Paychex HR and Payroll Services in Colorado

Colorado businesses trust Paychex for reliable, efficient payroll and HR solutions that grow with their needs. Choose the nationally recognized provider familiar with the Colorado business landscape.

Request a Free Quote

Paychex Services for Colorado Businesses

Simplify Colorado Payroll and Taxes

Easily pay your employees with our user-friendly online payroll software, featuring:

- Flexible processing

- Automated tax management

- Adaptable employee self-service

The Comprehensive Solution for HR

Paychex PEO* is your all-in-one HR solution to make it easier for you to manage:

- Employee benefits

- HR

- Payroll

- Compliance

Cover Your Business, Property, and Employees

Protect your business with comprehensive coverage,** from a business owner’s policy to workers’ compensation, tailored for small businesses, LLCs, or large organizations.

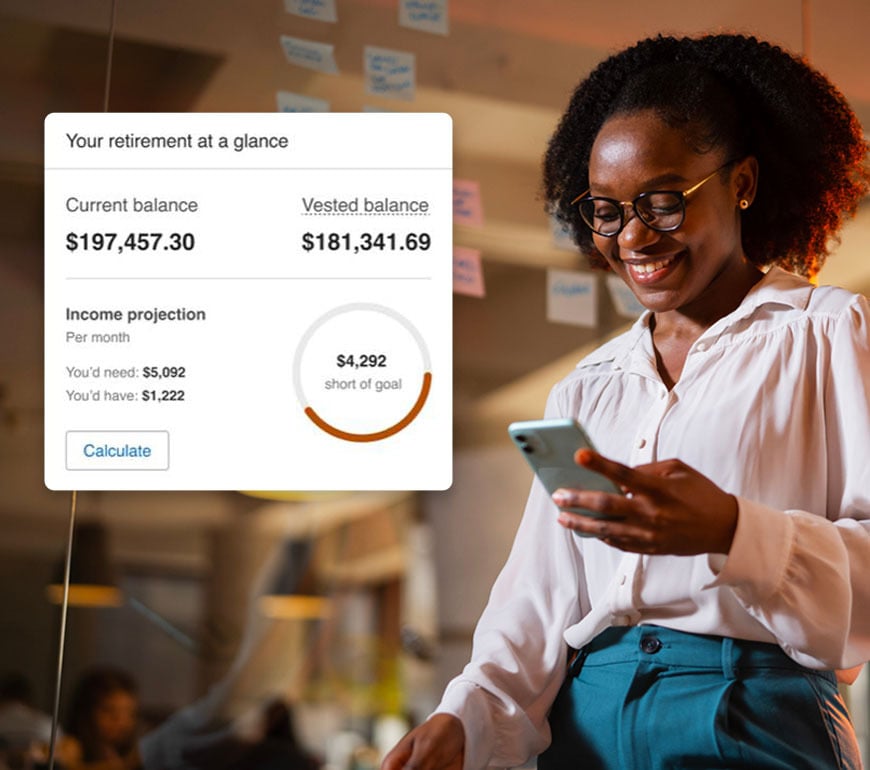

Offer Retirement Plan Options to Attract and Retain Employees

Empower your employees in Colorado to secure a stable future with Paychex, offering flexible plans, investment options, and transparent pricing with no hidden fees.

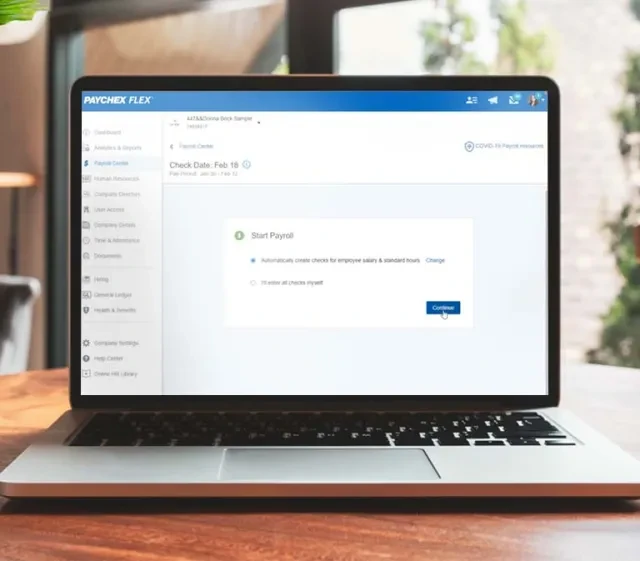

The Single Platform for your HR, Payroll and Benefits

Streamline HR, payroll, and benefits with Paychex Flex®. Whether you’re self-employed, a startup, or a large corporation, our award-winning platform scales to meet your needs with over 30 self-service features for employee convenience.

Contact a Paychex Payroll & HR Consultant

Looking for more reasons to work with Paychex?

- Over 50 years of industry experience to guide your business

- User-friendly technology to boost productivity

- In-depth knowledge of Colorado state and federal laws and regulations

Convenient and Time-Saving Service

Our solutions make it more convenient for Colorado businesses to manage payroll, HR, and benefits. Paychex helps save time and money so you can focus on what’s most important – running your business.

Need support? We're here to help.

Find the Right Solution for Your Business

Work with Paychex to move your business forward with the solution that best fits your business needs. We have the combination of technology, expertise, and customer service to save you time and money.

How Many Employees Do You Have?

Paychex Is the Smart Choice for Payroll and HR Services in Colorado

- We have a range of services that can scale with your needs and help your business reach its goals.

- More than 650 dedicated, highly-trained HR consultants — the most in the HR outsourcing industry and entirely based in the U.S.

- Paychex pays 12 million workers — 1 in 12 U.S. private sector employees

Additional Resources for Businesses in Colorado

Payroll Solutions for Businesses of Every Size

Our payroll services could save you time, allowing you to focus on what truly matters. With solutions for every business size, our customers share why they trust Paychex to simplify their payroll processes.

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

“We have quite a few employees that are working remote these days and Paychex Flex® really allows them to go in at any time and really check on their payroll, check on their contributions, and really look and make sure that everything is accurate."

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."