Professional Employer Organization (PEO) Services

Help attract and keep employees, offer world-class benefits, simplify payroll, and more.

What Is a Professional Employer Organization?

A PEO is an all-in-one HR solution that helps make it easier for you to manage employee benefits, HR, payroll, and compliance. Working with a PEO offers many benefits to businesses like yours, such as:

- Simplifying HR tasks to focus on what matters most

- Offering Fortune 500-level benefits more affordably

- Access to HR advice and guidance on specific issues

Featured PEO Services

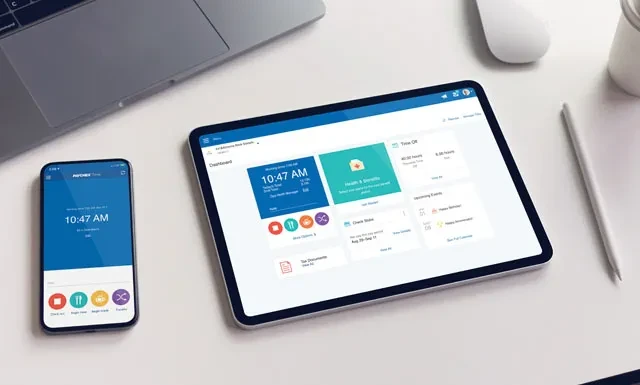

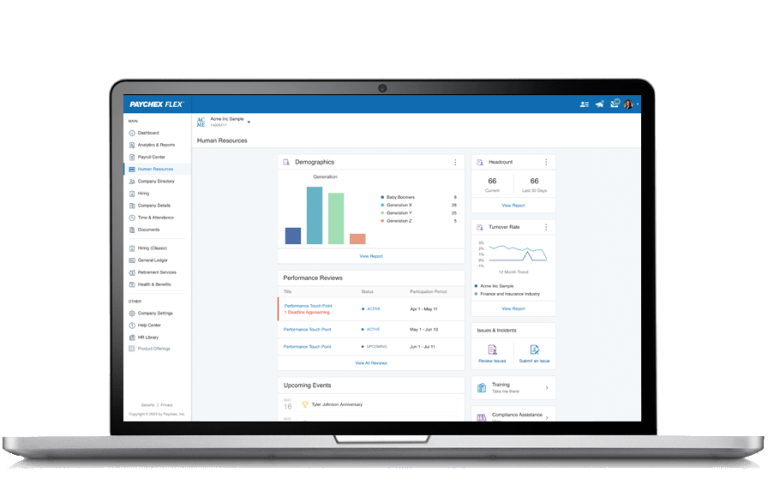

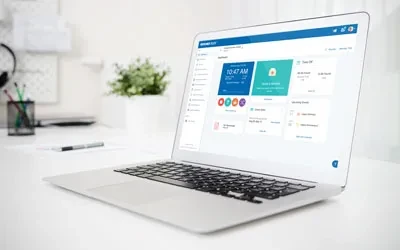

Access All-in-One HR Technology

According to our survey, nearly 70% of business leaders say they spend more than one week each month on HR tasks.2 Save time and money by managing HR, payroll, and benefits administration tasks with tools and insights from a single technology platform.

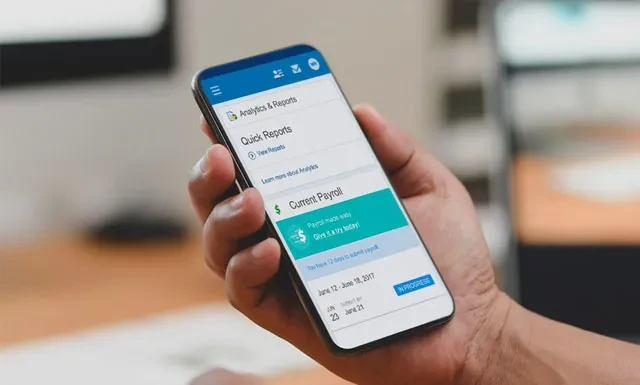

Help Pay Employees Accurately and On Time

Process payroll anytime, anywhere, from desktop or mobile, or over the phone with a dedicated payroll specialist. We’ll also help you file federal, state, and local payroll taxes and send payment to the appropriate agencies.

Offer World-Class Benefits

Gain a competitive edge with valued employee benefits that rival those of Fortune 500 companies. We offer access to plans that you sponsor and plans that Paychex sponsors, offering customization and opportunities to save time on plan administration.

Help You Reduce Risk and Maintain Compliance

Create effective action plans to help you comply with business and industry regulations and keep employees safe at work.

Focus on Your Core Business

Get proactive HR advice from a dedicated HR professional supported by a team of subject matter experts, so you can better navigate business challenges.

Value of a PEO

Working with a PEO provides all-in-one HR technology and support to help your business save time and money. The value of a PEO comes from its ability to help you:

- Hire and keep employees

- Reduce administrative costs

- Increase productivity and profitability

HR and Business Cost Savings Calculator

Our calculations reflect NAPEO's PEO research, showing:

- 27.2% ROI on average

- Lower employee turnover (by ~10-14%)

- Faster growth and higher survival rates

- PEO customers save an average of about $1,775 per employee per year in HR-related costs.

*Results shown are estimates based on information you provide, third-party sources, and assumptions. They are not guaranteed, a quote or offer to provide services, or part of any contract. Actual costs of services depend on many factors, some of which may not be included in the calculator.

Why Paychex PEO Is Ideal

Support From a Team of Professionals

Our PEO provides comprehensive HR outsourcing services supported by personalized HR guidance. We provide proactive HR advice from a dedicated HR professional who will get to know your business and provide recommendations, as well as access to other experts on payroll, recruitment, safety, benefits, and workers’ compensation.

We Help You Solve Your Specific HR Challenges

Whether you have five employees, or 5,000 employees, each of our HR solutions is built to grow with you. Our solutions are customizable to help meet your business’s unique needs, catering to your size, industry, location, goals, and culture.

Proven Technology To Support Your HR Processes

Simplify HR functions such as talent management, benefits administration, and employee safety with robust analytics that may provide insights to improve efficiency and free up your time and resources. Paychex was honored with gold and bronze medals for excellence in technology from the Brandon Hall Group in 2022.

Work With a Leading HR Provider

For more than 50 years, Paychex has been working with business leaders to support their HR needs. We bring together the knowledge, people, and technology to support you and your employees throughout the entire employee lifecycle, from finding and keeping talent to delivering world-class benefits and payroll services, and helping you maintain compliance.

Workers’ Compensation Plans and Payment Service

We offer a workers’ compensation payment service option that allows you to pay premiums based on actual wages — not estimates — to help eliminate big premium deposits and improve your cash flow.

Improve Employee Retention and Save on HR Costs With Paychex

California Pharmacy Finds Compliance Headaches Lessened With Paychex PEO

Businesses struggle to keep up with the numerous regulations in California. Pharmacists Nihar and Kirti Mandavia wanted to ensure when they became owners of The Druggist Pharmacy that they mitigated any potential missteps regarding compliance. Working with Paychex PEO has helped tremendously, plus it has given them options to improve their recruitment and retention efforts.

“With Paychex taking care of HR side of the business, my wife and I can focus on growing the business, being profitable, taking care of the employees, and taking care of the customers. To me, the Paychex impact has been tremendous.”

Answers to Your Frequently Asked Questions

-

What Types of Organizations Work With a PEO?

What Types of Organizations Work With a PEO?

We work with businesses of all sizes and can tailor our services to meet your unique needs. We support many HR-related administrative tasks so you can stay focused on your business and your team. The best PEO companies are a good fit for businesses interested in improving performance and retaining and engaging employees.

-

How Are PEO Services Delivered?

How Are PEO Services Delivered?

Each business has its own specific needs, so the Paychex HR PEO team includes professionals who can help with everything from HR administration tasks to payroll, benefits, workers’ compensation, and more.

- Relationship Manager – Your strategic partner helps optimize Paychex HR PEO to meet your specific business needs.

- HR Professional – Provides guidance for your strategic HR needs, helps address your business goals and create a supporting strategy. Your HR professional can also consult with you on employee relations and performance management, and will be your contact for the annual benefits enrollment process.

- Payroll Specialist – Supports payroll-related activities, including payroll processing, garnishments, time and attendance, and production of W-2s.

- Employee Benefits Specialists – Provide support and ongoing consultation on benefits packages, contribution strategy, and ancillary benefits – over the phone and through email.

-

Do I Need To Use All of a PEO’s Services?

Do I Need To Use All of a PEO’s Services?

As part of our client service agreement, a PEO company supports tasks in HR, payroll, benefits, and risk management. Additional services are available on an a la carte basis, and we can help you make selections that meet your specific business needs.

-

How Does the PEO Company Relationship Work?

How Does the PEO Company Relationship Work?

The client remains the employer, maintains control of the business, and oversees all business decision-making, including employee supervision and staffing decisions. The PEO helps to support administrative tasks associated with human resources services, payroll, employee benefits administration, and risk management.

-

What Is the Difference Between Employee Leasing and PEO Providers?

What Is the Difference Between Employee Leasing and PEO Providers?

While an employee leasing company provides a business with temporary workers who may perform work for a specified time, a PEO helps you handle HR administration tasks for your own workforce that you hire and manage. Throughout the entire PEO relationship, your workforce remains under your control.

-

What Is Co-Employment?

What Is Co-Employment?

Generally speaking, you and your PEO will sign a service agreement to establish responsibilities. The PEO can provide access to Fortune 500-level benefits and workers’ compensation coverage. When working with a PEO, you maintain control of your business operations and decision-making, including employee supervision and staffing decisions. The PEO assists with certain HR administrative tasks, administering benefits, processing payroll and payroll tax reporting, providing compliance support, helping you to maintain compliance, and improving workplace safety. This helps to ease the burden of traditional HR responsibilities, so you can focus on running your business.

-

Why Would a Business Use PEO Software?

Why Would a Business Use PEO Software?

PEO service providers can help businesses save time and money on HR related tasks, payroll processing, and employee benefits. Paychex can also provide proactive HR advice from an HR professional on a business’s specific HR issues. With its comprehensive services, PEO software makes it easier to complete many common business tasks with technology and support from a single solution.

-

Can My Business Benefit From Working With a PEO?

Can My Business Benefit From Working With a PEO?

Working with a professional employer organization can bring value to your business in the areas of human resources administration, employee benefits, payroll processing, and risk management. Our comprehensive PEO focuses on these core administrative areas for you, allowing your business to benefit and become better positioned to:

- Attract and retain talent — We can help you to offer programs and benefits that help you to recruit and retain the very best employees in today’s marketplace.

- Focus on your core business — We can provide support for many of your HR and payroll administrative tasks.

- Deliver world-class benefits — We can help you design a benefits package that will enable you to compete with Fortune 500 companies for the best employees.

- Reduce risk — We help keep you informed of complex employment laws and offer risk management strategies.

- Access leading technology — Our best-in-class technology helps make it easy to manage human resources, payroll, and benefits.

-

How Does a PEO Control Costs?

How Does a PEO Control Costs?

A PEO has the buying power to help businesses offer benefits more affordably by combining the employees of multiple businesses into a single group. It can also help improve cash flow by offering the ability to calculate workers’ compensation premiums based on actual wages, not estimates. Their technology also helps businesses improve the cost-efficiency of their HR processes.

-

How Much Does a PEO Cost?

How Much Does a PEO Cost?

The cost of a PEO may depend on many factors, such as employee benefits offered, insurance, workers’ compensation, state unemployment insurance (SUI), number of employees, and administration fees.

That is why it’s important to request pricing and discuss needs and options on a business-by-business basis. When a proper cost estimate is calculated, it is then easier to determine the potential cost savings a PEO could provide and how it may justify the PEO cost by paying for itself over time. -

What Is the Return-on-Investment (ROI) of a PEO?

What Is the Return-on-Investment (ROI) of a PEO?

Businesses may receive a significant ROI from working with a PEO by saving over time on HR, payroll, and benefits management costs. Research from the National Association of Professional Employer Organizations (NAPEO) has found that using a PEO reduces employee turnover by 20%; saves 27% on HR-related costs — up to $1,775 per employee, per year; and significantly reduces the cost of health benefits compared to businesses that do not use a PEO.1