Solutions for 100+ Employees

Automate tedious HR tasks and streamline payroll with our scalable, large business solutions:

- All-in-one HR technology

- Offer more affordable Fortune 500-level benefits

- HR advice and guidance from dedicated experts

Scroll Down

To Discover More

Simplified HR and Payroll Services for Large Businesses

Get Help with Human Resources

- Work with a dedicated HR professional to help you create plans to support your needs

- Access to HR compliance- related changes that may impact your business

- Use 160 HR Insights reports to help drive decisions

Run Payroll Quickly and Efficiently

Our payroll platform is built to grow with you and is equipped with easy-to-use software, access to multiple employee pay options, automated tax administration, and 24/7 support.

Support Your Employees with Benefits

Offer comprehensive employee benefits packages to help retain top talent with proactive HR support to stay ahead of employees’ everchanging needs.

Streamline Scheduling, Time Off, and More

Keep costs low and improve productivity with Paychex: accurately track employee time, attendance, and scheduling.

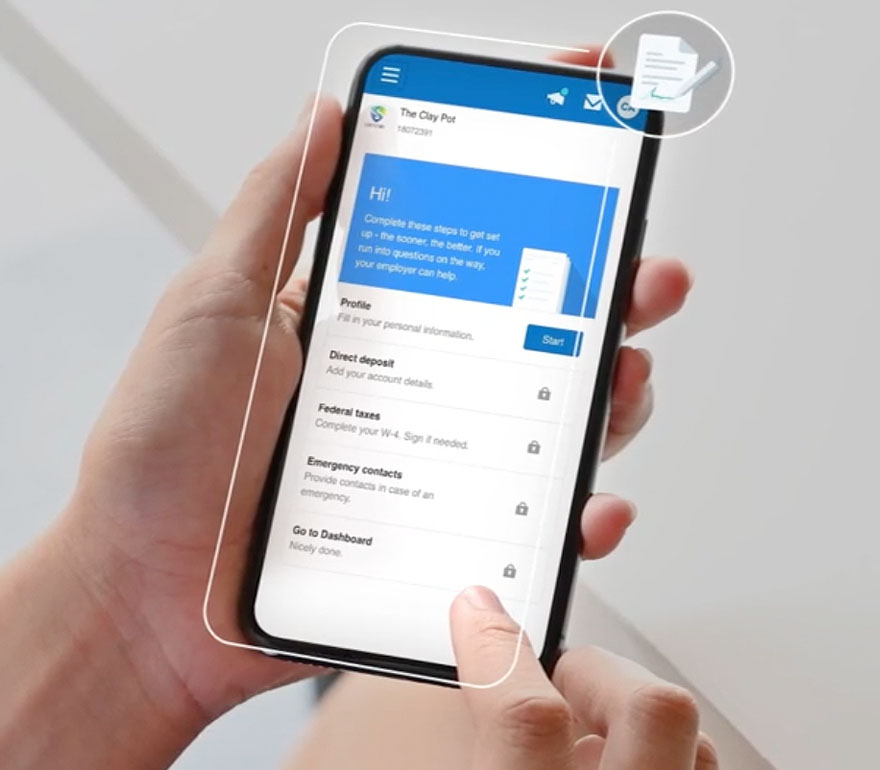

Simplify Hiring, Onboarding, and Performance Management

Post jobs, streamline onboarding, access performance management, and learning tools, simplify benefits administration and compensation management, and more within Paychex Flex®.

HR Plans That Fit Your Business Needs

Whether you’re looking for a full-service suite of HR solutions or just moving some time-consuming HR administrative tasks off your plate, we’ve got a package perfect for your business.

Support How and When You Need It

Get the support you need:

- Use in-app support with training resources and how-to tutorials for you and your employees

- Access 24/7 support (only a call, click, or swipe away)

- Get live support from a payroll specialist*

- Work with a Paychex HR professional dedicated to your organization

Enterprise Business Funding Solutions

Turn your unpaid invoices into cash with our flexible funding options. It's a hassle-free way to boost your business without the need for traditional loans. Get the money you need and watch your business flourish.

Add More Solutions As Needed

Our Paychex Flex platform is built to grow with your business. Unlike other providers, there’s no need to migrate systems—ever. Simply add or remove options as your business needs change.

Integrate With Software You Already Use

Paychex Flex integrates with dozens of popular tools to connect and share data seamlessly. Our ever-expanding library helps make hiring, managing, paying, and retaining employees easier.

See What Our Customers Have to Say

Paychex helps simplify your HR, payroll, and benefits with industry-leading, all-in-one technology.

“When we acquire a new community, continuity in the team members is very critical to the residents, so it’s very critical for us to ensure … all these team members are enrolled in a payroll system, signed up for their benefits, get their 401(k).”

“Being able to promote the jobs that we have with the different platforms that Paychex has, to get our jobs out there and recruit more people, they’ve made the onboarding process a lot easier for us to hire as quickly as possible.”

"In order for my business to do well, I basically have to pay lots of attention to the quality, the training, the employees. So, considering all of this, I am very happy I am with Paychex because they are making it easy for me."

Paychex helps us with so many services. My HR Business Partner has been super helpful with situations I’ve never had to deal with before, so it really helped guide us to make educated decisions based on our own culture and organization.”

— Jason Eller, HR Manager,

Recommended for You

Large Business FAQs

-

Why Do Large Companies Outsource Payroll?

Why Do Large Companies Outsource Payroll?

Companies choose large business HR services and payroll from a third party because they can result in cost savings, time and resources saved, and help the business meet certain compliance standards. Payroll systems for large companies can help in-house payroll teams or small HR departments with essential payroll and HR tasks, and focus instead on more strategic aspects of the business. Choose Paychex, one of the leading payroll companies for large businesses, to help your teams get more time back in their day and refocus their efforts.

-

Why Do Large Companies Outsource HR Administration?

Why Do Large Companies Outsource HR Administration?

HR plays a critical role in helping businesses achieve strategic growth, revenue, and other business strategies, such as hiring productive teams and finding ways to engage employees for maximum productivity. At the same time, HR departments have more on their plates than ever before. Large businesses need to map workloads and determine what tasks are of the highest strategic importance and then bring in outsourced HR help where it can be most effective. For example, determining or evaluating your benefits mix and offerings may be an internal strategic decision, but HR software for large companies can help manage the day-to-day HR administration to free up your HR team to focus on other things.

-

What Time and Attendance Solutions Work Best for Large Companies?

What Time and Attendance Solutions Work Best for Large Companies?

Paychex Flex Time, fully integrated with our all-in-one platform Paychex Flex, works to help large businesses save time, prevent errors, control costs, and meet their wage and hour requirements. Best of all, if you have employees in multiple worksites or in remote locations, Paychex Flex Time can connect staff with the information they need across devices, locations, and services.

-

How Can I Scale My Recruitment and Onboarding Efforts at an Enterprise?

How Can I Scale My Recruitment and Onboarding Efforts at an Enterprise?

To stay competitive in a tightening labor market, larger organizations may want to scale by adopting HR technology to help facilitate the recruiting and onboarding process (posting jobs online, offering an online application process, letting employees fill out all that new-hire paperwork at their own pace and in the comfort of their own home, etc.). Look for an integrated HR system that can make these processes simple for candidates, new hires, and administrators across the board.

-

How Do You Offer and Manage Benefits Packages for Large Businesses?

How Do You Offer and Manage Benefits Packages for Large Businesses?

Offering large business employee benefits is often a balancing act between satisfying employees' needs and staying within budget constraints. If you’re thinking about changing or adding to an existing large business employee benefits plan (large business health insurance plans, 401(k) accounts, health savings accounts, etc.) it might be a good idea to first conduct a benefits audit to review where things stand (usage rates, benefits costs, making sure proper withholding practices are being followed, etc.). An audit can also pay off in the long run and help your business stay competitive in today's tight job market. A third-party benefits provider can take care of many of the day-to-day administrative tasks and ongoing benefits management to help your teams stay focused on more strategic initiatives.

-

What Is the Role of HRM at the Enterprise Level?

What Is the Role of HRM at the Enterprise Level?

HRM at the enterprise level drives strategic workforce planning, including talent acquisition, employee development, and compliance. It helps to foster a positive workplace environment and aligns HR strategies with business goals.

-

What Is Enterprise Human Resource Management?

What Is Enterprise Human Resource Management?

In larger businesses, human resource management typically involves a variety of functions, including:

- Workplace collaboration, goals, and rewards

- Compensation and benefits administration

- Policy development

- Onboarding new hires

- Training and professional development

- Employee relations, including performance management