- Recursos humanos

- Artículo

- Lectura de 6 minutos

- Last Updated: 02/21/2025

Key Forms To Review During New Employee Orientation

Table of Contents

Paperwork is a necessary component of the new employee orientation process. At the same time, it can be a stumbling block where the new hire feels overwhelmed by HR and other forms.

One solution is employing an integrated HCM solution, which can result in less time spent collecting paper forms and provide more time for other onboarding activities. In today's digital era, there are numerous tools, technology, and resources available that enable employees to complete needed paperwork – much of it prior to that all-important first day – while tracking the time it takes to enable employers to comply with wage and hour requirements.

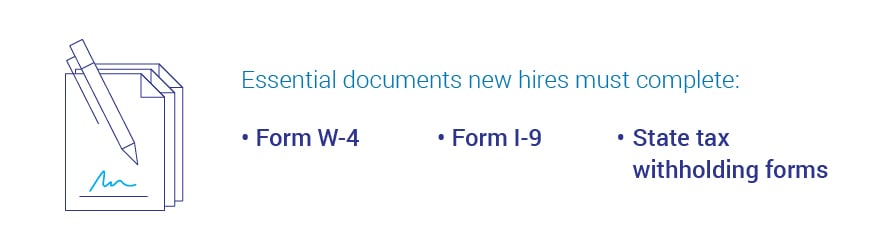

Though the range of forms may vary from company to company, certain essential documents must be completed by new hires in virtually all circumstances. These include:

W-4 Federal Income Tax Withholding Form

A new employee must complete and sign a withholding exemption certificate (Form W-4). This outlines the amount of taxes to be withheld from their wages.

Form I-9 Employment Eligibility Verification

This document is required to establish an employee's eligibility to work in the United States. The form verifies an employee's identity and employment authorization by requiring specific documentation. Take note of key changes to Form I-9.

Form I-9 for each employee hired must be retained by employers.

State Tax Withholding Forms

Depending on the state, it may be necessary to have the new hire complete a state income tax withholding form.

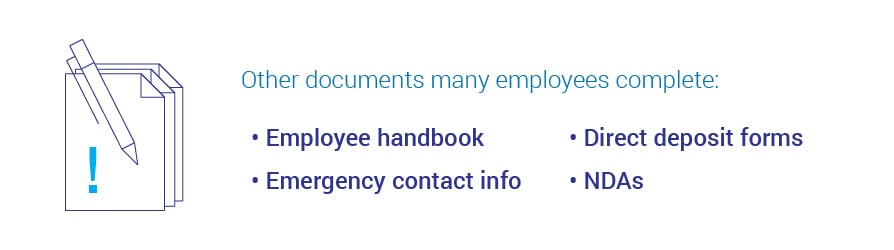

Additionally, many employers also have employees complete the following:

Employee Handbook

A customized, easy-to-use employee handbook can be one of the best ways to communicate workplace policies. As part of the new employee orientation process, give new hires time to review the contents of the handbook and collect a signed acknowledgment. This certifies that your new employee fully understands your company's policies and procedures, and agrees to abide by them.

Emergency Contact Information

While not required by law, it's a good idea to collect every new hire's emergency contact information as soon as possible. In the event of an injury, medical crisis, or some other unforeseen situation, being able to contact an employee's chosen individual can help everyone concerned.

Direct Deposit Form

Many employers offer their employees the option of being paid via direct deposit. It’s a secure, convenient method to pay employees electronically. Payroll funds are deposited into employees' accounts so they can access their wages immediately, while, for employers, all direct deposit amounts can be reconciled on payday. There may also be savings incurred by not using paper checks.

Nondisclosure Agreements (NDA)

Depending on the nature of your business, the location of the business and the employee’s position, it may be a good idea to have the new hire sign a nondisclosure agreement, particularly if their job entails using or reviewing delicate and proprietary information. This document should be reviewed by legal counsel and can help ensure confidentiality, as well as formally notify employees that business-related products and intellectual property belong to the company.

Tags