Financial Advisor Partnerships With Paychex

Your clients expect a fast response. We help you deliver it. Together, we can help grow your business. SPECIAL OFFER! Refer your clients and we'll reduce their fees.

We Move Fast, So You Can Move Mountains

Participant Event Notifications

This groundbreaking AI-powered tool delivers real-time alerts to your inbox whenever a participant achieves a retirement milestone. By viewing activity as it happens, you can quickly identify potential money-in-motion opportunities. Types of notifications include when a participant:

- Is eligible and not enrolled

- Terminates with a balance over a set amount

- Has reached the plan’s set retirement age

- Is highly compensated and has a status change

Fast Setup

Spend less time on setup, more time on strategy. We can onboard your clients quickly and efficiently, providing them with a more convenient client experience. This also helps reduce your administrative tasks, giving you more time to focus on consulting and new business acquisition.

Payroll Integrations

Our 401(k) plans can be integrated with 100+ leading payroll companies through our partner, Payroll Integrations®. This allows you to move your book to non-Paychex payroll customers. It can also save clients the time and hassle of switching to another payroll company. Of course, your clients can always choose Paychex or Paycor® for setup that is quick and seamless.

Pooled Employer Plans (PEPs)

As a pioneer of this popular 401(k) plan, we have redefined the value of smaller-sized asset plans for advisors. Because we take care of most administration, pooled employer plans allow advisors to take on more clients without significantly more work. Spend less time on busywork that slows you down, and more time consulting and expanding your book.

Financial Advisor Resources

Quick Links for Current Partners

The Advisor Download

Read the latest edition of The Advisor Download, our monthly newsletter with timely, curated topics and materials for Financial Advisors.

It’s Almost End-of-Year. Are You Ready?

It’s time to wrap up 2025. In this month’s Advisor Download, we give an overview of important actions you need to take before the year is over. You can also view end-of-year must-do’s in Paychex Flex® so you never miss a deadline.

401(k) Participant Events: A New Tool for Capturing Leads

In this Advisor Download, we define what 401(k) “participant events” are and how they can help you spot new opportunities for both retirement and wealth management.

State Retirement Mandates: Action Plan for Your Clients

Many states are requiring employers to offer a retirement savings option. Get practical tips on how to help your clients comply with state retirement mandates. We'll give you an overview of options to help them find the right plan for their business.

401(k) Plan Benchmarking: Checking Under the Hood

Compliance red flags. Hidden fees. Common errors. You never know what a 401(k) plan review will uncover. Also known as plan benchmarking, the IRS and Department of Labor recommend a yearly “check under the hood” to look at the plan’s basic operations.

Expanding Your Advisory Role With PEPs

Despite the misconception that Pooled Employer Plans (PEPs) will reduce their importance, many financial advisors are discovering that PEPs can significantly enhance their consultative capabilities when used strategically.

Why Partner With Paychex?

Supporting Clients and Your Business

For something as important as your client’s retirement future, you need trusted partners who excel in service, administration, and compliance. Paychex can simplify the administration process for your clients, look at ways to reduce your workload, and help make retirement a strategic asset for your business. Our services include:

- New plan set-up

- Conversion and Pooled Employer Plan (PEP) mergers

- Recordkeeping and plan administration

- Enrollment and employee education

- IRS and DOL filings

- Compliance testing

- Assistance with SECURE Act tax credit eligibility, and more

One Provider, One Platform

We can make the retirement journey easier by saving your clients the time and expense of working with multiple providers and technology platforms.

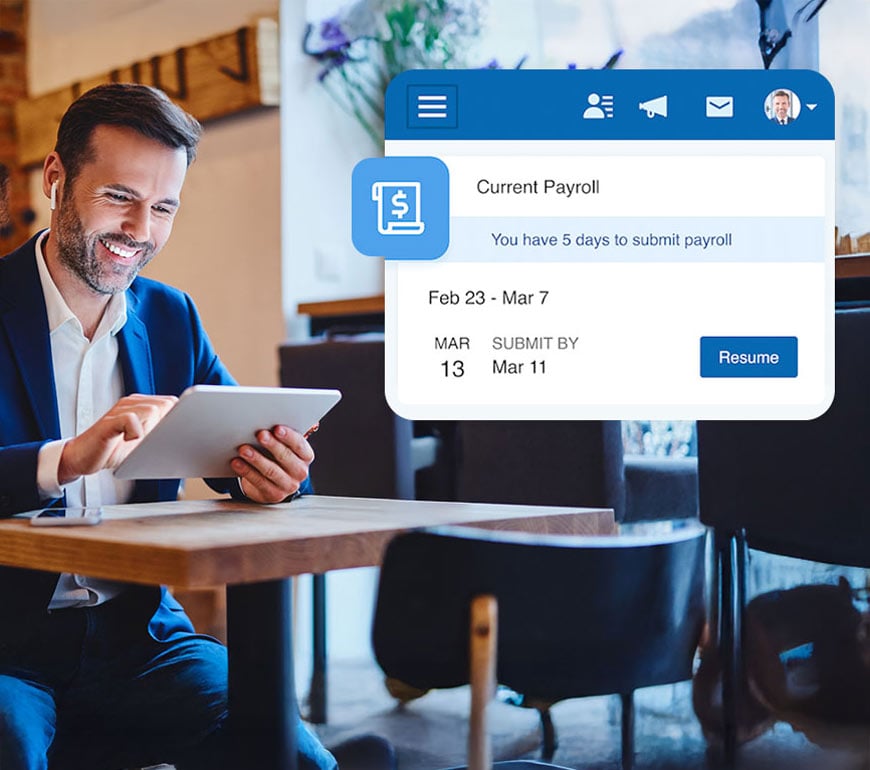

When you recommend Paychex to your clients, they can be assured of the streamlined simplicity of our Paychex Flex® solution. Using a single employee record, payroll and retirement data is wholly integrated. This helps clients save time and reduce cost, improve reporting, and make important deadlines. When payroll meets retirement, everything’s simpler.

A Plan for Every Client

As America’s industry leader in 401(k) plan recordkeeping1, Paychex has retirement plan options to fit every size and type of business. We specialize in helping businesses get on the path to retirement through affordable, easy-to-manage retirement options.

- Wide range of plan designs: traditional 401(k), Pooled Employer Plan (PEP), safe harbor, profit-sharing, and more

- Thousands of non-proprietary investments to choose from

- No hidden fees

The Advisor Console With Paychex Flex®

Our account management dashboard puts everything at your fingertips. A single sign-on to the Advisor Console gives you access to plans, reports, and resources. Need to make a change for a plan sponsor? You can do it in just a few clicks from your desktop or mobile device.

AI-Driven Advisory Tools

Our industry-leading advisory tools are designed to help you serve clients more quickly and focus on new business acquisition.

Participant Event Notifications are real-time, AI-driven alerts that capture 401(k) participant activity as it happens. This groundbreaking tool can help you identify potential money-in-motion opportunities for wealth management and retirement.

The Advisor Console allows you to manage plans and access your book of business with Paychex, all in one dashboard. Our k(index) feature provides access to thousands of investment choices. And our 401(k) fiduciary checklist and retirement calculator helps make sure sponsors and participants are retirement-ready and compliant.

Integrated Payroll With Leading Providers

If your retirement clients don’t have Paychex payroll, Payroll Integrations® can integrate their 401(k) plans with more than 100 payroll companies, including ADP, Paylocity, and Workday.

Integrated plan processing saves time and reduces your clients’ administrative burden. This service is available to Paychex retirement clients at no extra charge*.

Easy-To-Use Advisor Console Within Paychex Flex®

Access your book of business and perform routine plan management functions, all from a single online dashboard.

- Get real-time notifications about client and participant events

- Access your AUM and manage client plans

- Make investment changes and update fund lineups

- View participant information, including deferral rates and account balances

- Run reports and view plan documents

- Access k(Index), a resource that helps you match the right investments to your clients

Innovations for 401(k) Participants

See how easy it is to access employee data, get plan details, and more. Plan participants can enroll with ease, access their accounts through the online portal or mobile app, get personalized quarterly statements, and use the retirement calculator to check their progress.

For Details on the Benefits of Working With Paychex, Download Our Financial Advisor Partnership Guide

FAQs

-

Why Should I Join a Financial Advisor Partnership Program With Paychex?

Why Should I Join a Financial Advisor Partnership Program With Paychex?

- A leading provider of 401(k) plans in the U.S.1

- More than 20 years of experience working with financial advisors

- 1 in every six 401(k) plans in the U.S. uses Paychex

- Paychex is the leading PEP provider by number of adopting employers

- We have been ranked as one of America's Most Innovative Companies by Fortune® magazine, 2025

- We are a 17-time Honoree of the World’s Most Ethical Companies®, Ethisphere® Institute, 2025

-

How Can I Join the Paychex Financial Advisor Partnership Program?

How Can I Join the Paychex Financial Advisor Partnership Program?

Contact us and a Paychex professional will walk you through the details.

-

What Are the Benefits of a Paychex Financial Advisor Partnership?

What Are the Benefits of a Paychex Financial Advisor Partnership?

Business building and growth

We deliver new client opportunities and support your business development efforts.

Local, on-site plan expertise

Paychex retirement plan specialists are available locally to help answer client questions and help with a smooth plan conversion.

Flexible plan design

Paychex offers traditional and safe harbor plans, in addition to Roth 401(k), age-weighted, new comparability profit sharing, and other options

Account management tools

An exclusive advisor website delivers real-time plan and participant-specific data that helps you uncover needs and opportunities.

Complete investment neutrality

As the trusted advisor to your clients, you are the investment expert. We provide the means, administration, and recordkeeping to help deliver a plan that is right for them