Paychex HR and Payroll Services in Ohio

Ohio businesses trust Paychex for reliable payroll and HR outsourcing, providing customized services to help them reach their maximum potential and profits.

Request a Free Quote

Paychex Services for Ohio Businesses

Payroll Services Made Easy

- Scalable options to grow with you

- Compliance information to help you stay ahead of changes

- Automatic payroll tax calculations and payments

Dedicated Support From Your HR Professional

Having a reliable partner simplifies HR. We offer access to dedicated, experienced HR professionals to deliver your Ohio business the attention and support it deserves.

Comprehensive Business Insurance**

- 20+ years of experience

- Over 150,000 customers throughout the U.S.

- Wide variety of options, from cyber liability to property insurance

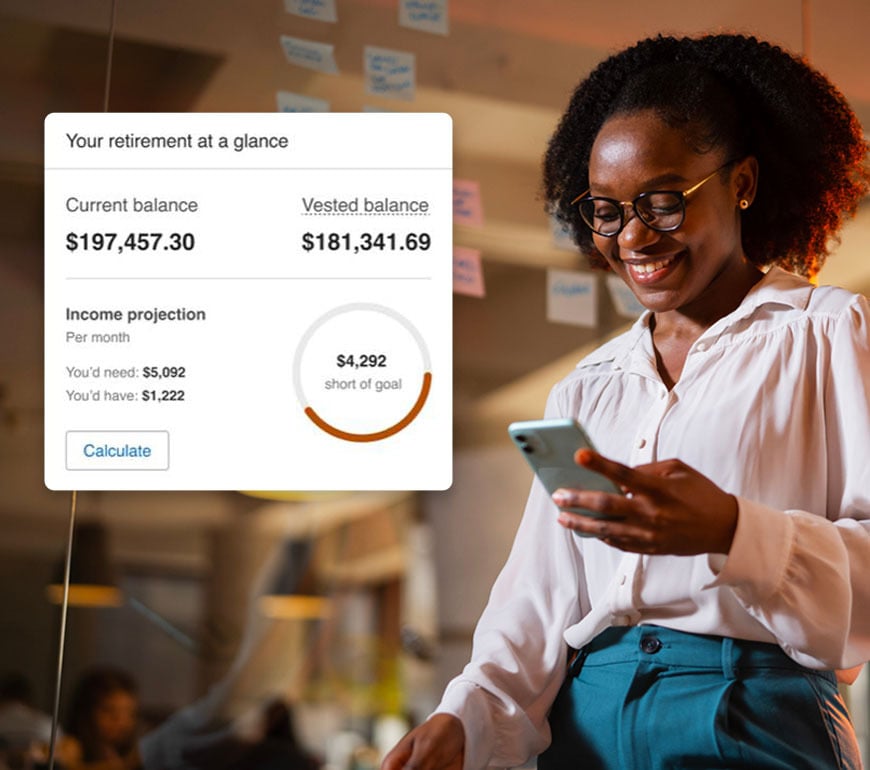

Simplify Retirement Plan Management

Business owners often think they can’t afford to offer a 401(k) plan. We’ll help you find a plan that supports your employees’ retirement goals and provides you with tax savings.

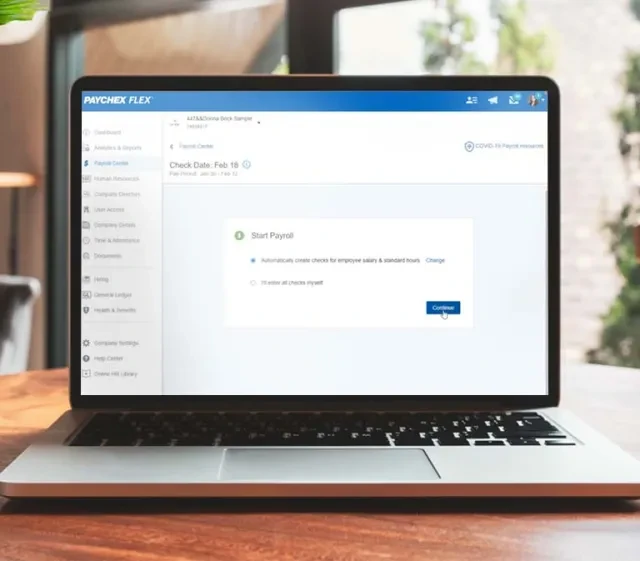

The Single Platform for Your HR, Payroll, and Benefits

From startups to large corporations, Paychex Flex® meets the needs of any business. Our software integrates technology and support on a single platform, adapting for your business growth and allowing for flexibility.

Contact a Paychex Payroll & HR Consultant

Need more reasons to work with Paychex?

- Extensive knowledge of Ohio state and federal laws and regulations

- Easy-to-use technology to help improve productivity

- Over 50 years of industry experience helping guide businesses

Convenient Service

Paychex helps Ohio businesses save time and leverage their expertise with solutions ranging from self-service time tracking to comprehensive human capital management and benefits support.

Need support? We're here to help.

Find the Right Solution for Your Business

Paychex offers affordable, innovative solutions and expert support to help advance your Ohio business, tailored to your needs today and tomorrow.

How Many Employees Do You Have?

Paychex Is the Smart Choice for Payroll and HR Services in Ohio

- Recipient of numerous awards for excellence and innovation in HR and payroll technology

- Flexible support when and where you need it

- HR industry experts since 1971

Additional Resources for Businesses in Ohio

Payroll Solutions for Businesses of Every Size

Paychex is ready to move your business in Ohio forward with its affordable, innovative solutions and expert support, sized just right for your needs. Hear from our customers about why they chose Paychex.

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

“When we acquire a new community, continuity in the team members is very critical to the residents, so it’s very critical for us to ensure … all these team members are enrolled in a payroll system, signed up for their benefits, get their 401(k).”

“We have quite a few employees that are working remote these days and Paychex Flex® really allows them to go in at any time and really check on their payroll, check on their contributions, and really look and make sure that everything is accurate."