Paychex HR and Payroll Services in Oregon

Oregon businesses turn to Paychex for time-saving solutions for payroll, HR, and benefits. Our easy-to-use single platform is tailored to your unique business needs.

Get a Free Quote

Paychex Services for Oregon Businesses

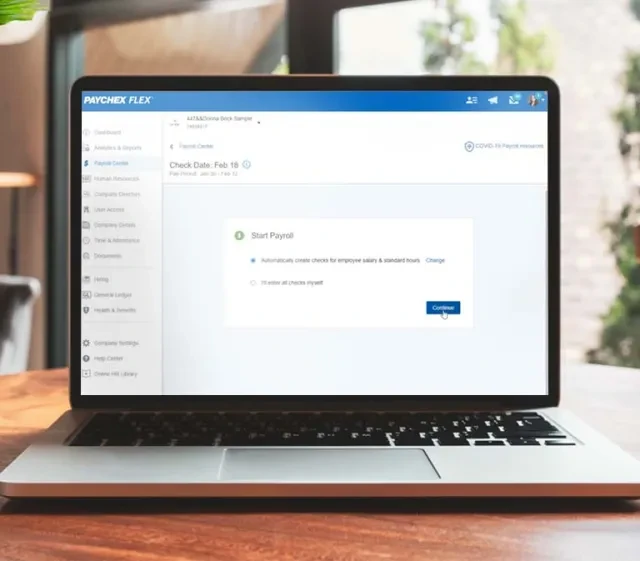

Quick and Easy Payroll Services

Paychex Flex® can help you simplify payday for you and your employees. As part of our payroll offerings, you'll get instant access to our payroll tax service, Taxpay®, for automatic tax administration.

An All-in-One HR Solution

Help attract and keep employees, offer world-class benefits, simplify payroll, and more. Wherever your business is going, Paychex has the right combination of innovative business solutions paired with award-winning service and support to help it reach its goals.

Find Insurance Coverage From Top Carriers

Injuries or illness can happen on the job anytime, anywhere. We want you to have workers' comp coverage that's just right, which is why we perform an initial assessment to help you find a plan that meets your needs.

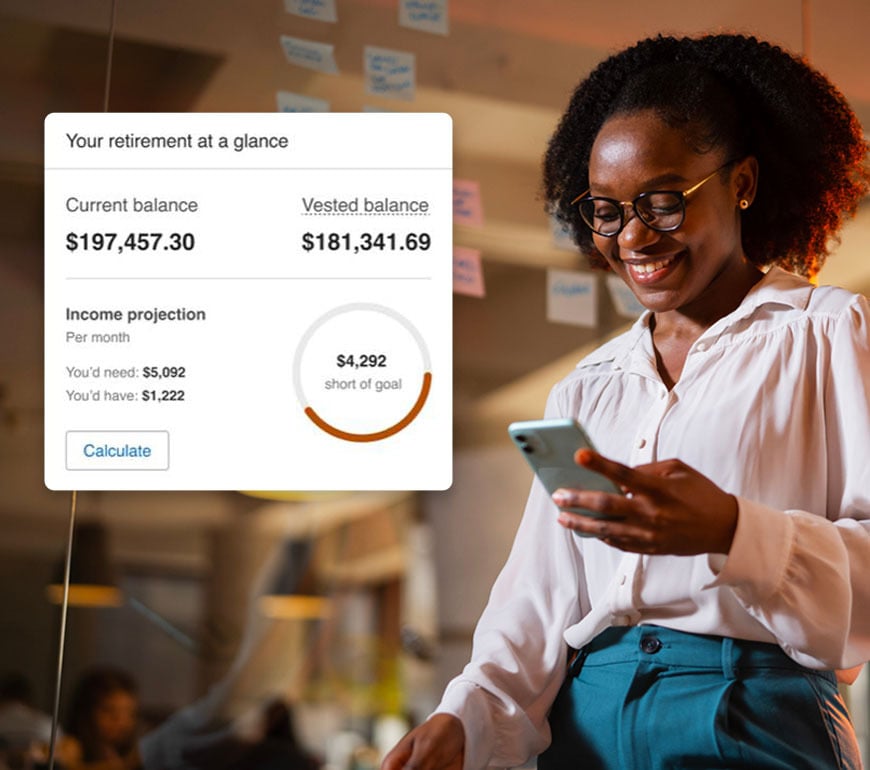

Retirement Made Easy

Empower your employees and business when using retirement services to secure a more stable future with a flexible 401(k) plan and investment options to stay competitive.

A Single Platform for your HR, Payroll, and Benefits: Paychex Flex®

- Our Award-winning technology platform — Paychex Flex — can scale to serve any business of any size

- Easy to use from your desktop or mobile device

- Do it yourself or work with one of our payroll specialists. We have a solution to meet your specific needs

Convenient Service for Oregon Businesses

We’re here when you need us, anywhere, anytime. Phone, email, mobile app: you choose. We work with you the way you want to work.

Contact a Paychex Payroll and HR Consultant

Paychex has more than 650 dedicated, highly trained HR consultants — the most in the industry. Their expertise and innovative thinking can help guide you through your HR challenges, backed by our highly trained payroll and HR customer service representatives.

Find the Right Solution for Your Business

With more than 50 years of experience, Paychex has the technology, expertise, and customer service to help move your business forward by finding the right solution that works best for your individual business needs.

How Many Employees Do You Have?

Paychex Is the Smart Choice for Payroll and HR Services

We help you take care of payroll, so you have more time to take care of business.

- We’ll help you stay up to date with changing state and federal regulations

- Get help creating and managing a benefits package

- Get complete business coverage, from a business owner’s policy, to workers’ compensation for your organization

Additional Resources for Businesses in Oregon

Payroll Solutions for Businesses of Every Size

Paychex Payroll Services can save you and your business time so that you can focus on what matters most. Hear from our customers about why they choose Paychex to help ease the payroll burden.

“(With staff in multiple states), we had different state labor laws (to deal with) … we didn’t have the resources to address …. Paychex sorted through that for us so we didn’t have to spend any time or effort on figuring it out.”

"Julie [my Paychex HR consultant] does a good job of bringing the best out of us."

“Payroll, HR, keeping up with the changing IRS rules; these are things that are critical to making our business hum … Not having to invest in the back office means we can put our resources into our core business.”

"As a recruitment tool, the 401(k) is a very integral part of what we offer our employees."

![[Update] What You Need to Know About New York State's Paid Family Leave Program nys paid family leave](/sites/default/files/styles/x_small_hq/public/image/2020-09/new-york-state-paid-family-leave.jpg?itok=neMwrJAO)