, is the administrative costs. This problem can be addressed with the tax savings from claiming a federal income tax credit available to small businesses through the SECURE Act. Businesses with 100 or fewer employees who received at least $5,000 in compensation in the previous year may be eligible for a total of $16,500 in credit over three years ($5,000 per year and an additional $500 per year for implementing auto-enrollment) that can be used to more than offset the administrative setup costs of a workplace retirement plan.

Under the SECURE Act 2.0, which became law in late December 2022, an additional credit is available of up to $1,000 per employee. The employer contribution credit is generally a percentage of the amount contributed by the employer. It is limited to employers with 50 or fewer employees and reduced for employers with between 51 and 100 employees.

The credit cannot be used by self-employed individuals for their own plans, or for owner-employees who do not have non-highly compensated employees participating in their plans.

Conclusion

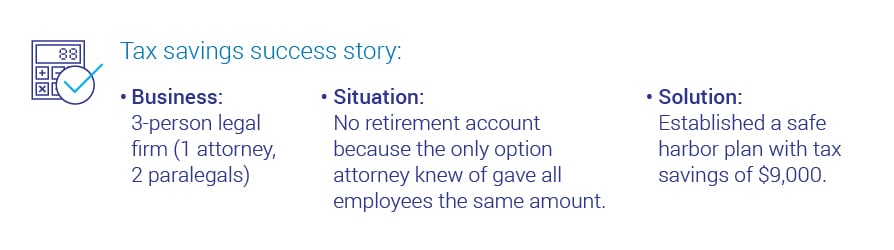

While tax savings can be significant to employers, employees, and self-employed individuals, there are tax traps that can trigger significant tax penalties (e.g., excess contributions, prohibited transactions, early distributions, excess accumulations). Balance the tax savings and other benefits of offering a retirement plan (such as attracting and retaining good employees) against potential costs; likely the tax savings will win out.

Tags