Business Resources to Help You and Your Employees

2025 Tax Bill: What’s In It and How It Impacts Your Business

Our experts will break down key changes in the tax and spending bill, offer tips to simplify tax compliance and strategies to position your business for success.

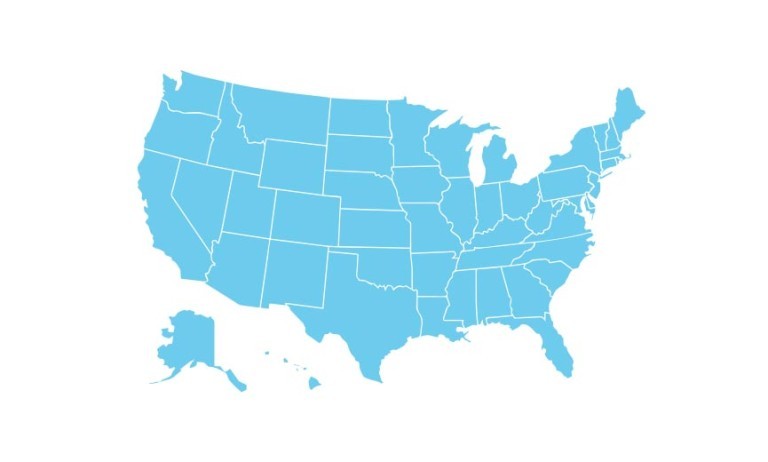

FUTA Credit Reduction States

Businesses in New York and California are becoming all-too-familiar with the extra money the state's unpaid debt to the federal government is costing them per employee. Connecticut rejoined the list in 2025, and all three face additional penalties if the Benefit Cost Rate is applied to the currently reduced credit rate. Find out what it might cost your business.

Business Podcasts

Paychex Thrive, a Business Podcast

Navigate the dynamics of today's business climate.

Paychex Pulse, an HR Podcast

The issues facing today's human resource leaders and managers.