HR Analytics and Reporting

Analytics and Reports simplifies workforce challenges with clear, actionable insights — fast. We offer scalable solutions to fit your specific needs, whether you're just getting started or ready for advanced analytics.

- Essential data & reports customizable to your specific business needs

- Intuitive visualizations that make trends and risks simple to identify

- Generative AI assistant providing instant responses to critical HR questions

Transform Your HR Data Into Actionable Insights

Many HR leaders collect data but struggle to find the answers they need. Our platform empowers you to:

- Identify turnover risks and understand workforce costs to boost retention

- Uncover trends in compensation, benefits, and staffing to optimize your strategy

- Leverage AI-powered insights to simplify analytics, find quick answers, and forecast next steps

- Easily share reports and information using custom dashboards to help align teams and drive decisions

Pick What Works for You

Essentials

Enhanced

Premium

Essential payroll and tax reporting

Real-time report access

Centralized hub for Flex data, reports, and insights with customizable views

Quick access to your most-used reports

View aggregated HR Analytics across multiple accounts under one FEIN

Build tailored reports with filters, data selections, and custom layouts

Ready-made templates for core needs like pay components and employee demographics

Use natural language to generate reports and uncover business insights instantly

Guided insights and analyses for smarter workforce decisions and strategic planning

Compare your HCM metrics against industry trends to identify improvement areas

Visualize future operations and workforce challenges with predictive insights

Research competitive pay rates by position, region, and industry

Quick and Actionable Insights To Grow Your Business and Care for Your Employees

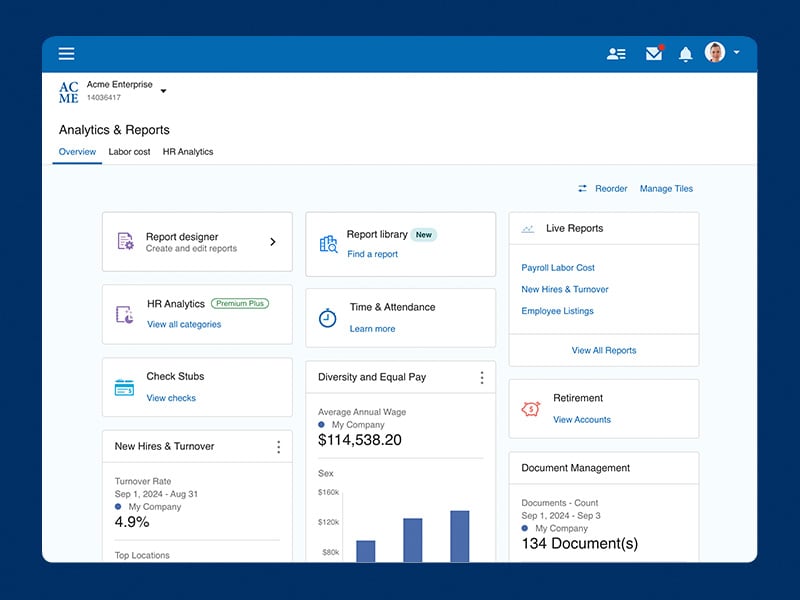

At-a-Glance Dashboard

Access key metrics instantly with a dashboard you control. Choose your views, organize your layout, and see real-time data for making faster, smarter decisions.

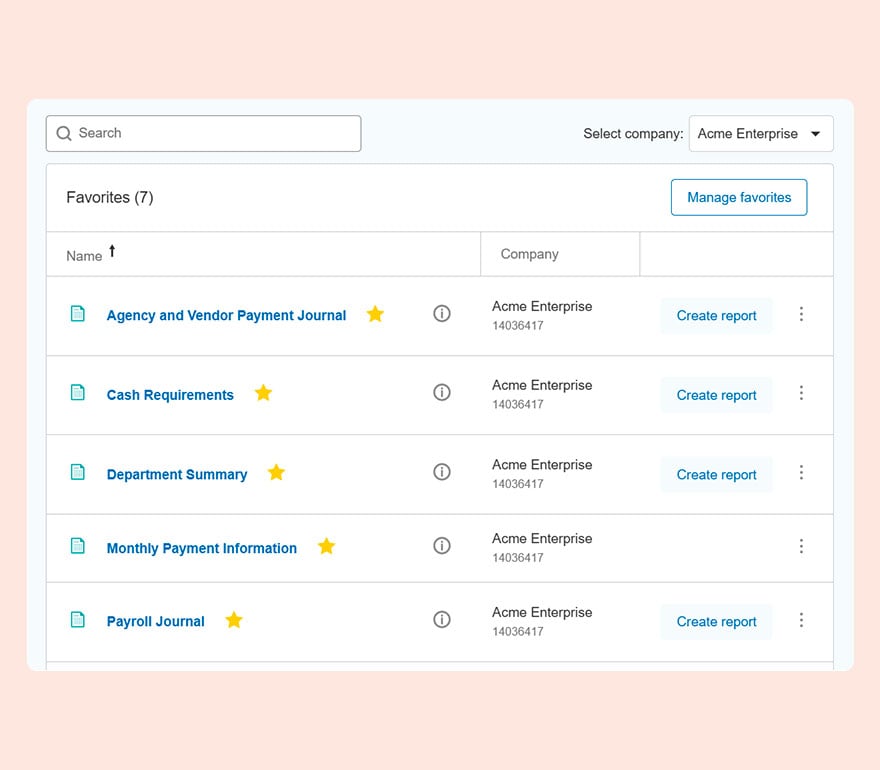

Report Library

Flexible reporting at your fingertips:

- 160+ templates for payroll, taxes, and demographics

- Live, real-time data updates

- Interactive graphs with drill-down capabilities

- Instant access to saved favorites

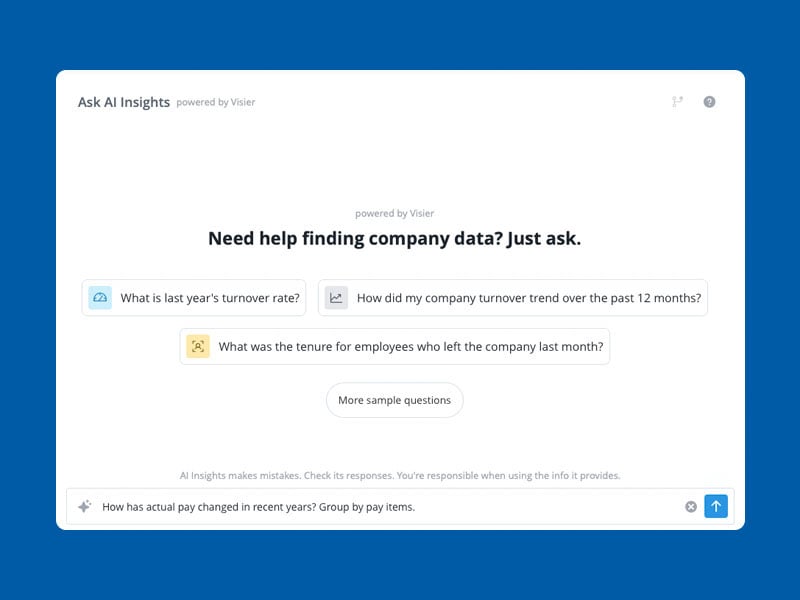

AI Customization

Skip manual searching and report building. Ask AI Insights to surface the exact data you need — instantly delivering relevant metrics and trends tailored to your business.

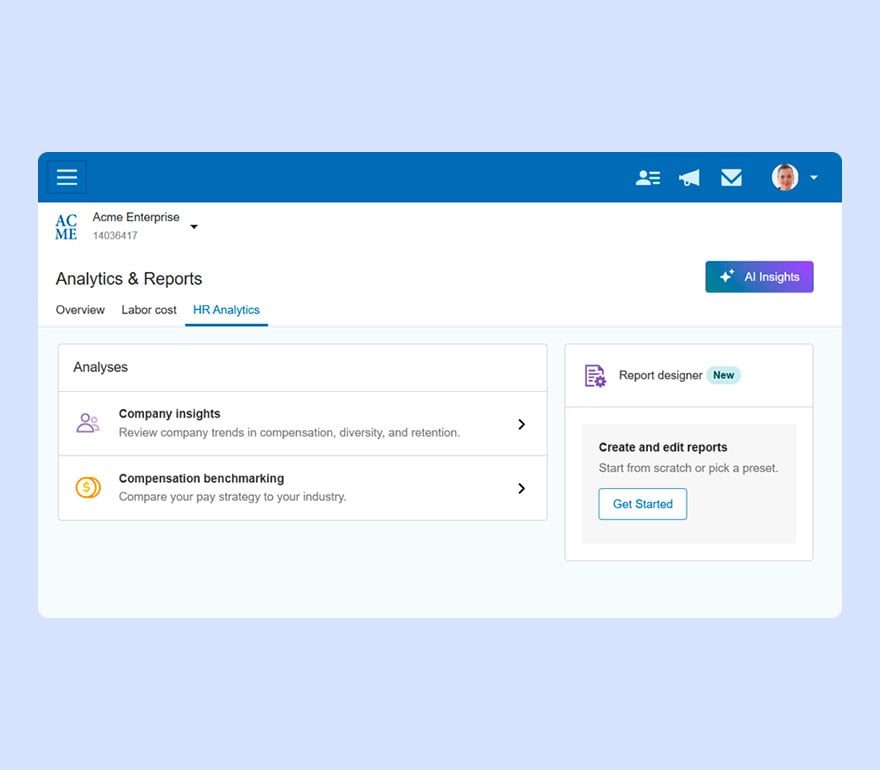

Smarter Workforce Decisions

Make informed decisions with HR Analytics. Get clear, guided views into key topics like retention, compensation, and performance to uncover trends and support strategic planning.

How To Buy

All packages include essentials standard reporting, with the flexibility to upgrade to enhanced or premium anytime. PEO clients automatically receive premium reporting. Need additional features? We offer flexible options to tailor to your specific needs.

Understand Your Changing Workforce

Choose Your Payroll or HR Package

Discover the solution tailored to your unique requirements

Choose the Best Value

Begin with the analytics tier that aligns with your current needs and budget, then scale up as your business grows

Get Insights With Confidence

Harness the power of your workforce data to gain a competitive edge in today's evolving market

Unlock Powerful Information To Drive Your Business

Compensation Benchmarking

Compare your compensation against 2 billion market data points to stay competitive in hiring

Diversity

Monitor pay gaps and assess the effectiveness of your diversity initiatives

Performance Management

Easily track reviews and feedback programs with essential performance metrics

Retention and Turnover

Identify turnover risks early and get predictive insights to boost employee retention

Employee Mobility

Discover internal talent for promotions and support fair, data-driven decisions

Pay Analysis

Track labor cost trends and measure the impact of your compensation strategy

Additional Solutions

Recommended for You

Analytics and Reporting FAQs

-

What Are HR Analytics?

What Are HR Analytics?

HR analytics applies statistical models to worker-related information to help businesses gain insight from selected HR parameters.

-

Why Is HR Analytics Needed?

Why Is HR Analytics Needed?

HR data analytics can help provide human resources departments with information to make data-driven business decisions. Whether a business unit manager needs the latest information on time and attendance to streamline their scheduling process, or a quick payroll audit by the HR manager to address a problem, analytics can help make valuable data accessible to business leaders.

-

What Are Benefits of Using HR Analytics?

What Are Benefits of Using HR Analytics?

Analytics can help guide strategic personnel decisions, give your firm an edge over the competition, and help you solve staffing dilemmas. In short, analytics can elevate HR's contribution to the success of the business.

-

What Are the 4 Levels of HR Analytics (Descriptive, Diagnostic, Predictive, Prescriptive)?

What Are the 4 Levels of HR Analytics (Descriptive, Diagnostic, Predictive, Prescriptive)?

Descriptive analytics offer insights into what’s happening within a business.

Diagnostic analytics help a business determine the reasons behind certain trends.

Predictive analytics help a business forecast what might happen in the future.

Prescriptive analytics provide intelligent recommendations for action based on business data.

-

Can HR Analytics Provide a Competitive Advantage?

Can HR Analytics Provide a Competitive Advantage?

HR analytics can help human resource managers gain a high-level view on what's happening with their business. With this information, it's possible to make strategic decisions that support key human capital management areas, from talent acquisition to employee retention. Companies that invest in gathering and understanding the right information have the foundation to make smarter decisions.

-

How To Implement HR Analytics?

How To Implement HR Analytics?

Implementing HR analytics involves defining goals and metrics, collecting and integrating relevant data, selecting appropriate analytics tools, analyzing data to generate insights, communicating findings, and taking data-driven actions to optimize your workforce.

-

How Is AI Used in HR Analytics?

How Is AI Used in HR Analytics?

AI automates data processing, identifies patterns, provides predictive insights, enables conversational data access, and enhances data-driven decision-making to optimize workforce management.

-

What Is the Difference Between AI-Powered Analytics and Traditional HR Reporting?

What Is the Difference Between AI-Powered Analytics and Traditional HR Reporting?

AI-powered analytics predicts trends and provides proactive insights using machine learning, while traditional HR reporting shows historical data in static formats. AI can forecast risks and recommend actions automatically, whereas traditional reporting requires manual interpretation.

Paychex HR Analytics offers both capabilities with intelligent dashboards that help you make faster, data-driven workforce decisions.

-

Which HR Solutions Offer Customizable Reporting and Dashboards?

Which HR Solutions Offer Customizable Reporting and Dashboards?

Paychex offers customizable reporting and dashboards through Paychex Flex®. Build reports for metrics like headcount, turnover, compensation, and benefits enrollment. Dashboards can be personalized by role, giving executives, HR managers, and department leaders access to their most relevant workforce data.