Paychex HR and Payroll Services in Arizona

Paychex provides payroll services in Arizona that help save time, improve accuracy, and comply with regulations. We’re your trusted HR and payroll service provider, and we leverage our technology and insights to help your business succeed.

Get a Free Quote

Paychex Arizona Locations

Centrally located in Phoenix and easily accessed just off the I-10 corridor, our team of dedicated HR and payroll professionals are prepared to help Arizona businesses of all sizes meet and exceed their HR goals.

16404 N Black Canyon Hwy

Paychex Services for Arizona Businesses

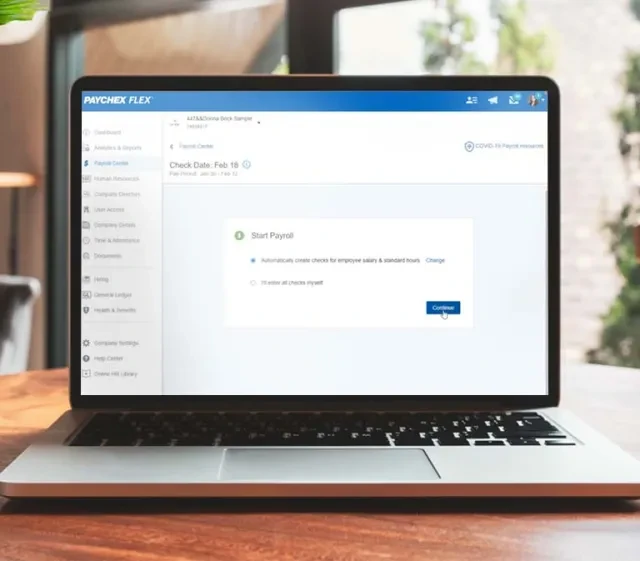

Simplify Arizona Payroll and Taxes

Our easy-to-use payroll software allows for:

- Automated tax administration

- Flexible processing

- Employee self-service

Professional Employer Organization (PEO) Services

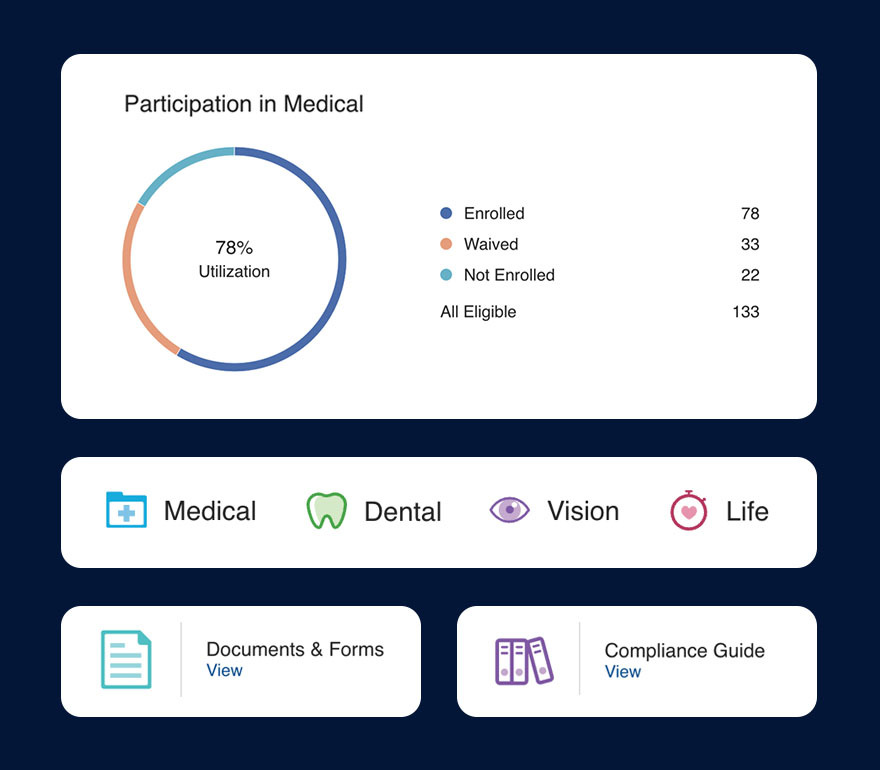

Paychex PEO* is your comprehensive HR solution, helping you manage employee benefits, HR, payroll, and compliance. Enjoy Fortune 500-level benefits at an affordable rate and access expert HR advice when you choose PEO.

Cover Your Business, Property, and Employees

Protect your business with comprehensive coverage for small businesses or large organizations,** from a general or cyber liability policy to workers’ compensation.

Offer Value and Convenience to Employees

Paychex Flex® empowers employees to handle tasks themselves, giving them the answers they need when they need them, saving your HR team time, and helping keep everyone productive.

The Single Platform for Your HR, Payroll, and Benefits

Whether self-employed or a large corporation, our Paychex Flex platform scales to serve any business size. Our award-winning technology offers employers a customizable solution to help with their most pressing HR and payroll needs. Save time and money with more than 30 self-service actions to increase employee convenience and independence.

What Are the Benefits for Arizona Businesses Working With a PEO?

Are you familiar with the E-Verify system? This is a requirement for businesses in Arizona that takes time to handle — time away from your business. A Professional Employer Organization (PEO) provides support for your HR administration, payroll processing, benefits administration, risk management, and more.

Contact a Paychex Payroll & HR Consultant

Need more reasons to work with Paychex?

- Extensive knowledge of Arizona state and federal laws and regulations

- User-friendly technology to help improve productivity

- Over 50 years of industry experience to help support your business

Convenient Service

Arizona businesses know how convenient it can be to work with Paychex:

- Use our app to do payroll and manage HR and benefits easily

- Save time by letting employees update their own information

- Get support when you need it most

Find the Right Solution for Your Business in Arizona

Paychex combines technology, expertise, and customer service to help you move your business forward. Find the right solution that works best for your individual business needs.

How Many Employees Do You Have?

Paychex Is the Smart Choice for Payroll and HR Services in Arizona

- Paychex pays 12 million workers — 1 in 12 U.S. private sector employees

- With over 15 years of experience on average, our national HR team helped clients on over 20,000 HR matters in 2023

- Chosen as the provider of the “Best HR Outsourcing for Small Business Overall” by Inc.com

Additional Resources for Businesses in Arizona

Payroll Solutions for Businesses of Every Size

Save time and money and focus on what matters most by working with Paychex for payroll services in Arizona. Hear from our customers about why they chose Paychex to ease the burden of payroll.

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

“When we acquire a new community, continuity in the team members is very critical to the residents, so it’s very critical for us to ensure … all these team members are enrolled in a payroll system, signed up for their benefits, get their 401(k).”

“We have quite a few employees that are working remote these days and Paychex Flex® really allows them to go in at any time and really check on their payroll, check on their contributions, and really look and make sure that everything is accurate."

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”