Payroll Services Made Easy

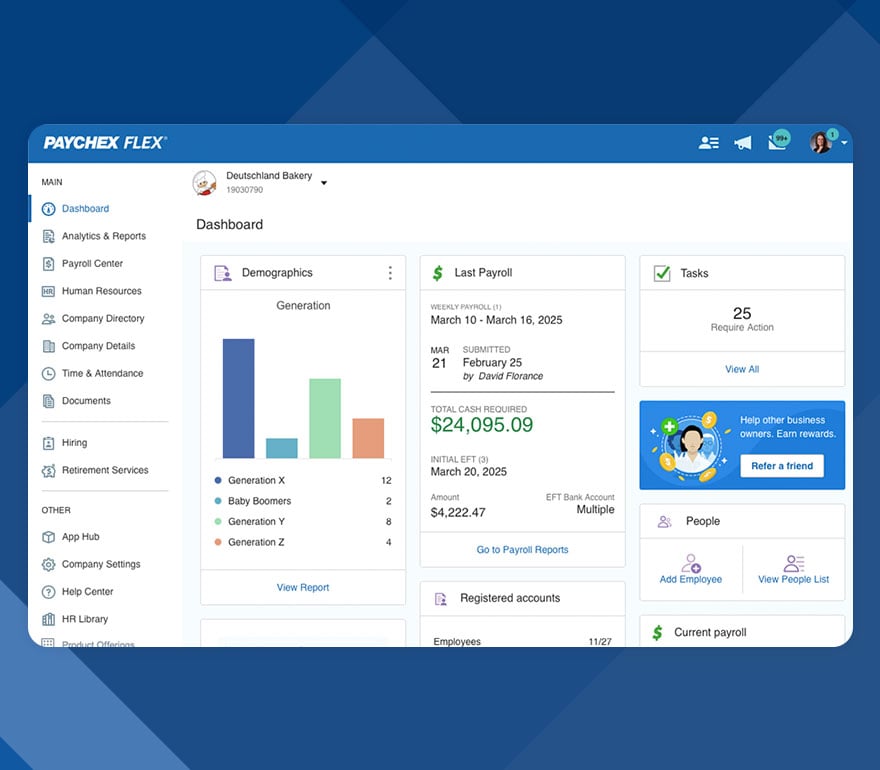

Run payroll in as little as 30 seconds with Paychex Flex®. Experience our HR platform featuring:

- Flexible processing options

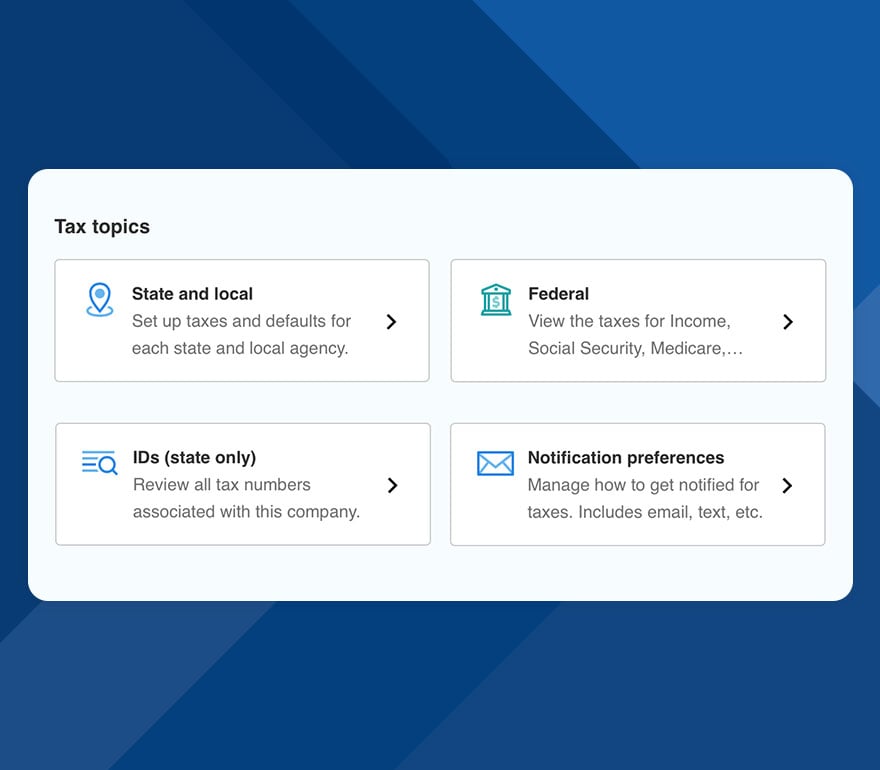

- Automated tax administration

- User-friendly 5-star mobile app

Reach a sales representative today at (855) 263-1021.

Payroll Solutions for Businesses of Any Size

Flexible Packages, Built For You

HR and Payroll are the foundation of your business. Start with just what you need and add more features as you continue to grow — without paying for the extras you don’t use.

Paychex Flex Select

Process payroll, file taxes online, and get access to online employee training and development, with flexible payroll support options.

Paychex Flex Pro

Easily setup, process payroll, and file taxes online or with an optional assigned specialist. Plus, you can access robust software and handbook tools.

Paychex Flex Enterprise

The complete large business payroll and HR solution, helping you stay compliant, train employees, gain insights through custom analytics, and more.

Why Our Clients Love Doing Payroll With Paychex

Flexible Payment Options

Employees can choose between direct deposit, printed checks, pay on-demand, and also access their pay stubs and tax documents at any time with self-service access.

Save on Time and Improve Accuracy

We automatically calculate, file, and pay your payroll taxes for you. That means fewer headaches and chances of costly mistakes.

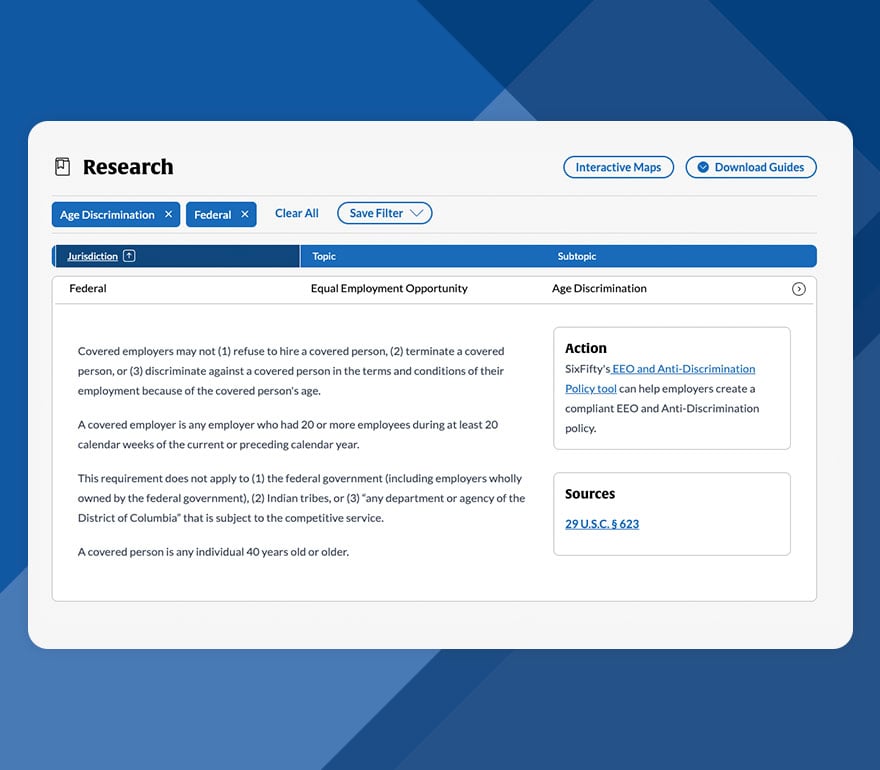

Reduce Risks and Penalties

We keep up with changing laws and regulations, so you can stay focused on running your business — not trying to understand legal updates.

Ensure Pay Day Precision

Allow employees to review their own paychecks in advance for accuracy using Paychex Pre-check®.

Scale As You Grow

Our HR and payroll packages grow with your business, so you never have to switch platforms — just add the features you need without having to learn a new system.

Run Payroll Faster Than Ever Before

-

Enter Payroll Data

Enter Payroll Data

Choose your pay period and enter employee hours, salaries, bonuses, or time off.

-

Review and Confirm

Review and Confirm

The system automatically calculates pay for you — just double-check to make sure it looks good.

-

Approve and Submit

Approve and Submit

In just one click, Paychex handles direct deposits, tax filings, and pay stubs/checks for your team.

-

Flexible Customer Support

Flexible Customer Support

Have any questions? We offer flexible support options via phone, chat, or email to help you when you need it.

Work With Tools You Already Use

Save time and reduce errors when you connect and share data between our HR software, Paychex Flex®, and dozens of other applications.

Industry Specific Technology

No matter what industry you’re in — Paychex is here to help you simplify processing payroll, deliver paychecks on time, automate tax filings, and comply with changing regulations.

Other Solutions To Help Your Business Succeed

Time & Attendance

Streamline workforce management with automated time tracking, scheduling, and attendance monitoring.

Human Resources

Comprehensive HR solutions support everything from hiring and onboarding to performance management and compliance.

Employee Benefits

Attract and retain top employees with competitive benefits packages including health insurance, retirement plans, and wellness programs.

Worker's Compensation

Protect your business and employees with workers' compensation insurance and claims management services.

Ready To Work With Us?

Easily Get Started

Have your information automatically uploaded whether you’re switching from another provider or starting new.

Simplified Onboarding

Easily complete onboarding and set up your Paychex Flex online account to begin processing your payroll instantly.

Support When You Need It

Gain access to HR, payroll, and account specialists ready to provide the best advice for your business, when you need it.

Why Nearly 800,000 Businesses Trust Paychex

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."

"StratasCorp Technologies was quickly outgrowing their payroll provider. Paychex helped them save 10 hours a month and $10,000 a year in tax penalties".

"We thought about doing our own payroll … and it would take maybe 5 to 7 hours …. With state and federal rules constantly changing, it would be difficult to keep up on … and I don’t want to make a mistake with my payroll … I want to get my workers paid and paid right."

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

Recommended for You

Payroll Solutions Frequently Asked Questions

-

Can I Do Payroll Online?

Can I Do Payroll Online?

Yes, you can do payroll online. Modern payroll services like Paychex Flex offer complete online payroll processing, including new-hire paperwork (W-4, I-9 forms), tax filing and payments, time tracking, benefits management, and reporting. Online payroll systems streamline processes, reduce errors, and provide 24/7 access to payroll data from any device.

-

What Information Do I Need for Payroll?

What Information Do I Need for Payroll?

To run payroll, you need business information (federal employer identification number, state ID numbers, workers' compensation coverage) and employee data including completed W-4 forms, Form I-9 documents, direct deposit information, and salary/wage rates. Additional requirements vary by state and business type. Learn more about everything you need to run payroll.

-

How Do I Set Up Payroll for My Employees?

How Do I Set Up Payroll for My Employees?

Setting up employee payroll involves five key steps:

- Obtain your federal employer identification number (EIN)

- Have employees complete W-4 and I-9 forms

- Choose your payroll frequency (weekly, bi-weekly, monthly)

- Set up tax withholdings and calculations

- Establish quarterly and annual tax filing schedules

-

Why Should I Use Paychex Payroll Services?

Why Should I Use Paychex Payroll Services?

Paychex payroll services offer comprehensive features including automated tax calculations and filing, direct deposit, compliance monitoring, HR integration, benefits administration, and dedicated support. Unlike basic payroll providers, Paychex provides full-service solutions that grow with your business and ensure accuracy and compliance.

-

What Payroll Support Options Does Paychex Offer?

What Payroll Support Options Does Paychex Offer?

Paychex offers three support levels: self-service online access, on-demand support with available representatives, and dedicated assigned payroll specialists. All plans include phone, chat, and online support, with higher-tier services providing personalized guidance and proactive compliance assistance.

-

Can Paychex Help With More Than Just Payroll?

Can Paychex Help With More Than Just Payroll?

Yes, Paychex provides comprehensive business solutions beyond payroll, including HR services, employee benefits administration, workers' compensation insurance, time and attendance tracking, compliance monitoring, and regulatory updates. Our HR professionals offer guidance on employment issues, policy development, and risk management to support your complete workforce needs. Need help finding a solution? Use our solution finder to explore your options.

-

Are Payroll Services Worth it?

Are Payroll Services Worth it?

Payroll services are worth the investment for most businesses because they save time, ensure tax compliance, reduce costly errors, and provide expert support. The cost of payroll mistakes, penalties, and time spent on manual processing typically exceeds payroll service fees, making outsourcing a cost-effective solution.

-

How Do I Do Payroll for My LLC?

How Do I Do Payroll for My LLC?

LLC payroll depends on your tax election and member structure. Single-member LLCs typically don't run traditional payroll, while multi-member LLCs may need payroll for employee-members. You'll need an EIN, proper tax elections, and compliance with state requirements. Consider consulting a payroll provider for LLC-specific guidance.

-

What Is a Payroll Service?

What Is a Payroll Service?

A payroll service is a company that manages employee payment processing, tax calculations, withholdings, and compliance reporting for businesses. Services typically include direct deposit, tax filing, year-end reporting (W-2s, 1099s), and compliance support, allowing business owners to focus on operations rather than payroll administration.