- Payroll

- Article

- 6 min. Read

- Last Updated: 03/06/2025

How To Set Up Direct Deposit for Employees

Table of Contents

Understanding how to set up direct deposit for employees is essential to developing a secure and efficient payroll system. Offering payroll with direct deposit provides convenience and security to both employers and employees and helps employees receive their wages on time.

Direct deposit can also minimize the effort in processing payroll by reducing the need for paper checks or manual recording. Setting up direct deposit for payroll may seem daunting initially, but it can be quick, easy, and straightforward when you have the correct information. This guide will cover the basics of setting up direct deposit, including steps to provide a smoother payroll experience for your business and your employees.

What Is Direct Deposit?

Direct deposit is an electronic funds transfer (EFT) method that allows employers to automate wage payments by depositing an employee's earnings directly into their designated account(s). Employers can transfer monetary wages directly into the employee's designated account, reducing the need for paper checks and manual bank visits.

This payment process saves employees time and effort while also providing a secure and efficient payment method. Employers and employees often choose this option because of its convenience, security, and efficiency—benefits that are especially valued as individuals and businesses increasingly rely on electronic payments.

Direct deposit works by routing the employee's net pay amount from the company's bank account into the account(s) designated by the employee. These accounts could include a personal checking or savings account or even a payroll debit card account set up on the employee's behalf. Regardless of how direct deposit is structured, it helps to streamline payroll processing, enhance financial efficiency, and minimize administrative burdens for businesses.

How Do Direct Deposits Work?

Direct deposit is an efficient way for employers to pay their employees by electronically transferring the owed payroll amounts directly to the employee's account(s) without worrying about additional paperwork. The process is initiated once the employer has identified the amount of payroll owed to the employee:

- First, the employer securely transmits the payroll information, including employee pay amounts to the bank or third-party service provider that will initiate the direct deposits on their behalf. Once the employer's bank or third-party service provider receives this information, they will send the direct deposit transaction to each employee's designated financial institution(s).

- Upon receiving this information, the employee's institution(s) will credit the employee's account. Typically, this process takes no more than 2 to 3 business days and is often as short as 1 business day, and most financial institutions do not charge extra fees for this service.

Since this process involves financial institutions communicating directly, this process may be faster and safer than many other payroll methods and helps reduce potential delays or opportunities for fraud on either side.

How Much Does It Cost To Set Up Direct Deposit for Employees?

If you're considering implementing a direct deposit system for your business, you may wonder, "How much does it cost to set up direct deposit for my employees?"

Sometimes, the banking software used to process payroll transactions may be expensive. However, using a third-party payroll service provider can minimize or eliminate this cost, as these providers typically have the necessary processing software already built into their service.

Most banks charge small fees for processing direct deposits, like minimum balances or per-payment charges. But compared to the resources you may save by reducing your reliance on paper checks, these fees barely make a dent in your budget. The hours saved on payroll tasks alone make up for any bank charges.

Tips for Setting Up Direct Deposit for Employees

Setting up direct deposit can simplify the administrative process behind your routine payroll processing and help reduce delays or potential inaccuracies associated with paper checks. The following 6 steps will help you get set up with direct deposit services, which can help you get your team members paid efficiently and responsibly each payday.

Step 1: Choose a Direct Deposit Provider

When selecting a direct deposit provider, it is important to choose a reputable provider that offers reliable service and secure banking connections. Be proactive in reviewing customer ratings for feedback on what it's like to work with the provider you are considering.

Working with a payroll service provider with direct deposit options is often easiest. You may be provided with a whole suite of tools for managing your payroll system from end to end – from the initial payroll calculations to the final deposit confirmations.

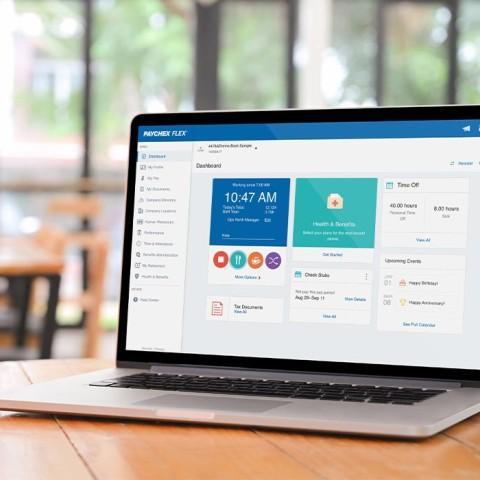

For example, Paychex offers a seamless direct deposit setup, integrating with payroll processing to help businesses automate wage payments efficiently. With secure banking connections and compliance support, Paychex helps you simplify your payroll management, reduce administrative burdens and ensure your employees get paid on time.

Step 2: Complete the Direct Deposit Setup Process

Once a direct deposit provider has been chosen, you must complete the initial setup steps with your financial institution or third-party service provider. This typically involves the following:

- Signing the ACH terms and conditions

- Providing recent financial statements or any other documentation required to prove the organization's creditworthiness

- Entering required business details (such as contact information or bank account numbers) into your payroll software or providing this information to your payroll service provider

Step 3: Gather Information From Employees

After completing the initial setup steps, you'll need to gather important information from any of your employees who will be paid via direct deposit. The fastest way to gather this info is by having your employees enter information directly into your payroll software program. This form typically asks for information such as:

- Employee name

- Employee's date of birth

- Mailing address

- Social Security Number

- Financial institution name and routing number

- Account number associated with the employee's account(s)

- Authorization from the employee to take part in the direct deposit program

Additionally, you should ensure employees are well-informed about how direct deposit works and understand the importance of notifying the company immediately whenever their personal information changes to avoid disruptions in the direct deposit process. Obtaining copies of voided checks is not required by most direct deposit providers, but taking this additional step when gathering your employees' information can help validate bank accounts and protect against fraud or financial loss.

Please note that in many states, direct deposit authorization must be obtained from employees and may not be mandated by an employer.

Step 4: Enter Employee Data Into Your System

Entering employee direct deposit data into a payroll system can be done manually or by uploading information in bulk. When entering data manually, it's important to double-check all the information that is being entered and ensure it is correct. Since you can only enter information for one employee at a time, this can be extremely time-consuming if you have many employees, but it is necessary for accuracy.

Step 5: Establish a Direct Deposit Payroll Schedule

When establishing a direct deposit payroll schedule, it is important to factor in any potential banking holidays that may affect when the funds are actually deposited. Depending on your company and applicable legal requirements, you may opt for different payroll deposit frequencies such as biweekly, or based on your industry or team, a weekly cycle may be more appropriate. Once you have settled on the proper timeline, it is essential to communicate the direct deposit schedule clearly and openly with employees.

Make sure that all employees know when their paychecks should hit their accounts so that they can plan accordingly and keep track of their payments. Additionally, give them access to digital records of their deposits so that they can verify payment information in case something goes wrong.

Step 6: Process Payroll

Once the direct deposit system has been set up, employee information has been entered, and a schedule has been set, processing payroll is the final step. Banks usually need at least 2 business days' notice before processing direct deposits, so it's essential to plan ahead and make sure you submit your payroll in enough time for it to be processed and received by banks before payday.

Benefits of Direct Deposit

Business owners typically gravitate towards direct deposit due to its relative ease. Money moves straight from your account to your employees' banks — no printing checks, no mail delays, no lost payments. Your employees know exactly when they'll get paid, and you spend less time dealing with payroll headaches. The result? A faster, safer way to pay your team that makes everyone's life easier.

Benefits of Direct Deposit for Employees

Employees gain several advantages from direct deposit:

- Convenience: No need to visit a bank or cash a check—wages go directly into their account.

- Reliability: Payments arrive on time, reducing worries about lost or delayed checks.

- Faster Access to Funds: Funds are available immediately on your employees' paydays without waiting for check clearance.

- Stronger Security: Reduces the risks of check theft, fraud, or misplacement.

- Financial Control: Employees can split their paychecks between multiple accounts for easier budgeting and savings.

Benefits of Direct Deposit for Employers

Employers also benefit from switching to direct deposit:

- Lower Costs: Minimizes expenses for printing, processing, and distributing paper checks.

- More Secure Payroll: Reduces the risk of fraud and lost or stolen checks.

- Streamlined Payroll Processing: Automates payments, cutting down on administrative time and errors.

- Better Employee Experience: Helps workers receive their wages without hassle, boosting satisfaction.

- Eco-Friendly: Reduces paper waste and supports sustainability efforts.

Offering direct deposit helps businesses run payroll more efficiently while giving employees a secure and reliable way to get paid.

Common Direct Deposit Errors

Setting up direct deposit requires accuracy to ensure employees are paid correctly and on time. Common mistakes include:

- Using incorrect account details: Entering information from a deposit slip instead of a voided check can result in failed transactions.

- Mixing up payment allocations: Sending an entire paycheck to savings instead of splitting it between accounts can disrupt employees' financial planning.

- Submitting payroll late: Delays in processing payroll can cause employees to miss their expected payday.

Verifying account details, double-checking payroll submissions, and using reliable payroll software can help prevent these errors.

Direct Deposit FAQs

Employers often have questions about how direct deposit works, what information is needed, and how long setup takes. Below are answers to some of the most common concerns.

-

How Long Does It Take To Set Up Direct Deposit?

How Long Does It Take To Set Up Direct Deposit?

The time it takes for an employer to set up direct deposit for their employees depends on factors such as the employer's payroll system and the bank used for direct deposit. Typically, the process can take a few days to a few weeks to complete. The total setup time can also vary based on how long the employer takes to gather the required documentation and provide it to the financial institution.

-

What Information Do You Need for Direct Deposit?

What Information Do You Need for Direct Deposit?

To implement direct deposit for your employees, you'll need to collect essential banking information from each participant. You'll need their account and routing numbers, bank name, and confirmation of whether it's a checking or savings account. Each employee should submit their legal name as shown on their bank account to prevent payment rejections. While not always required, requesting a voided check provides an extra verification step and helps catch any transcription errors before the first payment run.

Before processing the first direct deposit, ensure you have signed authorization forms from each employee and maintain these records in compliance with banking and employment regulations. Most direct deposit setups take 1 to 2 pay periods to activate. Create a straightforward process for employees to update their banking information through your payroll system or HR department and maintain secure documentation of all direct deposit arrangements. Remember to inform employees about the timeline for the first deposit to help manage their expectations during the transition.

-

Can I Set Up My Own Direct Deposit?

Can I Set Up My Own Direct Deposit?

Yes, employers can set up direct deposit on their own if their payroll software includes this feature; otherwise, they will need to work with a provider. There are many options available to employers when setting up direct deposit, but the process itself is relatively straightforward. You will need to register with a provider to access their direct deposit platform, fill out the necessary forms, and submit them to the provider.

Depending on the provider, you may also be required to provide additional information, such as bank account numbers or proof of authorization from a financial institution. After that, you should be able to begin setting up your direct deposit system quickly and easily.

-

How Long Does It Take Payments to be Processed Using Direct Deposit?

How Long Does It Take Payments to be Processed Using Direct Deposit?

The timeline for processing direct deposit payments can vary depending on the employer's payroll processing schedule and the bank's policies. Direct deposit payments can take anywhere from 0 to 3 business days to process, typically making them faster than paper checks.

With paper checks, employees may have to wait for the check to arrive in the mail and then take it to the bank to deposit, which can take additional time. This faster processing time allows employees to access their wages sooner without the delays of mailing and depositing paper checks, making direct deposit a more efficient and reliable payment method.

-

How Much Does Direct Deposit Cost?

How Much Does Direct Deposit Cost?

The cost of setting up a direct deposit system depends mainly on your chosen provider and the type of services they offer. Generally, there may be additional fees for some services, such as setting up multiple accounts or having more than one payee associated with an account.

However, these costs are typically minor and well worth it compared to processing paper checks. Additionally, most providers offer discounts for employers who commit to using their services for extended periods or those with large groups of employees.

-

What Are the Advantages of Using a Direct Deposit System?

What Are the Advantages of Using a Direct Deposit System?

One of the primary advantages of using a direct deposit system is convenience. Instead of manually writing physical checks each pay period before employees obtain and deposit them, money can be automatically transferred into employee accounts after the payroll process is complete.

This saves employers time and money since they don't have to worry about physically printing checks or dealing with costly mailing fees. Additionally, because payments are sent electronically rather than through traditional methods, employees can receive their funds faster, which leads to increased satisfaction and greater security since payments cannot be lost or stolen.

-

Is There Any Risk Associated With Using a Direct Deposit System?

Is There Any Risk Associated With Using a Direct Deposit System?

Yes, there is always some degree of risk associated with transferring money electronically; however, this risk can be reduced by taking certain precautions, such as making sure your chosen provider offers secure payment encryption protocols that protect data from potential hackers or malicious actors looking to gain unauthorized access into private systems. As an added layer of protection, employers should also gain consent from each employee before signing them up for any electronic transfer payment method.

-

How Do I Pay My Employees Without Direct Deposit?

How Do I Pay My Employees Without Direct Deposit?

Several payment options exist beyond direct deposit. Many businesses still use paper checks, which create a clear payment record but require employees to visit their bank. Payroll cards work like debit cards and give employees immediate access to their wages without needing a bank account.

Modern payment apps and digital platforms offer additional choices, though you'll need to verify that they meet payroll requirements in your area. When picking a payment method, consider your budget, employee preferences, and administrative time.

Make Payroll Easier with Direct Deposit

From small businesses to massive enterprises, Paychex has you covered. We offer payroll packages that are customized to fit your business needs and built to grow with you.

Tags