- Payroll

- Article

- 6 min. Read

- Last Updated: 02/27/2025

How To Run and Process Payroll for Your Small Business

Table of Contents

Processing payroll is an essential part of operating any business that has employees. But it doesn’t come without its challenges. The more employees you have, the more complicated the process can become. If things go wrong during the payroll process, they often come at a price.

To help prevent this from happening at your company, read this overview on how payroll works, how to run and manage payroll, and your options for completing the process.

How Does Payroll Processing Work?

Once you have hired employees, you must pay them for the work they perform and handle applicable taxes each pay period. There are many steps involved in completing these tasks, which we will cover in detail. These and other responsibilities comprise the payroll process, which you or another staff member can do, or you can find an accountant or payroll provider to handle these tasks for you.

Setting up payroll for your small business may be easier when you have all the necessary information on hand, including specific information on your business, employees, pay and benefits, and payroll bank account. Below are some basic steps explaining how to set up employee payroll for small businesses.

1. Gather Required Business Information

Before getting acclimated with payroll basics or getting started, the following business items should first be in place:

- Obtain a Federal Employer Identification Number (FEIN): This is assigned by the IRS and is used to identify a business entity. You need this 9-digit number to pay federal taxes, hire employees, open certain bank accounts, and apply for business licenses and permits. You can do this online on the IRS website.

- Register with your state and local government: Depending on your business structure and location, you may need to register for a state ID number to pay your business’s state taxes. Tax obligations and steps to get an ID number differ at the state and local levels, so check with the appropriate agencies.

- Look into workers’ compensation coverage: This coverage is mandatory in most states. However, rules vary from state to state regarding how many people a business can employ before it is required. Nonetheless, it’s strongly recommended that you have workers’ compensation coverage if you have employees.

- Report new hires: State and federal laws require employers to report information on new and rehired employees to the appropriate agency, generally within 20 days of beginning employment. Some states require reporting this data sooner.

2. Ensure You Have All Employee Information Needed To Process Payroll

There are also specific pieces of employee information you’ll need to gather before getting payroll started. They include:

- Employee classification: Any employee you bring on board must be classified correctly as either nonexempt or exempt from overtime and minimum wage protections under federal, state, and local law. Proper employee classification will help you compensate everyone on your payroll.

- New-hire documents (Form W-4, Form I-9, etc.): Although nearly all new hires complete certain forms, they may vary from company to company due to industry-specific regulations, company benefits, and policies. In addition, for employers with more than one location, different state and local laws may require employees at certain worksites to complete certain documents.

- Payment method: Depending on applicable law and your available options, you will have various tasks to complete to deliver employee pay whether that’s via direct deposit, paper checks, or a paycard. Learn more about employee pay options that may be available to your business.

3. Choose Desired Pay Periods

Companies can typically choose which pay period(s) they want to set up for paying employees, including weekly, biweekly, semimonthly, or other cycle frequencies. There can also be different pay schedules for different employees, such as one type of pay period for employees paid on a salary basis and another for employees paid hourly.

Remember that the state(s) in which you operate may have specific pay requirements, such as a particular number of days an employee must receive payment for earned wages after a pay period ends. Depending on the laws that apply to your business, you may choose different pay periods for groups of employees, but these frequencies should stay consistent.

4. Factor in Any Employee Benefits

Part of setting up payroll for small businesses requires knowing how much to deduct from each employee’s paycheck for benefits contributions. These can include statutory benefits and any supplemental benefits you might offer, such as health insurance, disability coverage, and retirement plans. How much to withhold depends on the benefits plan type, the coverage level an employee chooses, and whether they are pre-tax or post-tax deductions.

5. Create a Payroll Bank Account

It’s a good idea to set up a separate bank account from any other business account for paying employees and making tax payments. It’s not required as part of the payroll setup process, but it’s a valuable bookkeeping practice that can help you keep accurate payroll records.

How To Process and Run Payroll

Employees depend on and expect timely, accurate delivery of their paychecks. Any disruptions or errors can prevent your process from running smoothly and could lead to turnover. When learning how to run payroll, the following are foundational basics with which you must become familiar.

1. Accurately Track Time Worked

Processing payroll effectively relies on accurately tracking the time worked by employees. There are various methods for tracking time worked, including time and attendance software that may integrate with payroll systems or having employees track their time manually. Keep in mind that, like payroll, manual methods for tracking time worked by employees can lead to inaccuracies. This is why, when evaluating your payroll process, you may also want to assess whether a time and attendance solution is a good fit for your business.

2. Ensure You Understand Different Types of Pay

Before you can calculate your employees’ wages, it’s essential to understand the different types of pay so you can mitigate payroll errors.

- Gross pay: An individual’s total earnings before taxes and other deductions are withheld for a given pay period.

- Net pay: The amount an individual takes home after taxes and deductions.

3. Calculate Employee Wages

Many calculations and factors impact an employee’s wages, including:

- Determine your business’s payroll schedule: A payroll schedule establishes employee pay dates after considering state pay frequency laws, tax payment due dates, tax return filing deadlines, etc. You’ll also want to account for scheduling special payrolls for seasonal or annual bonuses.

- Calculate wages: Calculate wages in compliance with applicable federal, state, and local laws.

- Account for overtime pay: On the federal level, if an employee worked over 40 hours in a single workweek and is classified as nonexempt, they are eligible for overtime pay. However, note that certain states have different overtime requirements.

- Comply with wage garnishments: A wage garnishment is any legal or equitable procedure where some portion of a person’s earnings is withheld by an employer for the payment of a debt such as alimony, child support, student loan default, or other circumstances. If notified by an enforcement agency, employers should immediately start the wage garnishment process to ensure that payments are sent to the appropriate agency or creditor. This helps protect the business from any legal repercussions for not responding to the order.

- Factor in benefits contributions: Account for benefits contributions such as workplace-sponsored retirement plans, health, life, or disability coverage, and flexible spending accounts. In such cases, you’ll need to calculate and deduct each employee’s individual contributions from each paycheck.

4. Deduct Payroll Taxes

Employers generally must withhold federal and state income tax from all employees’ taxable wages based on what employees enter on their withholding form(s). Here’s a brief explanation of a few mandatory payroll taxes:

- Federal income tax: This is withheld from an employee’s wages, reported to the federal government, and applied to the employee’s calculated tax liability at the end of the year.

- Social Security and Medicare taxes: The employer and employee generally pay these taxes equally to fund these entitlement programs.

- Federal unemployment tax: This is paid to provide funds for paying unemployment compensation to workers who lost their jobs.

Some employers must also pay state unemployment (SUI) tax. Except for in a few states, SUI taxes are not deducted from an employee’s wages.

5. Pay Your Employees

Once you’ve deducted the proper taxes and withheld any deductions from employees’ gross pay, their take-home or net pay is what remains. You’ll pay employees according to their pre-selected receipt method, such as direct deposit, a paper check, or a paycard. Depending on your jurisdiction, you may need to include specific information on the pay stubs provided to employees when wages are paid. Employees should review their pay stubs and report any payroll mistakes.

6. File Taxes

Once you have deducted taxes from your employees’ paychecks, you must file them with the appropriate tax agencies. In doing so, you must use specific required forms to report withholding activities to the proper federal, state, and local tax authorities:

- Form 940, an employer’s annual FUTA tax return

- Form 941, an employer’s quarterly tax return reporting withholding and the employer’s share of FICA (Federal Insurance Contribution Act)

- Form 943, the employer’s annual return for agricultural employees

- Form 944, used for small employers eligible to pay employment taxes annually rather than depositing them according to a schedule

- Form 945, a federal income tax return used to report non-payroll payments, including pension distributions

Federal Payroll taxes must be deposited electronically through the Electronic Federal Tax Payment System, or EFTPS. Small employers who can pay their employment tax when filing their annual employer tax return can use EFTPS. For state employment taxes, check with your state to determine how to report and deposit employment taxes.

7. Properly Document and Store Payroll Records

Proper bookkeeping is one of the most critical tasks for a small business doing payroll. Good records are necessary to prepare tax returns, IRS and insurance audits, and bank financing. That’s why it’s essential to get started with a sound accounting system and maintain your backup records in a logical and organized manner. “One of the most common issues we find is that companies do not have a good recordkeeping system in place, so we always want to encourage clients to review their current process and identify areas of opportunity to prevent issues down the road,” noted Paychex Enterprise Services supervisor Nicole Hurley.

Learn more about bookkeeping basics and which records you need to keep and for how long.

8. Report Any New Hires

All employers must follow the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996, which requires employers to report all new hires to the appropriate state agency within a pre-selected period. As part of the onboarding process, 20 days if your business sends the information by mail or twice a month if you send this information electronically. Non-compliance with this federal regulation could result in monetary or non-monetary civil penalties by the state.

Most of this information can be found on the W-4 once an employee is hired, but you should check all paperwork to be sure.

Advanced Tax Handling Techniques

Handling payroll taxes can become complex with multi-state workers and expatriates and optimizing tax credits. Here’s a quick breakdown:

- Multi-State Taxes: Employers must navigate state income tax and unemployment insurance for employees working across state lines. Reciprocal agreements may simplify withholding, while apportionment is needed for employees working in multiple states . Learn more about tax compliance for your state.

- Expatriate/Remote Worker Taxes: U.S. workers abroad may qualify for the Foreign Earned Income Exclusion (FEIE), reducing their U.S. tax liability. However, employers must still handle Social Security and Medicare unless covered by a totalization agreement .

- Tax Credits: Leverage credits like the Work Opportunity Tax Credit (WOTC) for eligible hires or the R&D tax credit to lower payroll taxes for startups .

Expert Tip: Use payroll software like Paychex to automate compliance and track complex tax scenarios.

Should a Small Business Owner Put Themselves on Payroll?

A business owner has a few options to withdraw income from the business. Some owners can opt to take a regular salary instead of or in addition to an owner’s draw, which is money withdrawn from the company for personal use with no taxes withheld. When a business owner is on payroll and takes a salary, they are treated as any other W-2 employee. Once this salary level is set, it must be paid consistently with the appropriate amount of taxes withheld on both the employee (who, in this case, is the owner) and the business side.

Note that sole proprietors and partners in a partnership are not treated as W-2 employees by the IRS. In addition, any distribution of income needs to be reconciled with the IRS, and generally, self-employment taxes need to be paid on a quarterly basis. Business owners should always consult their accountant or attorney for safe guidance on this topic.

Depending on your business’s structure, specific methods for paying yourself as a business owner are ideal when factoring in flexibility, IRS regulations, and tax implications.

How Long Does Payroll Take to Process?

The timeline for processing payroll can vary depending on your payroll schedule, the bank’s policies, and the employee pay method. For example, once you’ve completed the initial setup for direct deposit and processed a successful payroll, employees can see funds posted up to 2 days before the check date and no later than the check date, depending on the banking institution. Most banks can also accommodate real-time or same-day ACH.

With paper checks, employees may have to wait for the check to arrive in the mail and then take it to the bank to deposit, which can take more time.

Can You Process Payroll by Yourself?

Running payroll is essential to operating any business with employees, regardless of size or industry. Business owners have several options for running payroll, including outsourcing the process. Depending on your chosen method, consider factors such as how much control or oversight you want to have, cost considerations, and time commitments.

Business owners who want to manage payroll themselves must become familiar with the terminology, options, and basics of running payroll, as well as some payroll-related laws to help avoid making costly payroll mistakes. So, while you can certainly figure out the process, doing payroll yourself can be difficult.

The consequences of a payroll mistake can be costly. Even if these errors are caught before submission, they can still require countless hours of reprocessing employee paychecks and tax returns.

Unpaid taxes or wages can result in hefty penalties, and mistakes in employee paychecks can result in additional penalties in certain jurisdictions while eroding worker morale and harming your business reputation. Understanding the ripple effect that payroll inaccuracies can have on a business, today’s leading payroll processing companies, such as Paychex, have developed tools such as pre-check services to help improve payroll accuracy by providing employees with a chance to report concerns with their paycheck before payday allowing their employer to resolve what could otherwise be costly errors. Advanced HR features and technology, such as letting employees quickly review and approve their paychecks before payday, are typically unavailable when doing payroll alone, making your business more vulnerable to payroll errors, miscalculations, and penalties.

Is Doing Payroll Yourself Worth It?

Given its complex nature, processing payroll alone can cost more than you may save initially. Plainly speaking, doing payroll yourself may not be worth it.

If part of your consideration is wondering how long payroll processing takes, consider that it can take hours of your already busy workweek to do payroll yourself. The process gets more complex as you add more employees to the payroll. This may contribute to a recent finding that nearly 80% of small businesses surveyed in the 2023 Paychex Pulse of HR Survey said they plan to digitize their HR efforts this year.

Why Integrate Payroll with Other Business Systems?

Integrating payroll with your HR management, accounting software, and employee scheduling tools can provide seamless data flow and real-time updates, minimizing repetitive tasks and manual data entry.

- Streamlined Operations: By connecting payroll to systems like HR and scheduling, you’ll ensure data consistency across all departments, cutting down on redundant work and administrative burdens.

- Reduced Errors: Automate data transfer between systems to eliminate manual entry errors, ensuring accurate payroll calculations and compliance with regulations.

- Time Savings: Automate processes like calculating pay rates by location or role to free up time and ensure precise and timely payroll processing.

Custom Payroll Considerations for Different Business Types

Each industry has unique payroll challenges that require specific solutions. Here are some key aspects to consider for 8 different business types, highlighting factors that can help make payroll more efficient and effective for each. Take note, however, that nearly all business types should account for most of the following.

Restaurants and Hospitality

- Tip reporting: Employers must accurately report tips and ensure compliance with IRS regulations, including calculating taxes on tips.

- Variable schedules: Manage fluctuating work hours, part-time shifts, and overtime due to irregular schedules.

- Seasonal workers: Hiring spikes during peak seasons require an adaptable payroll system to quickly onboard and offboard staff.

- Compliance with tip credits: Many states allow tip credits, impacting the minimum wage that businesses must pay; tracking this is critical .

Professional Services

- Salaried vs. hourly workers: Many firms have a mix of salaried and hourly employees, which can result in different payroll processes.

- Client-based expense reimbursements: Expenses incurred on behalf of clients may need to be integrated into payroll for quick reimbursement.

- Overtime exemptions: Professional services often involve salaried employees exempt from overtime; proper classification is critical .

Healthcare

- Multiple shifts and overtime: Healthcare involves rotating shifts and frequent overtime. Payroll systems must handle shift differentials accurately.

- Employee mix: Payroll must account for per diem staff, as well as part-time and full-time employees, each with different tax and benefit structures.

- Credential-based pay: Pay can vary depending on the qualifications or certifications of healthcare workers, such as nurses or technicians.

- Compliance with labor laws: Stringent labor laws govern healthcare, requiring accurate time tracking and proper overtime calculation.

Skilled Trades

- Job costing: Tracking labor costs per project or job is critical in skilled trades, such as construction or plumbing, to manage payroll effectively. For instance, construction companies may need to track hours across multiple jobs and large clients may need to distribute earnings across several departments.

- Union dues and benefits: For unionized workers, payroll must manage deductions for dues and ensure employees are paid in accordance with any collective bargaining agreements.

- Apprenticeship programs: Payroll may need to track wages for apprentices, which often change based on hours worked or milestones reached .

Retail

- Shift differentials: Retail businesses often have employees working varying shifts, requiring accurate payroll calculations for shift differentials and overtime.

- High turnover: Managing payroll for frequent new hires and terminations is a common challenge in retail.

- Commission and bonuses: Sales-based roles often involve commission structures, which must be integrated into payroll systems.

- Seasonal workforce: Retail businesses often need to scale payroll systems to handle the influx of temporary employees during peak seasons .

Senior Living

- Round-the-clock shifts: Like healthcare, senior living requires payroll systems flexible enough to account for multiple shifts, overtime, and varying schedules.

- Certification-based pay: Pay rates may vary depending on staff certifications, such as CNAs or registered nurses.

- Benefits management: Comprehensive benefit tracking is critical, as many senior living facilities offer healthcare, retirement, and other benefits .

Manufacturing

- Multiple pay rates: Employees working different roles or machines may be paid different rates, which must be managed accurately.

- Overtime and shift differentials: Manufacturing payroll often includes frequent overtime and various shift differentials that need precise tracking.

- Unionized workforce: If unionized, manufacturing businesses must manage complex payroll structures involving dues and negotiated pay increases.

- Job costing and labor allocation: Payroll must often account for time spent on specific projects or product lines.

Nonprofits

- Grant tracking: Payroll for nonprofits may need to allocate labor costs to different grants or funding sources.

- Volunteer and employee mix: Managing payroll for a mix of full-time employees, part-time staff, and volunteers requires flexibility.

- Tax-exempt benefits: Nonprofits must ensure that payroll processes align with their tax-exempt status and employee benefits packages.

- Donor-funded positions: Payroll systems may need to account for donor-restricted funds that pay for specific organizational roles .

Understanding your industry’s unique payroll needs allows you to tailor your processes to improve efficiency, reduce errors, and ensure compliance. Setting up payroll workflows that fit these distinct needs helps your business run smoothly while staying compliant with relevant regulations.

Benefits of Outsourcing Payroll

There’s too much at stake for business owners to commit time-consuming (and potentially expensive) payroll processing errors. Consider the benefits of using payroll services from a professional provider:

- Time saving: Payroll outsourcing can make the entire process more efficient. No matter how many employees a business has, processing payroll demands time and attention to detail. This often comes at the cost of valuable time that could otherwise be spent on more pressing business priorities. Outsourcing payroll to a reputable provider gives owners more time to focus on what matters most. In many cases, they’ll also have various options to maximize time saved throughout the pay period.

- Greater efficiency: Look for a provider that allows you to import multiple files at one time from one location, so you don’t need to wait for each file to complete before processing a new one.

- Money saved: Costs saved on printing and distributing paychecks and generating reports for in-house and accountant use.

- Greater security: Protection against identity theft, embezzlement of funds, and tampering with records for personal gain.

- Professional know-how: Payroll providers with expertise in running payroll can help at any point in the process.

Keeping up with the complexities of employee withholdings, minimum wage legislation, and IRS forms can be daunting. Outsourcing payroll can also help lighten the burden that often comes with payroll tax compliance, including mitigating your business’s risk of penalties for late or inaccurate payments. “Paychex is dedicated to being an integral payroll partner, assisting companies with the complexities within the payroll world and allowing businesses to be confident in their ability to pay employees timely and accurately,” said Hurley.

Legal Pitfalls When Running Payroll and How To Avoid Them

Payroll processing comes with several potential legal risks that may lead to fines or penalties if mishandled. Here are some common pitfalls and how to avoid them:

- Employee misclassification: Misclassifying employees can result in hefty penalties and back wages. Avoid this by following federal and state-specific criteria to classify employees correctly as exempt or nonexempt.

- Overtime non-compliance: Failing to pay eligible employees’ overtime can lead to legal consequences. Ensure your payroll system calculates overtime accurately by following the Fair Labor Standards Act (FLSA) and state and local laws .

- Wage errors: Underpayment or failure to meet minimum wage laws can lead to employee disputes and legal issues. Regularly audit payroll systems to verify accurate wage rates and deductions .

- Payroll tax mistakes: Late or incorrect payroll tax payments can incur IRS penalties. Use automated payroll software or partner with a service provider to help you process timely and accurate tax filings.

Expert insight: To avoid costly mistakes, be sure to review payroll processes regularly and seek legal or compliance guidance.

How To Process Payroll With Paychex

Payroll tasks can be particularly complex among the many items on small business owners’ to-do lists. Handling these administrative responsibilities alone carries many risks and costs, most significantly the time it can take away from busy workdays.

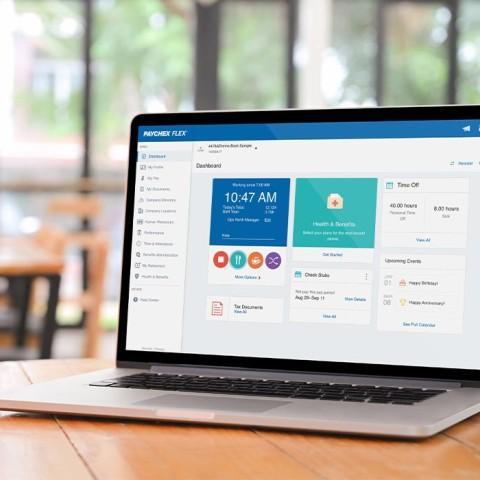

Paychex makes it easy for businesses of all sizes to process payroll using their Paychex Flex® platform or mobile app. To get started, you can input employee information, work hours, and any additional pay details into the system. Paychex Flex then calculates necessary taxes and deductions, helping with state and federal regulations. Once you review and approve the payroll, payments can be directly deposited into the employees’ accounts or distributed via various other payment options.

The information in these materials should not be considered legal or accounting advice and it should not substitute for legal, accounting and other professional advice where the facts and the circumstances warrant. It is provided for informational purposes only. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant, or other tax professional to discuss your particular facts, circumstances, and business needs.

Get Help With Payroll Processing Today

Not sure where to start? Paychex Flex® has bundle options that allow you to pick the services that fit your business needs.

Tags