- Payroll

- Article

- 6 min. Read

- Last Updated: 08/23/2024

What Is Base Pay and How Can It Be Calculated?

Table of Contents

The ability to compensate employees competitively as part of an effective talent acquisition strategy is top-of-mind for hiring teams and HR professionals who continue to grapple with today's labor shortage struggles. To meet these challenges, many HR leaders are offering or thinking of offering employee wellbeing support programs and other incentives to encourage candidates to accept job offers, according to the 2023 Paychex Pulse of HR Survey. Among the most effective tactics that HR leaders reported deploying include offering higher base pay as a component of a competitive offer.

Considering these factors, it's important to understand base pay as part of overall compensation packages when employees consider a job offer at your business or negotiate a raise.

What Is Base Pay?

Base pay, also commonly referred to as a base salary or hourly rate, is a fixed amount that an employer agrees to pay an employee in exchange for time and services agreed upon before the employee begins working. Base compensation is most often expressed as an hourly rate, or annual salary. It doesn't include benefits or additional earnings, such as commission, tips, overtime pay, or bonuses. With this in mind, base pay may only be one part of an employee's total compensation.

What does base pay mean to job candidates and potential new hires? A job offer may include details about base pay and other details about future wages, such as a potential commission for a sales job. However, the employer typically determines base pay based on a set workweek and various additional factors, including the individual's experience, job duties, and skills.

Base pay is often a starting point for compensation negotiations and may increase over time based on employee performance or other demonstrations of an employee’s value to the company. And in times when recruiting and hiring are especially challenging, employers may raise base pay to compete for top talent.

Who Receives Base Pay?

While some employees receive their base pay in the form of an annual salary distributed across pay periods, others may be paid through an hourly wage. Salaries typically represent how employees who meet the criteria for exemption from minimum wage and overtime pay requirements outlined by the Fair Labor Standards Act (FLSA) receive their base pay.

Other employees may receive their base compensation on a per-hour, shift, or day basis. These are typically nonexempt employees under the FLSA who are owed minimum wage for all hours worked and overtime for hours worked over 40, among other protections.

If you aren't already familiar with the distinctions between exempt and nonexempt employees, it's important to understand each of these employee classifications. The Department of Labor has created materials to help you classify employees correctly, adhere to these federal standards, and properly pay employees for time worked. Remember that your business may also be subject to federal, state and local wage and hour laws.

Base Pay vs. Gross Pay

A firm understanding of base pay vs. gross pay is paramount, especially when negotiating employee compensation. As previously stated, base pay is an employee's hourly rate or salary before any additional payments are added. On the other hand, gross pay includes base earnings plus overtime pay (if applicable), commissions, bonuses, tips, etc., before deductions are taken. Usually, base pay is a set amount that changes infrequently (e.g., annual performance reviews, market adjustments, etc.), while gross pay may fluctuate based on additional incentives.

In addition to base pay vs. gross pay, you should also consider net pay, which is the amount an employee “takes home” each pay period. This is gross pay minus taxes and other deductions.

How Is Base Pay Calculated?

Variables such as the employee's experience level, certifications, and market value for employees in similar roles can all help an employer establish an appropriate base rate while considering the job duties and number of hours the employee will work per week, typically 40 hours for a full-time employee. You may also want to look at pay data from the U.S. Bureau of Labor Statistics (BLS), which offers information across professions, industries, and geographic areas.

To calculate base pay, you can use one of the following calculations, depending on the employee's classification:

[Regular pay amount per payment period] x [# of payment periods in a year] = Annualized base pay

[# of hours worked in a week] x [# of weeks in a year] x [hourly wage] = Annualized base pay

Base Pay Calculation Examples

Using the basic calculations above, let's look at how base salary and base pay can be calculated, along with basic calculations for bonuses and overtime:

Example 1: Base Salary

[Regular pay amount per payment period] x [# of payment periods in a year] = Base salary

[$4,000 bi-weekly salary] x [26 pay periods] = $104,000 base salary (annually)

Example 2: Base Pay

[# of hours worked in a week] x [# of weeks in a year] x [hourly wage] = Base pay

[30 hours worked per week] x [52 weeks] x [$40 per hour] = $62,400 base pay (annually)

Example 3: Bonus as a Percentage of Annual Salary

[Employee's annual salary] x [Percent bonus rate] = Bonus amount

[$104,000 annual salary] x [3% bonus] = $3,120 bonus

Factors Impacting Base Pay

It's ultimately up to the employer to determine base pay after considering things like applicable minimum wage or salary requirements, but new hires and employees may negotiate for a higher base pay, pointing to several factors. While businesses need to ensure they provide pay that meets applicable wage and hour law requirements, base pay can be negotiated or determined by variables such as:

- The employee's experience, skillsets, education, and specialized knowledge

- Any professional certifications that relate to the job

- Amount budgeted for the position

- Geographic location

- How much competitors are paying for similar roles based on market data

- Cost of living adjustments

- How much current employees in similar roles are compensated

- How long a position has been unfilled

- Whether other forms of compensation are offered, such as equity

When hiring or negotiating with an employee, use a standardized compensation formula and a well-designed compensation structure. These tools, along with base pay considerations, are crucial for creating a fair and equitable workplace. They help businesses assess a position's value in the labor market and within the company. This formulaic approach may diminish bias and promote equitable pay practices.

Common Questions about Base Pay

How Do I Set a Competitive Base Compensation?

Setting a competitive base salary is crucial for attracting and retaining top talent. Here's how you can do it effectively:

Conduct Market Research and Salary Surveys: Understanding the going rate for roles similar to yours is the first step. Market research and salary surveys provide valuable insights into what other companies pay. These tools help you gauge average salaries for specific positions, identify high-demand skills that may command premium pay, and benchmark your offerings against competitors.

Understand Regional Differences and Industry Norms: Base pay varies significantly based on location and industry. Here's why it's important to consider these factors:

- Regional Differences: Cost of living and local job markets influence salary expectations. For example, a software engineer in San Francisco might expect a higher base pay than one in a smaller city due to living costs and market demand.

- Industry Norms: Each industry has its own compensation standards. Knowing these norms ensures your salaries are competitive within your sector, whether you're in tech, healthcare, finance, or another field.

Combining thorough market research with an understanding of regional and industry-specific trends allows you to set a base salary that attracts talent and supports your company’s growth.

What Legal Considerations Should I Be Aware Of?

When setting base pay, it's crucial to consider both federal and state wage laws and the importance of maintaining equity and avoiding discrimination.

Overview of Federal and State Wage Laws

Navigating the legal landscape around wages can be complex, but it's essential for ensuring compliance and fairness:

- Federal Laws: The Fair Labor Standards Act (FLSA) sets minimum wage, overtime pay, and recordkeeping standards. Make sure your base pay meets or exceeds the federal minimum wage.

- State Laws: State-specific regulations may impose higher minimum wages or additional requirements. Always stay informed about local laws, which can vary widely and impact your payroll practices.

Importance of Maintaining Equity and Avoiding Discrimination

Equitable pay practices are not only ethical but also critical for legal compliance:

- Avoid Discrimination: Ensure that your compensation policies do not discriminate based on race, gender, age, or other protected characteristics. The Equal Pay Act mandates equal pay for equal work, regardless of gender.

- Pay Equity: Regularly review and adjust your compensation structures to address disparities. Implement transparent compensation practices to foster trust and demonstrate your commitment to fairness.

By adhering to both federal and state laws and prioritizing equity, you can create a fair and compliant compensation strategy. This helps protect your business legally and helps build a positive and inclusive workplace culture.

How Often Should I Review and Adjust Base Pay?

Reviewing and adjusting base pay should occur annually. This regular review helps ensure that salaries remain competitive and aligned with the organization’s financial health and goals.

Factors prompting adjustments:

- Inflation: Period adjustments are essential to keep up with the rising cost of living and ensure employees maintain their purchasing power.

- Market Changes: Regularly benchmark salaries against industry standards and local market conditions. Significant shifts in the job market or industry trends may necessitate more frequent reviews.

- Employee Performance: Recognize and reward high-performing employees with merit-based increases. This can motivate individuals and help retain top talent.

You can encourage a motivated workforce and stay competitive by routinely assessing and adjusting base pay.

Align Your Base Salary with Industry Standards

To recruit and retain top talent, employees' total compensation packages — a significant percentage of which may be base pay — need to be competitive yet reasonable and fair. Partner with experts in HR to help you effectively find and retain great talent, offer salaries that make sense for your business and industry, and keep you in compliance with applicable wage and hour laws and regulations. Working with an expert payroll provider can also help you pay your workforce accurately and on time during every pay period.

Ensure Fair and Competitive Compensation for Your Team

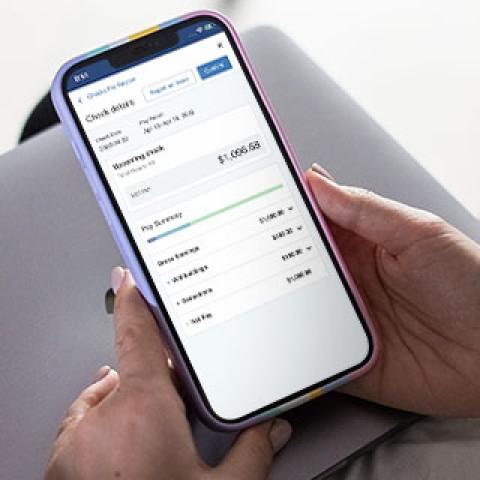

Our blend of innovative technology, support, and flexibility helps businesses like yours manage payroll, HR, and more. If you’re looking for top-tier payroll software, look no further.

Tags