- Finance

- Article

- 6 min. Read

- Last Updated: 08/29/2022

Break-Even Point Calculation and Analysis: Will Your Business Become Profitable?

Table of Contents

Learning how to calculate your break-even point is essential for determining when your business will become profitable. Using a cloud-based accounting system can help you monitor when sales fall below this point and begin operating at a loss. It can also help you determine when you need to increase your sales to operate beyond breakeven and maintain profitability.

What Is Break-Even Point?

At its simplest, the point of breakeven is the point where you are earning as much as you are spending — no more, no less. Although breaking even is better than operating at a loss, operating beyond the break-even point is where business owners want to be. It allows them to:

- Begin to realize profits

- See signs of growth and stability

Performing a break-even analysis allows you to determine when you will likely begin generating a profit and where your sales levels need to be to maintain profitability on a monthly basis. You can simplify this process by using a good cloud-based accounting system, which allows you to monitor increases and decreases in sales.

As a small-business owner, you need to understand what it means to break even and how to calculate the break-even point. These are critical ways to determine whether the business is making a profit. Be careful not to confuse generating revenue with making a profit, as well as the difference between a net profit versus a gross margin and fixed costs versus variable costs (both of which you'll need to calculate the break-even point).

When a business reaches the break-even point, (which is also referred to as the point of breakeven) the business is no longer operating at a loss. It's not operating at a profit either, but it's no longer losing money. Normally associated with startups, breakeven is often used in established businesses as well.

The point of breakeven can be looked at in two ways:

- When the initial cash needed to fund a new business or venture (such as a business loan or investment) is no longer needed to sustain the business. In this case, there's sufficient revenue to cover the fixed and variable cost and the cash balance is $0.

- When a company is not operating at a profit or at a loss and the net income is $0.

In either case, a business can reach its break-even point when sales reach a certain level and can become profitable as sales increase. It's important to find out how much revenue you need to generate to operate beyond the break-even point and become profitable, as well as monitor your revenue levels on a regular basis.

Is your small business breaking even but barely getting by? Or are you operating just beyond the break-even point? There are some simple steps that you can take to help you monitor your business's ongoing monthly sales and profits.

Advantages of a Break-Even Analysis

Conducting a break-even analysis arms businesses with a clear picture of pricing and financials, allowing them to make better decisions and reduce the likelihood of going out of business as a result of financial shortfalls. More specifically, the benefits of a break-even analysis include the following:

- Clear product pricing: You may have an idea of how much you want to sell your products for, but pricing without data to back up the reasoning is risky. Finding your break-even point and knowing how it will affect your profitability makes smart business sense and can help you price realistically.

- Support for business decisions: Similarly, a break-even analysis can help take the emotion out of pricing your products. Base your business decisions on facts and real numbers.

- Reduce missed expenses: With all the moving pieces going into a new business, it's easy to overlook or lose track of some expenses. A break-even analysis requires gathering key financial data, which can help you have a clear understanding of the numbers you're working with from the get-go.

- Set revenue targets: Break-even analysis gives you clear numbers and sales targets. This can help make business goals clear as well.

- Limit financial strains: Conducting an analysis can bring to light potential negative business outcomes. Having this data can help businesses avoid failure and limit potential financial pitfalls.

- Be ready for funding: Securing financing or getting funding from investors will usually require conducting a break-even analysis. It not only offers hard facts to potential backers that your business plan is viable, but it can also assuage any trepidation you may feel about taking on financing.

Depending on the outcome of the break-even analysis, you may consider taking any number of next steps: change the price of your product for better profit margin, increase or decrease fixed costs, change variable costs, and many other possible actions. In doing so, however, make sure that your pricing and sales targets are realistic based on the time and resources you have to go after them.

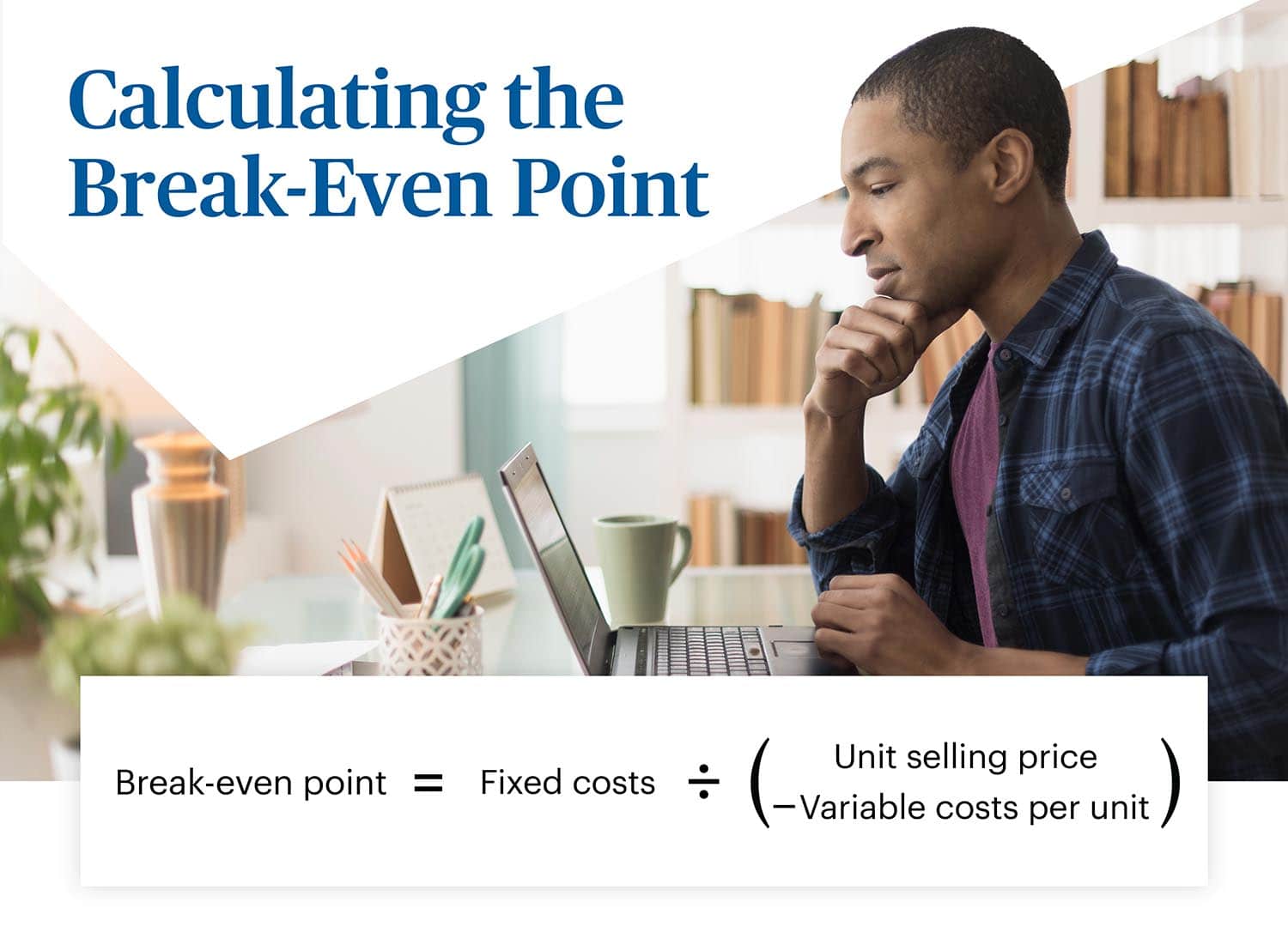

Calculating the Break-Even Point: What Is the Break-Even Point Formula?

A simple formula to calculate the break-even point for your business is:

Break-Even Analysis Example

Let's take a closer look at this formula's components by using an example of t-shirt sales:

- Fixed cost: This consists of costs that remain the same regardless of how much is generated from monthly sales, such as rent expense, salaries, insurance, and other ongoing, general office and administrative expenses. For our t-shirt example, we'll use $10,000 as the monthly fixed cost.

- Unit selling price: This is the price you sell your product. In this example, $25 is the selling price for each t-shirt.

- Variable cost: This not only includes the cost of the t-shirt, but other costs, such as shipping and delivery. For this example, it costs $10 to purchase/manufacture the t-shirt, plus $3.50 for shipping, making the total variable cost per unit $13.50.

Break-Even Point Calculator

Based on the break-even point calculator, you would need to sell 869.6 units each month to break even, and you would need to make $21,739.13 every month in sales:

Break-even point = fixed costs / (unit selling price - variable costs)

Fixed costs / (unit selling price - variable costs) = 10,000 / (25 - 13.50) = 869.9 units

Break-even point = 870 units or $21,750 in sales revenue

To generate a profit and operate beyond the point of breakeven, unit and monthly sales would need to be greater than 870 units or $21,750 in sales revenue. When sales are lower, the t-shirt company would be operating at a loss.

Your goals are to stay in business and become profitable. Following these simple steps can help you perform a break-even analysis, determine how much you need to generate in sales for your own business to make profits, and keep your doors open.

Tags