Paychex Flex® Essentials

Easy online sign up, payroll, and tax filing for hands-on business owners.

Our most affordable option: Only $39/mo. + $5 per employee

- Paperless payroll with our five-star mobile app

- Figures and files your payroll taxes

- 24/7 support options available

- No cost or obligation until your first payroll

How It Works

-

Customize earnings and deductions

Customize earnings and deductions

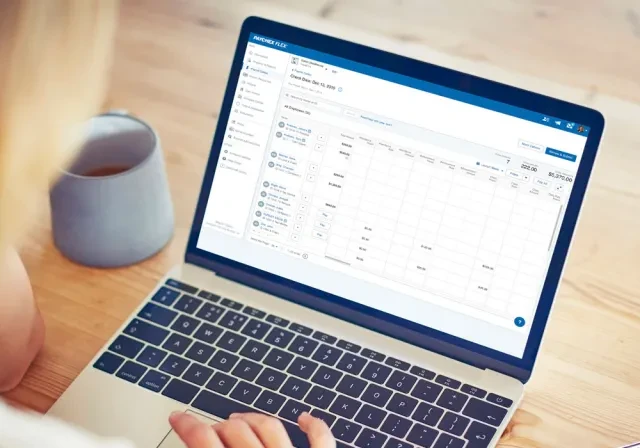

Choose from three different pay entry options, including a grid view for quick data entry.

-

Analytics and Reports

Analytics and Reports

Receive essential reports to help you more effectively run payroll.

-

Employee Self-Service

Employee Self-Service

Use People View to add new employees and invite them to log in and complete activities, such as updating their personal information and tax withholding.

-

Sign Up Quickly Online

Sign Up Quickly Online

Our easy, secure online sign-up process guides you step-by-step. Start payroll as soon as today — and save time and money. Our expert support team is available 24/7 to answer questions at any point along the way.

What You Get

Paychex Flex Essentials

Pay employees as often as you like with no restrictions or additional fees.

Electronically deposit payroll funds into employees’ accounts

Meet state reporting requirements for new and rehired employees and independent contractors.

Download the Paychex Flex mobile app to access Paychex information – and even submit payroll – on-the-go.

Add new employees and invite them to register for an account where they can complete activities on their own — saving you time.

Receive essential reports to help you more effectively run payroll.

Get access to common payroll reports such as a general ledger of all your financial transactions.

Rest easy knowing your federal, state, and identified local payroll taxes will be calculated, paid, and filed on your behalf. *Additional fees may apply.

Get your required employee and independent contractor tax forms for tax season. **Available at additional cost.

Electronically deposit payroll funds onto a prepaid paycard for easy access.

Help employees meet their financial goals with a variety of tools and education, including short-term employee loans.

Get help finding and applying for tax credits for which your business may qualify to maximize your tax savings.

An EAP can help your employees solve personal issues that may affect their productivity at work.

Customized Payroll Solution for Your Specific Needs

We created Paychex Flex Essentials specifically for businesses that:

- Have fewer than 20 employees and/or contractors

- Want to continue with Paychex payroll as their business grows

- Prefer signing up online rather than speaking with a salesperson

- Want the satisfaction of paying employees themselves while saving money

- Would like the ability to add health insurance, a retirement plan, and other HR solutions now or in the future as needed

One Platform for Your Business Needs

Our small business solutions are built to grow and change with your business. Run and manage your business from wherever you are with Paychex Flex, our all-in-one solution.

Frequently Asked Questions

-

What information will I need to sign up for payroll?

What information will I need to sign up for payroll?

To begin the process, please collect the following:

Company information

- Bank account details, including routing, checking account, and next check numbers

- Payroll schedule, including pay period (for example, biweekly) and date employees are paid

- Know who is legally allowed to sign company documents (in other words, your signatory)

Employee information

- Name, social security number, employee ID, address, contact phone and email, demographic, compensation, tax withholding information

Paychex Flex will fill in details along the way, including common pay items and taxes based on your company’s legal address. If employees work in other states, you can add that information too.

Note: A physical signature may be required on your state tax documents. We’ll let you know.

-

How easy is it to switch plans if my situation or needs change?

How easy is it to switch plans if my situation or needs change?

Each of our payroll packages and solutions are built to grow with you. Your Paychex representative can help you easily add services as they become necessary, as well as recommend solutions that may better fit the changing needs of your business.