All-in-One Employee Benefits Administration System

Make employee benefits management easier for employees, admins, and brokers. From health plans to retirement and insurance, access a customizable dashboard, payroll integration, and built-in ACA and HIPAA compliance support.

Manage Benefits With Confidence

Stay on top of managing eligibility tracking, enrollment forms, benefit changes, and more with our automated benefits platform. Here’s how:

Stay on Top of Admin Tasks

Track benefits approvals, access shared info, and reduce errors with an easy-to-use dashboard.

Connect With Your Carriers

Connect seamlessly with hundreds of national and regional carriers.

Keep Up With Compliance

Easily manage ACA, HIPAA, and other regulations with help from our all-in-one solution.

Get the Help You Need

Receive personalized support from a dedicated employee benefits specialist.

Save Time on Enrollment

Streamline self-service benefits enrollment with plan comparisons and in-app videos — no broker or HR needed.

It's a Benefit for You

Take control of benefits management with our all-in-one software. Get started today!

See Our Benefits Administration Software in Action

Manage benefits efficiently with our software, integrated with Paychex Flex®. Whether you outsource benefits administration or manage them in-house, we've got you covered with:

- In-app tutorials for guidance

- Connections to leading carriers

- Customizable dashboards

- Advanced reporting tools

Let us take care of the details so you can focus on your business.

3 Steps to Streamlined Benefits Administration

Find The Right Coverage

Don’t have a benefits provider? Paychex Insurance Agency* can help you find one and provide a seamless benefits administration platform at no additional cost.

You Can Work with Your Benefits Provider

Already have a benefits provider? Our benefits administration platform makes it easy to add and manage employee benefits, no matter who your provider is.

Take Efficiency to The Next Level

Handle benefits, HR, and payroll seamlessly with a professional employer organization (PEO). A PEO is an all-in-one solution that helps streamline your business operations — without extra costs for benefits administration.

Get More Done With Integrated Solutions

Find Perfect Benefits for Your Team

If you're searching for a benefits provider, Paychex can help you customize the best packages for your employees. Tailor solutions that meet their needs and support their well-being.

Offer Non-Traditional Benefits

Let employees choose voluntary employee benefits — at no cost to you — from financial wellness programs to home and auto insurance, life, dental, disability, and vision plans.

Attract the Best Talent

Use your well-managed employee benefits packages as a powerful recruiting tool - attract top talent and stand out in the job market.

Looking for more ways to find great candidates? We’ve got additional recruiting solutions to help you.

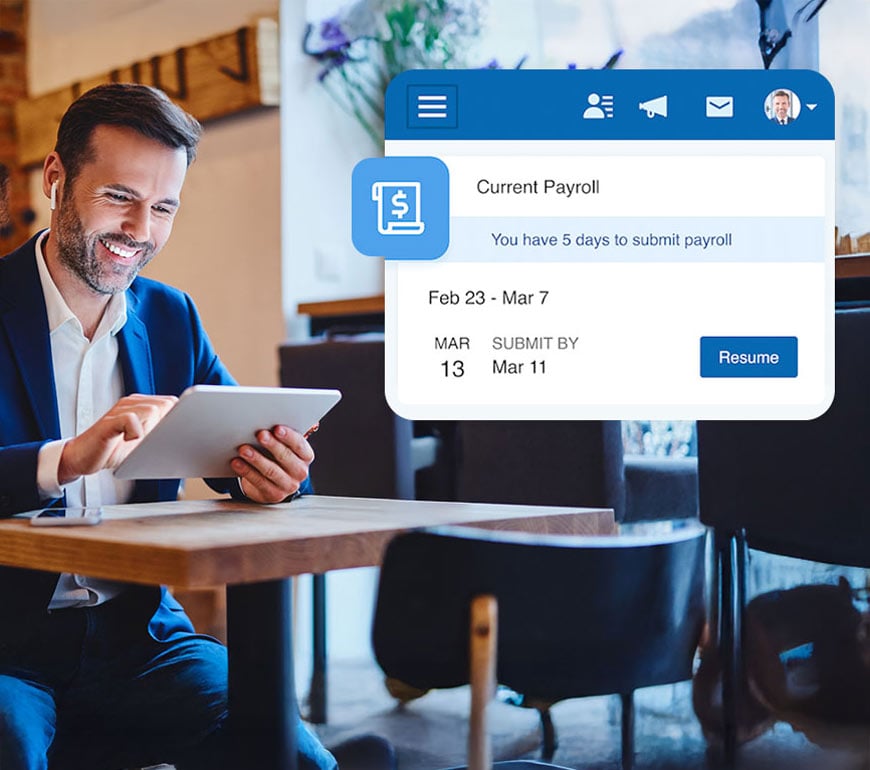

Dread Running Payroll? We Can Help with That, Too.

Our benefits administration and payroll software work together to save you time and reduce potential errors in pre-tax deductions or benefits plan changes.

“It has been a life-changing opportunity for me. It was the first time in 20 years that employees for FreeFlight Systems actually experienced electronic enrollment, and it was incredibly seamless for our team.”

Morgan Branum, Director of Organizational Development, HR, and Compliance

FreeFlight Systems

Additional Employee Benefits Resources

Benefits Administration FAQs

-

How Do You Offer and Manage Employee Benefits?

How Do You Offer and Manage Employee Benefits?

Our customers can set up their own benefits packages, but managing them can be complex. That’s why we offer the option to work with Paychex Insurance Agency to:

- Simplify administration with payroll integration

- Provide easy enrollment and employee self-service

- Access licensed agents for plan selection

- Help you stay compliant with ACA reporting requirements and more

-

What Is Employee Benefits Benefit Plan Administration?

What Is Employee Benefits Benefit Plan Administration?

Benefits are a key part of employee compensation. Using an effective benefits administration service can make managing and streamlining the process much easier.

-

What Is Included in Benefits Administration?

What Is Included in Benefits Administration?

Benefits administration with Paychex includes tools for managing enrollment, compliance support, and tracking. It supports group health insurance, retirement services, flexible spending accounts (FSAs), health savings accounts (HSAs), dental and vision insurance, and other ancillary benefits like retirement plans or wellness programs.

-

How Do You Outsource Benefits Administration?

How Do You Outsource Benefits Administration?

Outsourcing benefits administration can help save time and money. Follow these steps:

- Identify tasks to outsource, like payroll or health insurance.

- Evaluate proposals based on cost, services, and expertise.

- Collaborate with your provider to set up services and transfer information.

- Monitor performance and adjust as needed.

-

Why Outsource Benefits Administration?

Why Outsource Benefits Administration?

Managing benefits can be time-consuming. Outsourcing allows companies to focus on core functions while accessing expert administrators to help deliver competitive, compliant benefit packages efficiently. It can also help control costs and stay updated with HR regulations.

-

What Are the Goals of Benefits Administrator?

What Are the Goals of Benefits Administrator?

A benefits administrator can simplify management with seamless payroll and carrier integration, compliance support, and dedicated assistance when needed.