Paychex HR and Payroll Services in North Carolina

Businesses in North Carolina rely on Paychex to deliver exceptional payroll and HR services and support. Choose the nationally recognized provider familiar with the North Carolina business landscape.

Request a Free Quote

Paychex North Carolina Locations

Our location is built to serve businesses across North Carolina — payroll services, HR solutions, benefits administration, and much more are available, no matter where you operate.

4015 Meeting Way

Paychex Services for North Carolina Businesses

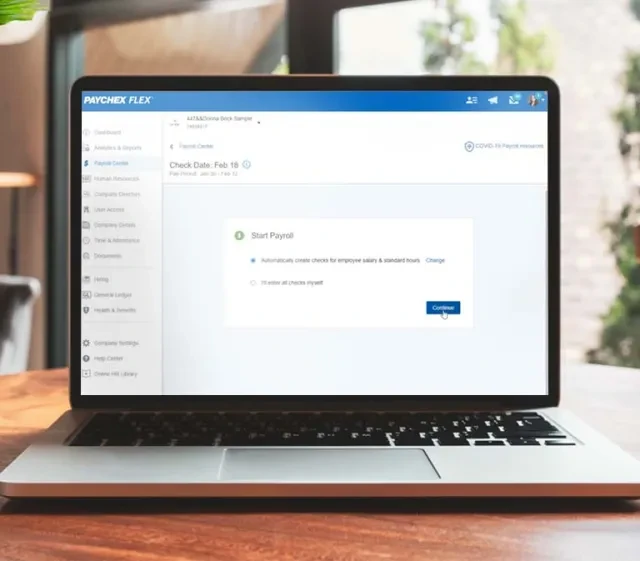

Simplify Payroll and Tax Admin

Easily pay your employees with our user-friendly online payroll software, featuring:

- Flexible processing

- Automated tax management

- Adaptable employee self-service

Manage Your Employees and More

Whether you need assistance with everyday HR tasks or want to outsource HR administrative tasks with a PEO,* Paychex offers solutions that help save you time and money, allowing you to focus on what truly matters.

Cover Your Business, Property, and Employees

Safeguard your North Carolina business with tailored coverage options, from business owner’s policies to workers’ compensation. We have choices perfect for small businesses, LLCs, and large organizations.**

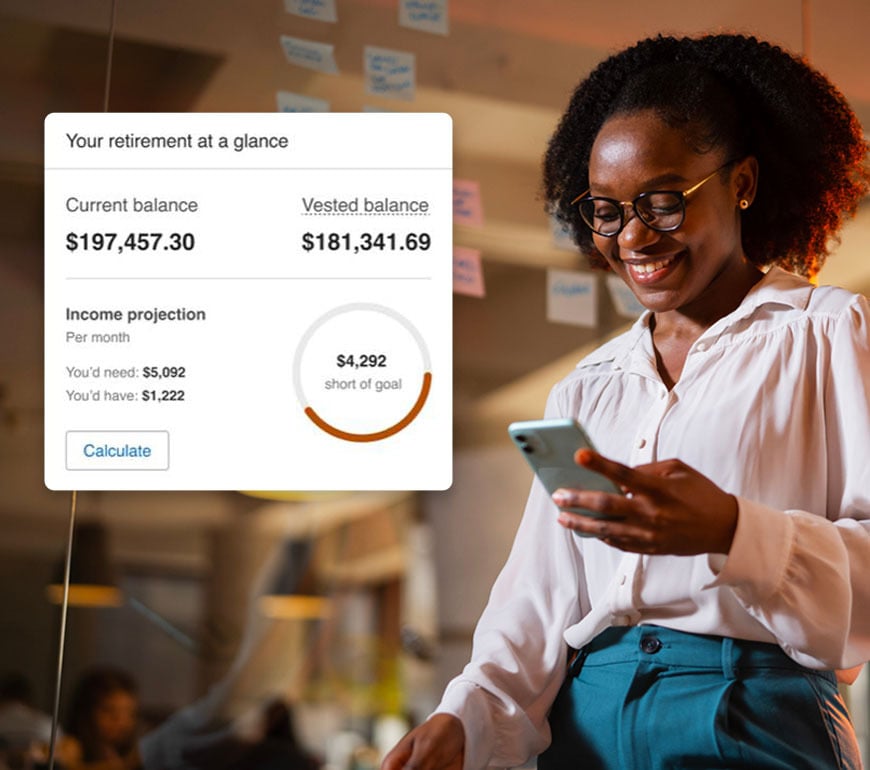

Affordable 401(k) and Retirement Plan Options

We can help you find a plan that helps your employees to achieve their retirement goals while putting tax savings in your pocket.

The Single Platform for Your HR, Payroll, and Benefits

Whether you’re self-employed, a startup, or a large corporation, our award-winning technology scales to serve businesses of any size, giving employers a customized solution to their most pressing HR and payroll needs.

Contact a Paychex Payroll & HR Consultant

Need more reasons to work with Paychex? Look no further:

- 50+ years of industry experience to help guide your business

- Extensive knowledge of North Carolina and federal laws and regulations

- Easy-to-use technology to help improve productivity

Convenient Service and Support

North Carolina businesses know how convenient it can be to work with Paychex:

- Use our app to do payroll and manage HR and benefits in one platform

- Allow employees access to over 30 self-service actions for increased employee convenience and independence

- Save time so you can focus on what truly matters – your business

Need support? We're here to help.

Find the Right Solution for Your Business

Paychex has the technology, expertise, and customer service to help you move your business forward. Easily manage human resources, benefits, and payroll with our all-in-one platform.

How Many Employees Do You Have?

Paychex Is the Smart Choice for Payroll and HR Services in North Carolina

- Largest HR company for small to medium-sized businesses

- Over 650 HR professionals averaging 8 years of training and expertise

- Award-winning service and integrated HR and payroll technology

Additional Resources for Businesses in North Carolina

Payroll Solutions for Businesses of Every Size

Whether a small business or a large corporation, Paychex Payroll Services can save you valuable time, allowing you more time to focus on your business. Discover why our customers trust Paychex to simplify their payroll needs.

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

“We have quite a few employees that are working remote these days and Paychex Flex® really allows them to go in at any time and really check on their payroll, check on their contributions, and really look and make sure that everything is accurate."