Small Business Solutions

Growing your business should always be top of mind. Let us help handle administrative burdens that take time away from your day – now and down the road.

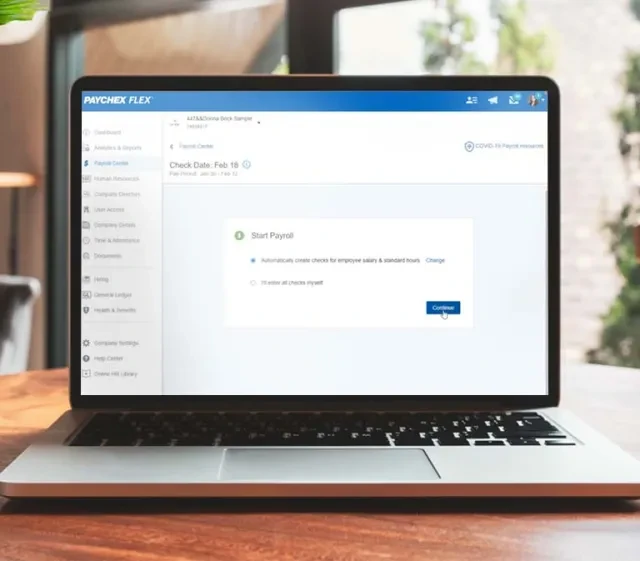

Payroll Software Tailored to Small Businesses

Simplify Payroll, From Setup To Service and Support

Pay your people in a few clicks through easy-to-use software with flexible processing, automated tax payments, and employee self-service.

Mobile App for Employers and Employees

The Paychex Flex® App allows you and your team to stay connected to your business from anywhere.

Automated Payroll Taxes

With automated calculation, payment, and tax filing to help ensure compliance, you can stay focused on growing your business.

24/7 Support

When you need us, award-winning help is only a call, click, or swipe away with 24/7 support.

Accomplish More With Integrated Services

Process payroll, handle hiring needs, review benefits plans, and more in one seamless platform.

Time & Attendance

Track time with our modern solutions that easily integrate with payroll.

Employee Benefits

Offer Fortune 500-level benefits packages to help hire and keep workers with proactive HR support.

Workers’ Comp

Work with the Paychex Insurance Agency to help find workers’ compensation and other business coverage.

Small Business Loans

We’ve partnered with Biz2Credit® to help you find the best financing options to support your business.

Incorporation Services

Help protect your assets and add potential legitimacy to your business through incorporating.

Payment Processing

We can help you find a solution to fit your needs when collecting payments for products and services.

Small Business Funding

Uncover cash flow quickly by selling unpaid invoices to Paychex Funding Solutions.

Stay Compliant With Changing Regulations

The Paychex HR Library helps you stay informed and manage the ever-changing federal and state compliance requirements.

Add What You Need, When You Need It

You have enough on your plate, so be at ease knowing our products are built to grow as you do. With our all-in-one HR solution, Paychex Flex®, you can take care of:

Work Seamlessly Across Systems

Paychex integrations help connect and share data between Paychex Flex® and dozens of business tools while also helping you reduce manual entry errors.

Recommended Resources

1-19 Employees FAQs

-

What HR Solutions Are Available for Companies With Under 50 Employees?

What HR Solutions Are Available for Companies With Under 50 Employees?

Paychex offers tailored HR solutions for small businesses of any size, including payroll, employee benefits administration, time and attendance tracking, and HR compliance support. Small business can create the solution that works best for their needs and include options like new hire reporting, tax filing, and access to HR professionals for guidance. These scalable solutions grow with your business and can be customized based on your specific needs and budget.