Paychex HR and Payroll Services in Tempe, Arizona

Paychex has the services, support, and expert staff to help Tempe’s businesses succeed. We’ve spent decades delivering reliable, reputable payroll and HR services to businesses nationwide.

Get a Free Quote

Business Information for Paychex in Tempe

Address and Phone Number

Need Customer Support?

View Support OptionsBusiness Hours

| Weekday | Time slot | Comment |

|---|---|---|

| Monday | 8:00 am-5:00 pm | MT |

| Tuesday | 8:00 am-5:00 pm | MT |

| Wednesday | 8:00 am-5:00 pm | MT |

| Thursday | 8:00 am-5:00 pm | MT |

| Friday | 8:00 am-5:00 pm | MT |

| Saturday | Closed | |

| Sunday | Closed |

Tempe

1600 N Desert Dr

Suite 125, 230

Tempe, AZ, 85281

Payroll Services for Tempe Businesses

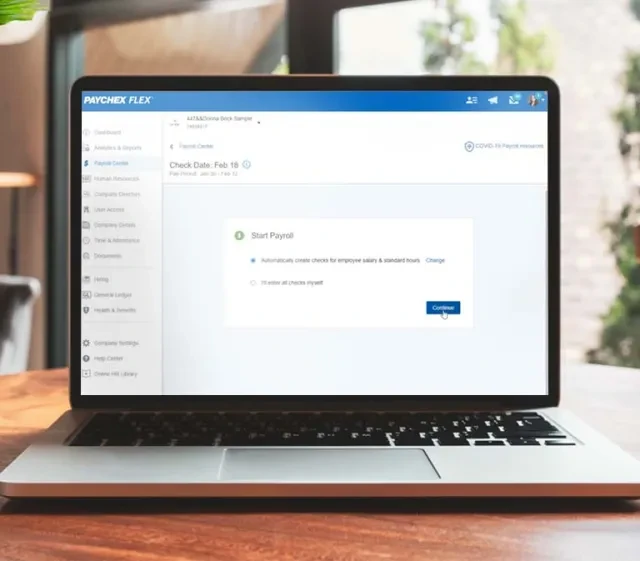

Payroll Made Easy, From Setup To Service and Support

We can help with payroll processing and other tasks so you can focus on more pressing areas of your business.

Compare Payroll Plans

Tempe businesses can choose from various payroll plans, from do-it-yourself solutions to more in-depth payroll support.

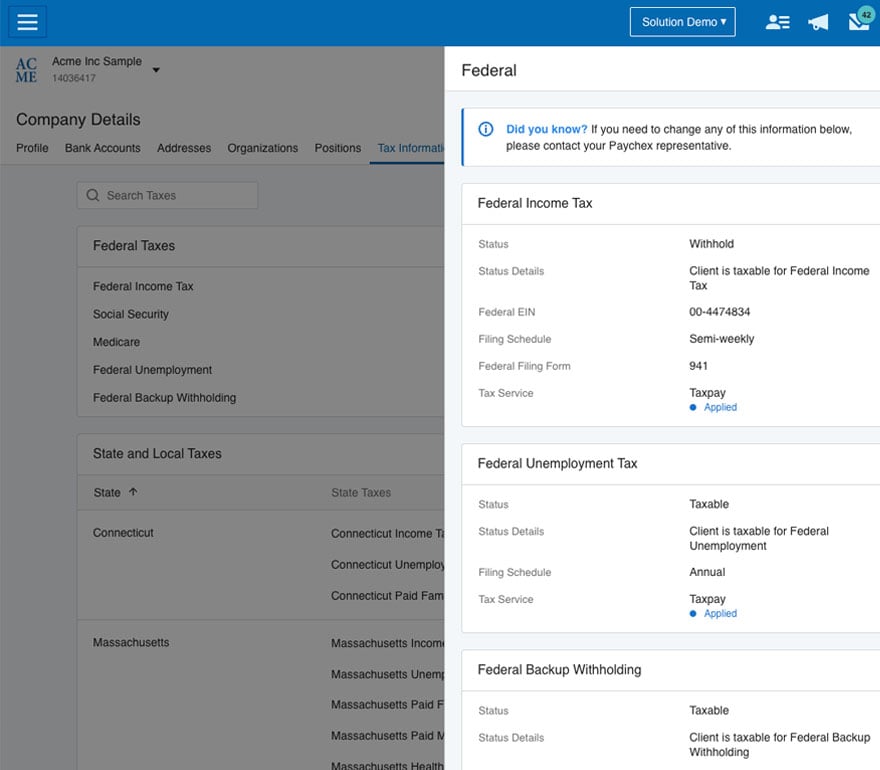

Automate Payroll Taxes

Paychex Flex® helps automate the calculation, payment, and filing of payroll taxes efficiently while helping your business secure tax credits it deserves.

Mobile App for Employers and Employees

Employers can manage business on the go and access payroll, HR, and other services.

How Paychex Supports Businesses

Our payroll solutions and HR services are here to support your Tempe business through every stage of the employee lifecycle.

Find the Right Solution for Your Business

Paychex leverages technology, expertise, and award-winning customer service to propel Tempe businesses forward. Find the right HR and payroll solution for your unique needs.