2018 Paychex Pulse of HR Survey

- HCM

- Guide

-

Last Updated: 06/18/2018

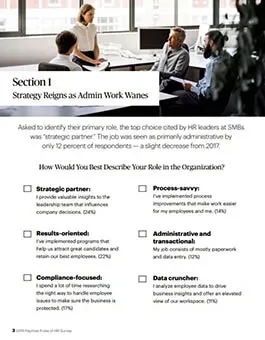

Three hundred HR decision makers from U.S. companies with 50 to 500 employees participated in the 2018 Paychex Pulse of HR Survey. And the results revealed a shift in the roles and challenges faced by HR departments across the country.

As HR leaders take on increasingly strategic roles, employee productivity is top of mind. The three most common HR practices involved productivity, staff training and development, and focusing on company culture — while the importance of regulatory compliance has almost doubled since the 2017 survey. Seventeen percent of companies now dedicate time to researching how to handle employee issues to make sure their business is protected.

Compliance also increased in importance since 2017, as two of the top three HR challenges cited by HR leaders this year were keeping up with regulations (38 percent) and complying with them (35 percent).

One of the main factors driving this shift in responsibilities is technology, according to the 2018 survey. Three-quarters of respondents said technology has improved HR leadership’s ability to play a critical role in corporate success.

Want to know what other trends we uncovered? Take a look at our full survey results now.