- Payroll

- Article

- 6 min. Read

- Last Updated: 02/28/2025

What Is a Cost-of-Living Adjustment (COLA) and How Does It Work?

Table of Contents

Continued economic uncertainty in the U.S. may bring up the topic of providing cost-of-living adjustments to employee pay. While not based on job performance or promotion, COLAs may help employees manage rising prices for basic staples. With inflation continuing to raise concerns in 2025, businesses may increasingly consider implementing cost-of-living adjustments. Read on to learn more about how a COLA works.

COLAs are increases in compensation intended to help employees maintain the value of their pay against inflation. These increases are not viewed as merit increases but should be considered a way to help employees maintain their earning power.

What Is COLA Based On?

Since 1975, the Social Security Administration (SSA) has calculated the annual cost-of-living adjustments to SSA benefits based on a price index such as the Bureau of Labor Statistics' Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the increase in consumer prices for households where at least half of the income comes from clerical or urban wage jobs, and where at least one person has worked 37 weeks or more in the past year. This represents approximately 29% of the U.S. population.

Why Is a Cost-of-Living Raise Important?

A cost-of-living raise is important because it's a compensation practice used to help keep employees' pay on par with rising prices for basic needs, such as housing, energy, and food. The government issues COLAs related to Social Security benefits, but employers may also apply similar percentage increases to employees' yearly wages. According to the 2026 Business Leaders Priorities survey, 58% of businesses cite inflation as extremely challenging, ranking ahead of customer acquisition and interest rates. Employers who want to keep pace in a competitive labor market may choose to apply these increases as part of their employee compensation plans.

What Is the COLA for 2025?

Each year, the SSA automatically applies COLA to payments made to those receiving Social Security and SSI. For 2025, the COLA increase was based on the rise in the CPI-W from the third quarter of 2023 through the third quarter of 2024.

The SSA announced a 2.5% COLA increase for 2025 in October 2024. The increase took effect with Social Security and Supplemental Security Income (SSI) payments for December 2024, which were distributed in January 2025. SSI pays monthly benefits to those with limited income who are blind, 65 or older, or have a qualifying disability. Additionally, the Social Security Administration announced that the earnings limits for retirement beneficiaries will go up, both for individuals below “full” retirement age and those reaching that age.

How Does a Cost-of-Living Adjustment Work?

A COLA is a standard across-the-board increase for a group of individuals. Employers will often structure cost-of-living raises so that each employee receives the same percentage increase.

Typically, living costs in large cities such as New York or Los Angeles are higher than in smaller towns or rural communities. Employers with employees in several different cities or states may choose to adjust their cost-of-living raises based on location. This may help workers to meet more expensive housing, gas, or food costs in certain areas.

In some cases, cost-of-living pay increases may be a requirement. Minimum wage laws, union agreements, executive contracts, and even retiree benefits such as employee pensions may contain provisions for annual COLAs. Some of these automatic adjustments may be programmed into a compensation system to guarantee they take effect as stipulated, while others may require additional oversight.

What Is Included in the Cost-of-Living Adjustment?

A COLA is often calculated based on an underlying metric, such as the Consumer Price Index (CPI) or the CPI-W. The indexes calculate price increases in living staples such as housing, food, and energy costs. State law or a union agreement may specify which index should be used to calculate a COLA increase. Employment agreements may also state the specific index that must be used to measure any cost-of-living raises.

How To Calculate a COLA Increase for Employees

A COLA typically can be calculated as part of an annual compensation plan review. An employer should figure out which price index they’re required to use or which one best aligns with their employees' cost of living.

For example, if the chosen index rose 6% in the past year, employee compensation would be adjusted similarly. Employees with a $100,000 base salary might receive a 6% raise, or $6,000 for their COLA, before any performance-based increases. Likewise, an employee making $20 per hour might receive another $1.20 per hour, raising their pay rate to $21.20.

How Much Is a Social Security Cost-of-Living Adjustment on Average?

Over the years, COLAs have varied. In some years, prices have been largely stagnant, resulting in either no or minimal adjustment, as shown in the chart below. This year's 2.5% COLA is a slightly smaller percentage compared to the 2024 COLA of 3.2%. Historically, adjustments to the minimum wage were enacted to help lower-paid workers when the cost-of-living increases. Many states and localities have a higher minimum wage than the federal amount and several have implemented annual increases based on the rise of the cost-of-living.

Understand How Cost of Living Impacts Your Business

Keeping employee pay competitive is at the forefront of talent acquisition and retention. Aligning wages with cost-of-living adjustments is a smart addition to your hiring, retention, and compensation strategies for 2025.

Planning to introduce a cost-of-living raise this year? Simplify the process by collaborating with your payroll provider to roll out the increase seamlessly.

COLA FAQs

-

Do Employers Have To Give Cost-of-Living Adjustments?

Do Employers Have To Give Cost-of-Living Adjustments?

A cost-of-living increase is not mandated unless required by law or agreement. Additionally, it may not be needed every year. This may be the case during years when inflation remains flat, and the cost of living doesn't change, meaning that employees' pay value is not diminished.

-

Why Would an Employer Give a COLA?

Why Would an Employer Give a COLA?

There are several common reasons, including:

- Concern over employee retention when competing firms begin to offer higher pay rates

- The need to persuade employees to move to a city or state with a higher cost-of-living

- To alleviate the financial stress placed on employees during periods of inflation

- Doing so is required by law or under the terms of an agreement

-

What Is Cost-of-Living?

What Is Cost-of-Living?

Cost-of-living refers to the amount of money needed to maintain a particular standard of living in a specific location, with the ability to cover basic expenses such as housing, food, and transportation. Areas of the country, such as major cities, for example, tend to have a higher cost of living than suburban or rural areas.

-

How Often Should Cost of Living Raises Be Given?

How Often Should Cost of Living Raises Be Given?

In instances where it's not mandated, COLA raises and how often they are given are at an employer's discretion. Cost-of-living raises may not be needed every year. For example, in years when inflation remains flat, employers may choose not to give a cost-of-living raise.

-

When Are Cost of Living Raises Given?

When Are Cost of Living Raises Given?

In instances where employers have the option to give a cost-of-living raise, they can choose when to give them. Usually, a cost-of-living raise would be the same percentage increase for all employees, so it may make sense to implement the change at the beginning of a new year or following annual performance reviews. During these conversations, employees could also ask about a pay increase. Cost-of-living adjustments aren't merit- or performance-based. Your compensation plans should reflect market conditions and employees' ability to maintain earning power.

-

Who Is Eligible for a Social Security COLA Increase?

Who Is Eligible for a Social Security COLA Increase?

All Social Security and SSI beneficiaries, including those receiving spousal benefits, automatically receive a cost-of-living adjustment increase. This equates to more than 71 million Americans. The increase began with benefits that Social Security beneficiaries received in January 2025. Increased SSI payments began with the December 31, 2024 payment.

-

What Are Other Types of COLAs?

What Are Other Types of COLAs?

Most people think of cost-of-living adjustments as they relate to wage increases and salary, but they can also apply to benefits and other compensation packages.

-

What Are Cost-of-Living Adjustments vs. Minimum Wage?

What Are Cost-of-Living Adjustments vs. Minimum Wage?

Minimum wage is the lowest mandated base pay a company can offer its covered nonexempt workers. The minimum wage is set by federal, state, and local governments (many states' minimum wage is higher than the federal minimum wage of $7.25 per hour, which has remained unchanged since 2009). State minimum wages are based on many factors, your state’s minimum wage laws may include provisions for cost-of-living increases. If you haven't already done so, learn about this year's minimum wage increases and other regulatory issues.

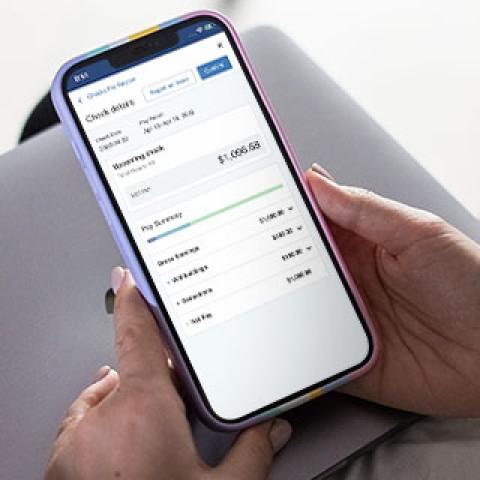

Better Pay Requires Better Payroll

Paychex payroll services help take the hassle out of payday and allow you to get your freedom back. See why approximately 800,000 customers use Paychex for their payroll needs.

Tags