Why Not Get the Credit You Deserve? Explore Paychex’s ERTC Whitepaper

- Taxes

- Guide

-

Last Updated: 12/16/2022

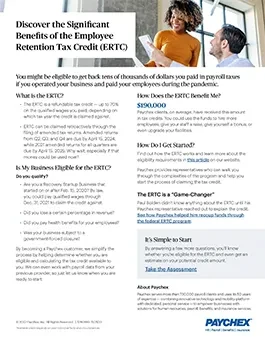

If your business paid qualified wages to employees during the pandemic, you might be able to claim the Employee Retention Tax Credit (ERTC) retroactively. Learn about the credit*, eligibility requirements, as well as a success story from a satisfied client. Then, get to an assessment to answer a few questions. Paychex handles the rest. It's that simple.

Take a minute to fill out the form (at right) to access the free content.

If you paid qualified wages to employees during the pandemic, you might be able to retroactively claim the Employee Retention Tax Credit — a major tax credit. How major? Our ERTC Service clients have received, on average, a whopping $130,000 in tax credits1. Think of what you could do with that kind of money — put it back into your business, reward your employees, take a well-deserved vacation. If you’re eligible, we’ll help make it happen.

The Paychex ERTC Service team can help you:

- Determine your eligibility

- Calculate potential credit

- File amended forms with the IRS

Discover how the Paychex ERTC Service is helping businesses get the credits they deserve.

1Credit amount varies based on your business circumstances.