Small Business Payroll Services

All-in-one payroll software with 24/7 service:

- Easily enter and run payroll online in as few as two clicks

- Automatically calculate, pay, and file payroll taxes

- Allow your employees to make self-service actions

Compare Small Business Payroll Options

Paychex Flex® Select

Paychex Flex Select provides expert service to match your business needs to our solutions. Process payroll, file taxes online, and have access to online employee training and development with 24/7 support.

Paychex Flex® Pro

Full-service setup, payroll, and tax filing online, plus, valuable HR tools, and personal consultation to meet your business needs. Chat and phone support 24/7.

Paychex Flex® Enterprise

The complete large business payroll and HR solution, helping you stay compliant, train employees, gain insights through custom analytics, and more.

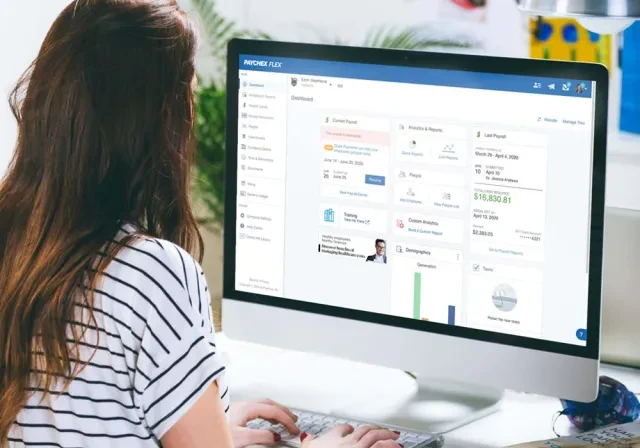

How Paychex Flex® Works

-

Run Payroll Quickly and Easily

Run Payroll Quickly and Easily

Enter payroll in as few as two clicks from your desktop or mobile device.

-

Access Critical Reports

Access Critical Reports

Paychex PreviewSM Preprocessing Report allows you to run and review your payroll reports before processing to ensure accuracy and reduce errors.

Automatically create cash requirements, job costing, and tax deposit notices. View W-2s and leverage other real-time features.

-

Resource Center

Resource Center

Use our Help Center to access current information, chat features, articles, and how-to guides for activities and tasks.

-

View Employee Information

View Employee Information

Have administrator access to the most up-to-date information about employees, including the ability to quickly view their contact information, view their performance evaluations, and keep track of in-app conversations you've had.

What You Get With Paychex Small Business Payroll Services

Simplify Payroll

- Flexible and automated payroll processing online from desktop or mobile

- Submit payroll by phone or payroll specialist

- Automatic tax administration

- Garnishment payments

Utilize Employee Services

- Online employee self-service

- Direct deposit, paycards, paper checks, online tip sharing, and on-demand access to earned wages

- Free mobile app for you and your employees

HR Analytics and Reporting Capabilities

- Payroll dashboard with configurable views

- Robust reporting and analytics for insights into your payroll and HR data

- HR analytics and events calendar

Compliance Support

- New-hire reporting to government agencies

- Labor law poster kit

- HR Library helps you stay informed and manage federal and state compliance requirements

Simplify Payroll, From Setup To Service and Support

We’re one of the nation’s leading payroll companies for small business, offering hundreds of thousands of businesses with services and support that can help ease the time-consuming burden of small business payroll processing and tax filing.

Payroll For One Employee

No matter how many employees are on your payroll, you can choose the level of technology to adapt to your needs and add services as you see fit. We’re built to grow with you.

Getting Help with Complex Payroll Earns Seal of Approval from Client

Greg Duffy deals with certified payroll to properly pay his employees. When he started out, he spoke to a few businesses about processing payroll himself and then said he realized how complex it was, how much time it took, and that he was concerned about making costly mistakes on his taxes. He’s now been a Paychex client for more than 30 years and said he’s amazed at how simple that part of his business has become.

“We thought about doing our own payroll … and it would take maybe 5 to 7 hours …. With state and federal rules constantly changing, it would be difficult to keep up on … and I don’t want to make a mistake with my payroll … I want to get my workers paid and paid right.”

All-in-One HR and Payroll System

Like all of our payroll options, our small business payroll software integrates with other Paychex services through Paychex Flex to help you take your organization where it needs to go.

Frequently Asked Questions

-

Can I Do Payroll Myself?

Can I Do Payroll Myself?

When considering how to do small business payroll, an important decision business owners need to make is whether to handle payroll and tax responsibilities in-house or outsource to an expert third-party provider. You may have also asked yourself, “How do I set up payroll for my small business?” at some point. Consider the many steps required to set up and run payroll, and note that payroll and tax responsibilities can be time-consuming and complicated, plus even a single payroll error can be costly to the business.

-

What Is the Best Payroll Service for My Small Business?

What Is the Best Payroll Service for My Small Business?

If you are looking for a high-quality small business payroll system, Paychex offers leading payroll processing, tax preparation, calculation, and filing services, as well as many HR services. The best payroll service for your business will depend on factors such as how many employees you have, any budgetary considerations, and your current and future business objectives.

-

How Much Does Payroll Cost for Small Businesses?

How Much Does Payroll Cost for Small Businesses?

Cost is often a determining factor when considering whether outsourcing payroll is the right decision for your business. On one hand, you may feel that your business can't absorb the added cost of paying someone else to manage payroll. On the other hand, handling payroll on your own can be time-consuming and expose your company to unnecessary risks. Luckily, there are many cost-effective payroll options built specifically for small businesses. For instance, Paychex has payroll packages starting as low as $39 per month, plus $5 per employee.

-

Do I Need a Payroll Service for My Small Business?

Do I Need a Payroll Service for My Small Business?

You are responsible for running payroll every pay period as soon as you bring on a single employee. And generally the more employees you bring on board, the more complicated the process can become. That’s why it’s so beneficial to have leading online payroll services for small business that can scale with your organization.

-

How Does Paychex Help With Ensuring Compliance on Taxes and Other Issues?

How Does Paychex Help With Ensuring Compliance on Taxes and Other Issues?

Your business must stay on top of payroll tax responsibilities, including keeping up with payroll tax rates, calculating liabilities, and making timely payments. These tasks can be time-consuming, but fortunately Paychex can help. Our payroll tax services can help you avoid tax penalties for late or inaccurate payments, and our tax credit services can assist you in finding valuable tax credits that your business deserves. Learn how Paychex can help you take care of payroll taxes.

-

Do I need to Use a Payroll Company for One Employee?

Do I need to Use a Payroll Company for One Employee?

Many small businesses choose to process their payroll manually. While this task may seem simple for a small team, consider using a payroll company to save time and reduce the chance of costly errors, especially if you plan on continuing to grow your business.

-

How To Do Payroll for Small Businesses?

How To Do Payroll for Small Businesses?

To start processing payroll for your small business, you may be unsure where to start. The steps below can help you get a feel for what you may need in place to begin paying employees.

- Obtain an EIN (Employer Identification Number), which identifies your business for tax purposes.

- Collect employee information such as names, addresses, social security information, and tax withholding information found on completed W-4s.

- Determine the payroll schedule, consult pay frequency laws, and choose the frequency you pay your people (weekly, bi-weekly, or monthly).

- Establish your payroll process so that you have a system in place to record data, streamline your processes, and help reduce errors.

- Calculate wages and benefits to have the proper payment amount when you define compensation.

- Calculate and withhold taxes so that the correct amounts are paid to the appropriate tax agency.

- Process payroll and generate paychecks or any other employee pay options.

- Keep accurate records and maintain details of each payroll run, which helps with compliance and tax reporting efforts.

Consulting with an accountant, human resources professional, or a dedicated payroll provider like Paychex can help you to customize the process to your unique business needs.

-

Who Does Payroll for Small Businesses?

Who Does Payroll for Small Businesses?

There are many options that small businesses can turn to when processing payroll. Your small business may process it:

- In-house, manually

- With a bookkeeper or accountant

- With a payroll provider, such as Paychex, which offers multiple payroll packages to fit your needs

Or, if you prefer to outsource this administrative function, our professional employer organization (PEO) services can assist you in paying employees.

With the Right Payroll Provider, Businesses Stay in the Driver's Seat

Frank's Auto Repair uses technology to stay current and keep its customers' cars on the road and running smoothly. Owner Frank Roberts made the same discovery about payroll and his business, choosing Paychex to help ensure the process was efficient, accurate, and compliant with payroll tax requirements.

"When it comes to Paychex, the personal touch is nice .... Having Paychex as my payroll service just makes my life a lot easier. Never had any problem with any tax issues or anything."