- Recursos humanos

- Artículo

- Lectura de 6 minutos

- Last Updated: 06/26/2025

How To Calculate Total Compensation for Employees

Table of Contents

Employees often consider their total compensation to be the same as the amount on their paycheck. But in reality, compensation goes far beyond hourly wages or annual salaries. The total compensation you provide to your employees includes both direct wages and indirect compensation like health benefits, retirement plans, PTO, and career development programs.

When determining how much you can offer for a position, you should consider all of these elements. While estimating the value of wages plus benefits on a monthly or annual basis may seem difficult, a total compensation calculator can simplify the process. As you add each contributing factor, you'll gain a better understanding of the true compensation value employees receive in exchange for their hard work.

What Is Total Compensation?

Total compensation is defined as all types of payment an employee receives in exchange for the work they do. A well-rounded compensation strategy should consider all forms of compensation, from base pay to bonuses, incentives, and benefits.

"Think of total compensation as the full value of what you offer your employees," explains Jessica Vitous, a Talent Enablement Partner at Paychex. "This goes beyond their paycheck. Total compensation encompasses the complete value of all forms of remuneration, including both direct and indirect components."

What's Included in a Total Compensation Package?

An employee's total compensation includes both direct and indirect forms of pay. Written compensation plans can help standardize these elements and provide guidance across positions and business lines. Each employee should receive a total compensation package that aligns with the policies and guidance in the compensation plan.

Direct Compensation

Direct compensation refers to monetary payments and cash benefits that an employee receives. This typically includes:

- Base pay, such as hourly or salary pay

- Commissions

- Incentives and bonuses

- Overtime pay

Indirect Compensation

Indirect, or non-monetary, compensation covers all other non-cash benefits available to the employee. Indirect compensation varies based on the company, role, and other factors. It may include:

- Paid time off (PTO)

- Health insurance

- Retirement savings

- Fringe benefits (e.g., wellness programs, gym memberships, legal services)

- Employee stock options

- Career development or training programs

- Tuition assistance

- Technology allowance (cell phone, laptop)

- Vehicle allowance (company car)

- Commuter benefits and support

- Childcare assistance

- Employee rewards

- Flexible work arrangements

To calculate total compensation, add the estimated value of non-monetary benefits to the employee's direct compensation.

Total Compensation vs. Salary

While salary can be an important aspect of compensation, total compensation provides a more complete view of the value an employer offers. By strategically designing a competitive total compensation package, companies can manage costs effectively, attract and retain top talent, and foster a motivated and satisfied workforce.

Indirect compensation components can sometimes be the deciding factor between two equally attractive jobs offering similar salaries. For example, a job candidate may value stronger health care benefits or a better retirement plan more than a slight increase in annual salary. Providing an overview of benefits and perks could give you a competitive advantage over employers who merely communicate a target base pay.

Why It's Important To Know How Much Your Compensation Package Is Worth

Knowing the value of your compensation package is critical for several reasons:

- Budgeting: Indirect compensation costs add up quickly. Calculating total compensation helps you plan your budget accurately as you develop your compensation strategy. When managing compensation, employers may need to weigh the cost of certain benefit programs against increased employee wages. For example, smaller companies that need to stretch their compensation budget can showcase the value of their benefits along with the wages they offer.

- Recruiting: Competitive pay and benefits are important factors in attracting top talent. To keep a competitive edge, employers should consider offering a benefits package that addresses the varying needs and preferences of their workforce. This may include mental health support, flexible work arrangements, or financial counseling in addition to standard benefits.

- Retention: Because benefits aren't always easy to quantify, it's easy for employees to focus primarily on payroll dollars rather than programs or perks. Highlighting the value of available benefits can help employees feel valued and satisfied in their roles.

How To Calculate Total Employee Compensation

When assessing an employee's total compensation, you'll need to include all sources of direct and indirect pay. Here's how to calculate it accurately:

Total Compensation = Direct Pay + Indirect Compensation

- Add up all direct pay (base salary, bonuses, commissions, overtime pay, etc.).

- Calculate the value of indirect compensation. Include health insurance, retirement contributions, PTO, stock options, and any other benefits.

- Combine the two amounts to find the total compensation amount.

Total Compensation Example: Step-by-Step Calculation

Let's walk through a realistic example to see how total compensation adds up.

Sarah is a marketing manager who receives an annual base salary of $75,000. She also receives an annual performance bonus of $8,000, giving her a direct compensation of $83,000 per year.

Added to her direct pay, Sarah receives indirect compensation of $21,469 from the following benefits:

- Health Insurance (employer portion): $9,000

- Dental Insurance: $600

- 401(k) Match (6% of salary): $4,500

- Paid Time Off (20 days × daily rate): $5,769

- Professional Development Budget: $2,000

- Gym Membership Reimbursement: $600

Sarah's employer would calculate her total compensation like this:

$83,000 (Direct) + $21,469 (Indirect) = $104,469 Total Compensation

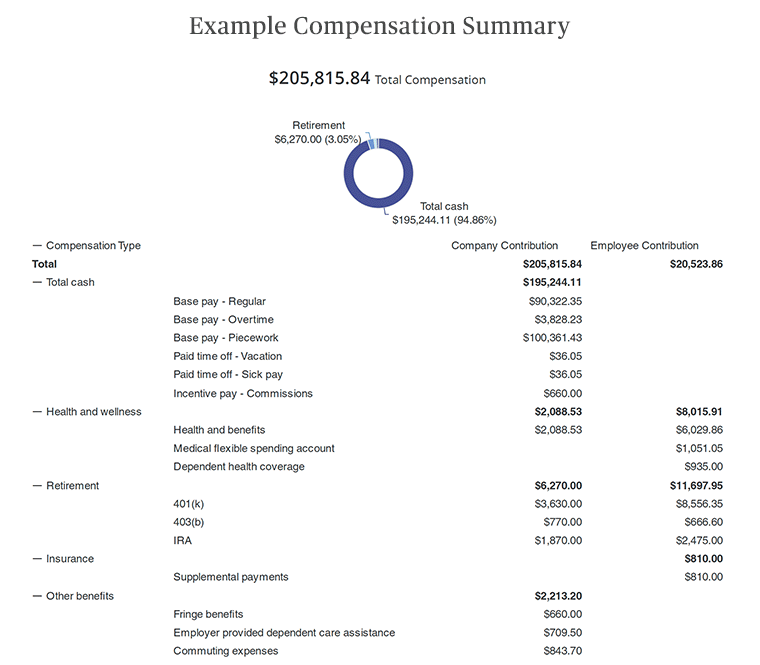

Below is another example of a full total compensation summary broken down.

Example Compensation Summary provided for demonstration purposes only.

Stay Competitive by Knowing the Worth of Your Compensation Package

Employers make a significant investment in their employees that goes beyond base wages. Calculating and optimizing total compensation for each employee helps your business remain competitive and attract the best talent in your industry. If you need further assistance with compensation planning or calculating total compensation, our HR services experts are here to provide support and guidance.

Tags