Midsize to Enterprise Payroll Services and Software

Get HR technology and 24/7 service that grows with your organization's needs, gives you the tools to help you make informed decisions and helps you stay up-to-date with the latest tax rates and regulations.

What You Get With Paychex Midsize to Enterprise Payroll Solutions

Simplify Payroll

- Online payroll processing

- Direct deposit, paycards, paper checks, and other payroll options

- Pay workers on different bases — exempt and non-exempt employees, contractors

- Automatic payroll tax administration

- Garnishment payments

HR Analytics and Reporting Capabilities

- Robust reporting and analytics for insights into your payroll and HR data

- Retirement plan summary report

- General ledger report

Get HR Administrative Support

- HR administration support

- Benefits Administration

- New Hire reporting to government agencies

- Labor poster kit

- Employment and income verification services

Additional Solutions for Your Business

- Financial wellness program

- Learning management systems

- HR Events Calendar

- Indeed® stipend

- And more

How Paychex Midsize to Enterprise Solutions Work

Perform critical payroll and HR tasks effortlessly all in one integrated platform — Paychex Flex. Not only can you simplify enterprise employee payroll, onboarding, labor forecasting, and other areas of the employee lifecycle, but you can also save time, money, and resources by having the HR enterprise solutions you need all in one place.

Payroll Packages To Meet Your Needs

Paychex Flex® Select

Paychex Flex Select provides expert service to match your business needs to our solutions. Process payroll, file taxes online, and have access to online employee training and development with 24/7 support.

Paychex Flex® Pro

Full-service setup, payroll, and tax filing online, plus, valuable HR tools, and personal consultation to meet your business needs.

Paychex Flex® Enterprise

The complete large business payroll and HR solution, helping you stay compliant, train employees, gain insights through custom analytics, and more.

Enterprise Software Capabilities

Fully Integrated for Efficient Payroll, HR, and More

Paychex Flex isn’t just an enterprise payroll administrator — it’s an all-in-one technology and service platform. It includes tools that can help drive workforce retention by empowering employees through self-service access, while providing robust reporting and valuable insights to automate administration and help drive greater efficiency.

- Recruiting

- Hiring and onboarding

- Time and attendance

- HRMS

- Performance management

- Learning management

- Enterprise employee benefits

- Retirement

Through our integrations with third-party vendors and applications, you can access these services from one platform and help your organization share data and analytics across departments, communicate more effectively, and reduce the risk of errors and penalties.

Custom Analytics and Reporting

Our powerful custom analytics and reporting tools help you create reports and visualizations that can meet the unique demands of your midsize business:

- Analyze payroll labor costs across time and departments.

- Quickly view your payroll journal, employee earnings record, enterprise paycheck stubs, cash requirements, department summary, tax deposit, and year-to-date reports from the dashboard.

- Access 160+ payroll and HR reports and customize them to your needs.

- Discover if labor supply met demand with labor costs trends analytics that compare pay periods side-by-side.

- Access real-time HR and workforce analytics to help identify and benchmark corporate, location, and department turnover trends.

Multiple Employee Pay Options

We offer a variety of payment options for you to choose from that best meet the needs of your business and your employees:

- Direct deposit

- Same-day ACH capability to pay employees in time-sensitive scenarios

- Paper checks with check signing and insertion services

- Paycards for employees who may not have a bank account but may still benefit from direct deposit1

- Real-time payments

Job Costing and Labor Distribution

Our system includes a payroll journal and the data you need for job costing and labor analysis. View a list of departmental costs, including:

- Earnings

- Employer taxes

- Employer expenses

Wage Garnishment Payments

Help protect your company with assistance processing garnishments within federal and state laws. Paychex Flex can help you:

- Calculate garnishment wages

- Make deductions from your employees’ wages

- Pay the appropriate agency

Import to Your Accounting Software With General Ledger Service

Keying in payroll information to your accounting software by hand can be tedious and error-prone. Using a secure online process, Paychex lets you easily post payroll data to your accounting program from our enterprise payroll software. Compatible software includes:

- QuickBooks®

- Sage Intacct®

- Xero™

Solutions by Industry

You may run a brick-and-mortar retail store, operate a senior living community, own a restaurant, or something else altogether. Either way, we understand that your business has unique challenges. Our blend of technology and dedicated support can provide you with the solutions to overcome them.

Minimize Payroll Discrepancies To Help Improve Accuracy

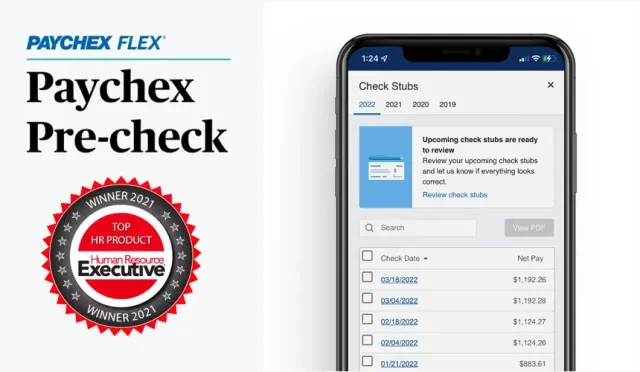

Allow your employees to review their scheduled pay and notify you of any potential issues before payday. Named Top HR Product of the Year by HR Executive Magazine, Paychex Pre-checkSM combines comprehensive payroll, time management, and employee self-service technology to help you manage HR.

Sub Shop Franchisee Simplifies Routine and Gets on a Roll with Payroll

Deciding to process his franchise’s payroll to save money resulted in Tommy Stuckey spending too many hours not focusing on his business. When he turned payroll over to Paychex, it built trust and inspired confidence.

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes.”

All-in-One Payroll and Human Resources

Like all of our medium business solutions for payroll and HR, our enterprise payroll system is designed to integrate with other services that help you take your organization where it needs to go.