Self-Employed & Sole Proprietor Business Solutions

As a solopreneur, you don’t have to do it alone. Paychex helps owner-only businesses (independent contractors, freelancers, and other self-employed individuals) succeed by offering:

- Solo 401(k) plan for significant retirement savings potential

- Self-employed payroll and tax services to help you minimize tax liability

- Flexible customer support options for ongoing assistance

Maximize Savings on Taxes, Payroll, and 401(k)

In 2026, you can set aside up to $72,000 (limit is the total an employee can receive from all contributions).

Solutions to Help Your Business

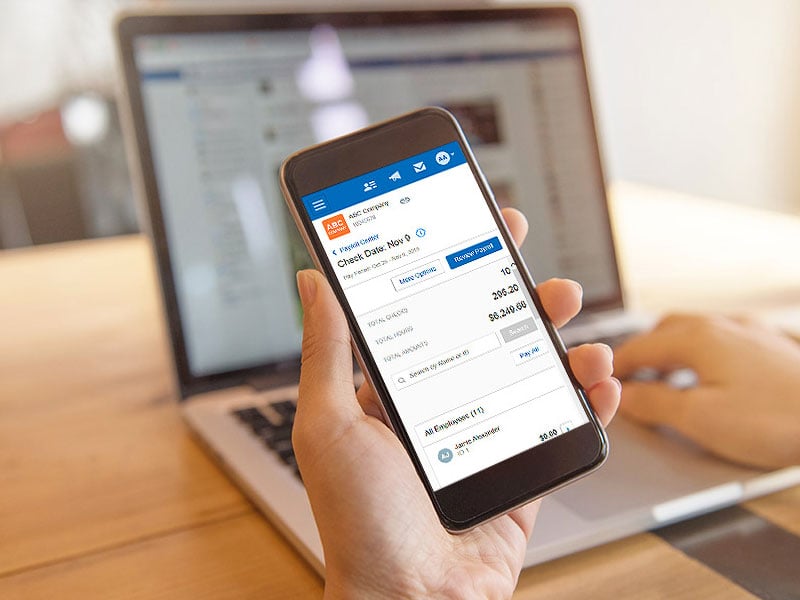

Payroll for One Employee

Take care of payroll for one employee easily and free up time to focus on managing your daily business operations. Our all-in-one platform grows alongside your business, adapting to your needs every step of the way.

Incorporation and Startup Services

We partner with MyCorporation® to offer the following services to help add legitimacy to your business and more:

- State IDs

- Business licenses (DBA or city business license)

- Corporate formations

- Federal tax IDs

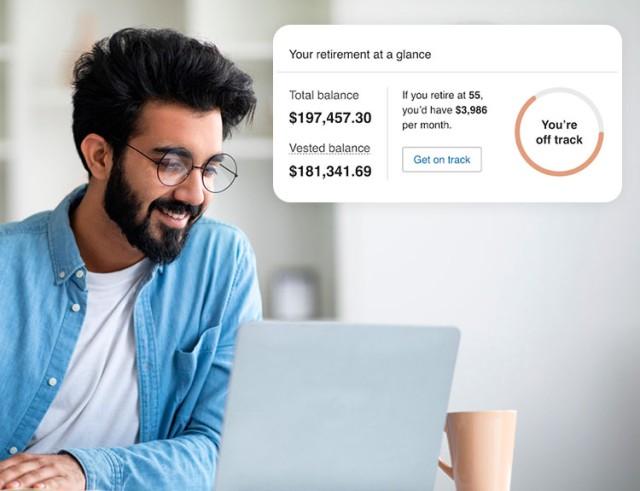

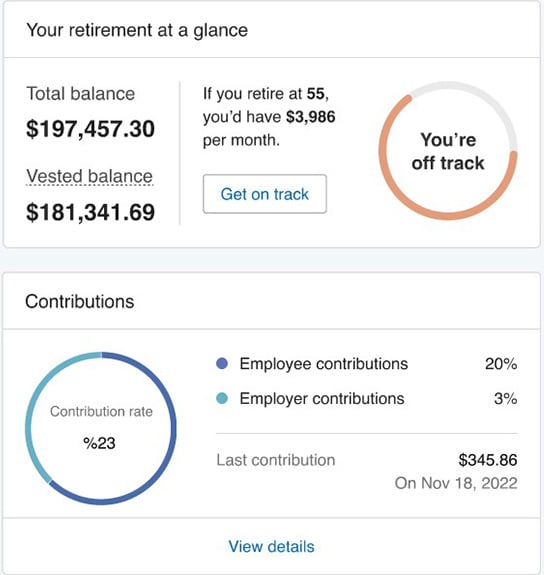

Self-Employed 401(k) Services: Start Earlier and Potentially Save More

Paychex offers owners-only businesses the chance to make significant 401(k) contributions as both employer and employee – making the most of your retirement contribution and tax breaks on business deductions.

Integrated Payroll Services for Self-Employed Businesses With Future Scalability

Integrating your 401(k) with payroll services means your solo 401(k) contributions are withdrawn on a pre-tax basis, allowing you to build your retirement savings while saving on federal and state taxes. If you ever decide to hire workers, our payroll software for independent contractors and solopreneurs can scale with your growing business.

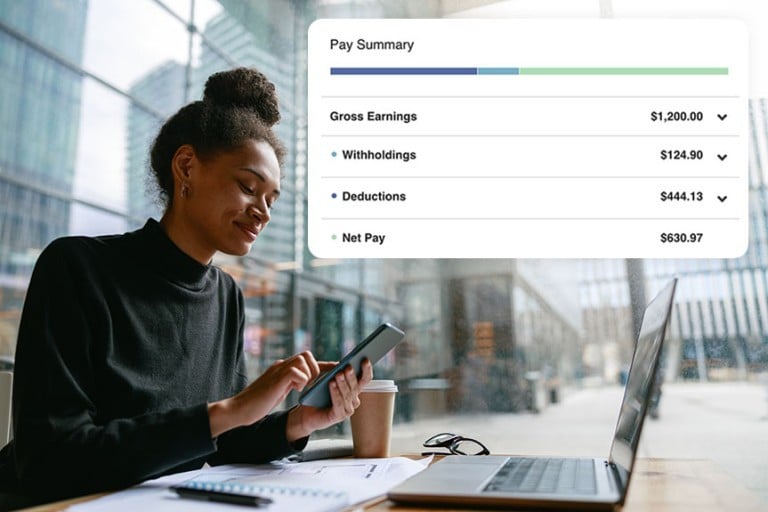

Pay Yourself Correctly: Payroll and Tax Savings

If you don’t know how to pay self-employment taxes, we can help. Paychex helps you save on self-employment taxes by making it easy to pay yourself a salary and establish your business as an S Corporation. Tax benefits of becoming an S Corp:

- Payroll taxes are taken directly from your paycheck, making them easier to manage

- Deduct your salary to reduce your taxable income

- You don’t have to pay Federal Insurance Contributions Act (FICA) taxes on income earned beyond your reasonable salary amount, which may be a significant savings

Simplify Your Complex Business Challenges With Paychex

Self-Employed 401(k) Plan Retirement and Payroll FAQ

-

How Do You Set Up Payroll for Sole Proprietorships or When Self-Employed?

How Do You Set Up Payroll for Sole Proprietorships or When Self-Employed?

We can provide you with a simple, efficient way to pay yourself wages as an employee of your own business when you’re incorporated as an LLC or S Corp. This includes options for direct deposit and helping file IRS Forms W-4 and W-2.

-

What Is a Solo 401(k)?

What Is a Solo 401(k)?

A solo 401(k) is a retirement plan specifically created for a self-employed person. It offers retirement and tax-saving benefits of a 401(k) for self-employed individuals while making it easy to establish and manage a plan. We also provide payroll services, too.

-

How Much Can I Contribute With a Solo 401(k)?

How Much Can I Contribute With a Solo 401(k)?

In 2026, an owner-only 401(k) allows you to contribute a maximum of $72,000, plus a $8,000 catch-up contribution if you are over 50 (for those aged 60-63, the catch-up contribution is $11,250). This limit is the total an employee can receive from all employee and employer contributions.

-

Who Is Eligible for Solo 401(k), Payroll, and Incorporation Services?

Who Is Eligible for Solo 401(k), Payroll, and Incorporation Services?

If you’re self-employed, you may establish payroll and a self-employed 401(k) through Paychex if you do not have any employees, are incorporated, and meet general 401(k) plan qualification requirements. Our partnership with MyCorporation can help you with the filings necessary to start the process.

-

Do I Need an EIN To Set Up a Solo 401(k) and Payroll?

Do I Need an EIN To Set Up a Solo 401(k) and Payroll?

Yes. Before establishing self-employed payroll and contributing to a solo 401(k), an individual must obtain an employer identification number (EIN) from the IRS. Incorporation services can help you establish an EIN to take advantage of our solo 401(k) and payroll services for self-employed individuals.

-

Can a Form 1099 Independent Contractor Benefit From a Solo 401(k)?

Can a Form 1099 Independent Contractor Benefit From a Solo 401(k)?

Yes. Independent contractors are self-employed individuals. The solo 401(k) was created for sole proprietors like 1099 independent contractors.

-

Can I Do My Own Payroll for S Corp?

Can I Do My Own Payroll for S Corp?

S Corporations must have a payroll system in place to pay their employees and any shareholders who are considered employees. While you can do payroll yourself, this can be a time-consuming task, not to mention the associated risks you take on when doing payroll on your own. Paychex payroll services can help self-employed individuals and S Corps complete payroll more easily.