Paychex HR and Payroll Services in Irving and Dallas, Texas Area

Paychex helps Irving business owners streamline HR tasks and enhance payroll accuracy, giving you the confidence and resources to reach your full potential.

Request a Free Quote

Business Information for Paychex in Irving

Address and Phone Number

Need Customer Support?

View Support OptionsBusiness Hours

| Weekday | Time slot | Comment |

|---|---|---|

| Monday | 8:00 am-5:00 pm | CT |

| Tuesday | 8:00 am-5:00 pm | CT |

| Wednesday | 8:00 am-5:00 pm | CT |

| Thursday | 8:00 am-5:00 pm | CT |

| Friday | 8:00 am-5:00 pm | CT |

| Saturday | Closed | |

| Sunday | Closed |

Irving

8605 Freeport Parkway

Suite 100, 150, 250

Irving, TX, 75063

Payroll Services for Irving and Dallas Businesses

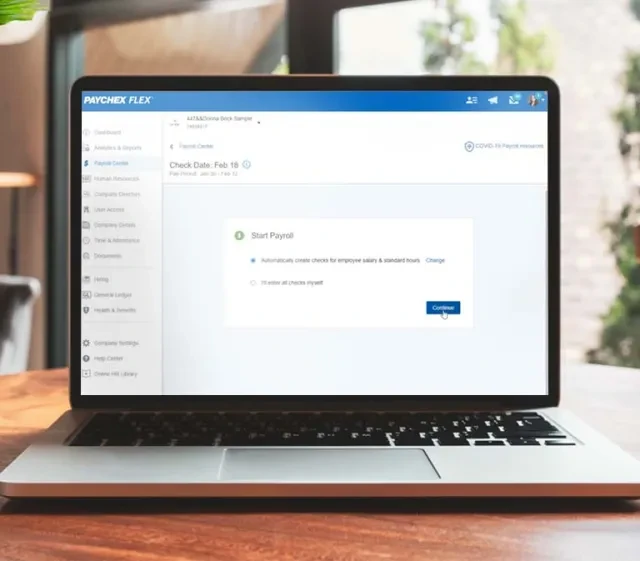

Simplify Payroll, From Setup To Service and Support

Pay your people in just a few clicks through our easy-to-use online payroll platform with flexible processing.

Compare Plans for Your Business

Paychex Flex® has various bundle options to fit the needs of businesses of any size in Irving.

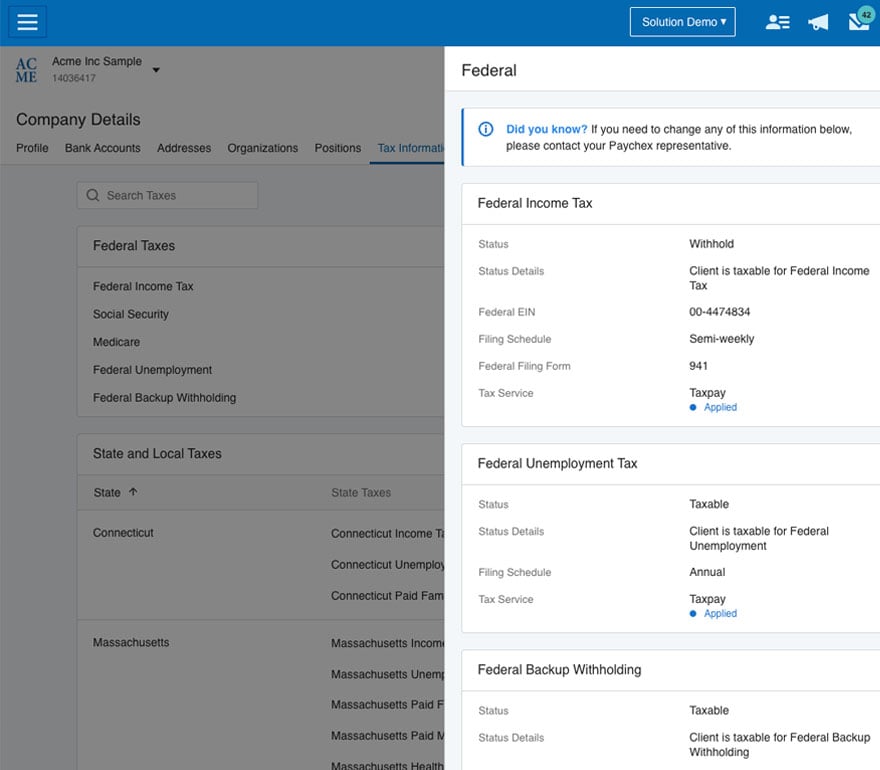

Automate Payroll Taxes

Efficiently keep up with payroll tax rates, accurately calculate liability, and make timely payments.

Mobile App for Employers and Employees

Enjoy easy access to your payroll, HR, and other services directly from your smartphone or tablet.

Additional Solutions for Irving and Dallas Area Businesses

We offer a variety of HR, payroll, and benefits solutions for businesses in Irving. With services ranging from tax administration to attendance tracking to personal HR consultation, we’re prepared to help you move your productivity and business forward.

Find the Right Solution for Your Business

Whatever the size of your business and whatever your HR or payroll needs may be, you can find the right solution at Paychex.

![[Update] What You Need to Know About New York State's Paid Family Leave Program nys paid family leave](/sites/default/files/styles/x_small_hq/public/image/2020-09/new-york-state-paid-family-leave.jpg?itok=neMwrJAO)