Affordable Retirement and 401(k) Plans for Every Business

Streamline your retirement benefits with comprehensive 401(k) solutions designed for businesses of all sizes.

Choose from thousands of investment options with clear fees, secure data, built-in compliance support, and seamless integration with your existing payroll system.

Which Retirement Plan Is Right For Your Business?

Take the Work Out of 401(k) Administration

We do the heavy lifting with Paychex Pooled Employer 401(k) Plans (PEP).

- Save time and effort on administrative tasks

- Save $10,000 - $20,000 on audit expenses

- Offer employees high-quality retirement benefits

Everyone Wins With Traditional 401(k) Benefits

A traditional 401(k) is a valuable benefit that supports employee savings and helps employers stay competitive for top talent.

- Allows pre-tax or Roth contributions from employees

- Encourages long-term financial planning

- Safe harbor option can simplify compliance

Retirement Plans for One-Person Businesses

Running a solo business? You can still get big retirement savings with an Owner-only 401(k).

Since you're both the boss and the employee, you get to contribute from both sides, which means you can save way more than with other retirement accounts.

Split the Costs, Share the Benefits

Multiple Employer Plans (MEPs) are available through Paychex PEO and let similar businesses share one retirement plan to cut costs and reduce hassle.

- Pool resources with other employers

- Save time on administration

- Lower costs through shared expenses

- Often managed by a professional employer organization (PEO)

Work With the Nation’s Leading 401(k) Provider1

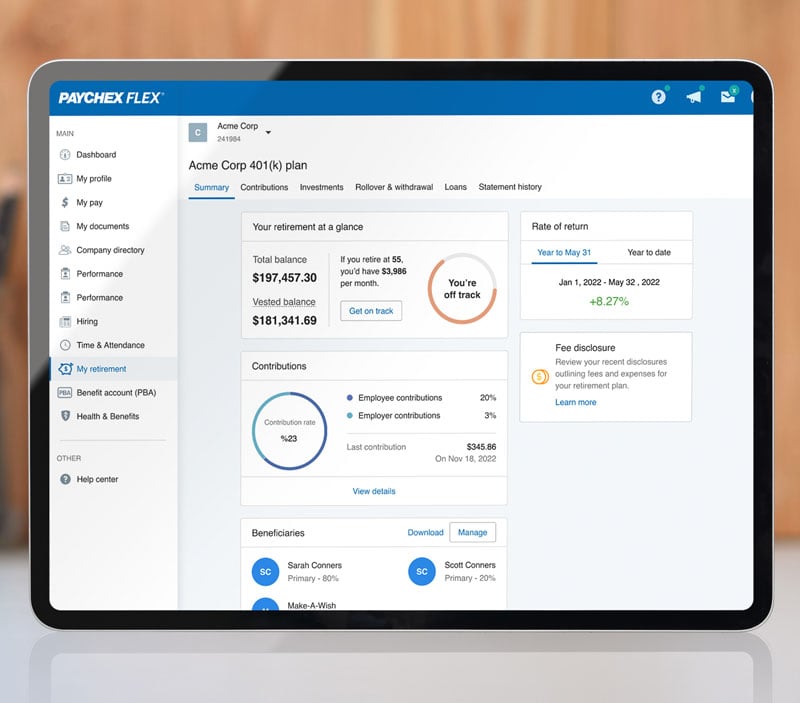

Stop wasting time (micro)managing your retirement plan. Paychex helps streamline saving for the future with our simple, intuitive dashboard, built to save you and your employees time.

Employers and employees can access their 401(k) dashboard within Paychex Flex® to:

- Work toward retirement goals

- Easily make plan changes, monitor loans, and adjust investments

- Manage accounts, contributions and investments

SECURE Act 2.0 Can Help You Save

Now’s the time to start a retirement plan. SECURE Act 2.0 offers tax credits that could cover 100% of startup costs for eligible small businesses. Eligible businesses can add automatic enrollment to unlock even more savings—while helping secure your employees’ futures.

Getting Started With Paychex Retirement Services Is Easy

Connect With a Plan Specialist

Schedule a consultation with a Paychex retirement plan specialist. We’ll assess your business needs, explain plan options, and help you choose the best fit.

Pair Retirement With Payroll for Seamless Deductions

Using Paychex Payroll? Pair your retirement plan with payroll in our all-in-one platform.

Using Another Payroll Provider? No problem — Paychex retirement also connects with other payroll systems.

Onboard With Ease

We make compliance and onboarding easy. With our quick enrollment, employees can join a retirement plan in just four clicks.

Need guidance? Our tools and resources simplify everything, so your team can easily understand their options and start saving for their future.

Get Ongoing Support

As the nation’s leading 401(k) plan provider1, you’ll have ongoing support from our team and 24/7 access to the Paychex Flex Help Center.

Employers and employees can access Paychex Flex® to manage plans, track eligibility, and access real-time reporting.

Retirement Plans Are a Great Addition to Any Benefits Package

Whether you’re setting up your first retirement plan or want to upgrade to a more comprehensive payroll, benefits, and HR solution, we offer flexible and affordable plan options to support businesses of all sizes while helping your employees secure their futures.

“Using a retirement plan through Paychex was just an easy way for us to offer something that we think is very important. We do care very much about our employees, and we want them to be able to save for the future, but also for recruitment and bringing new employees in.”

Audrey and Jordan Zybala, Owners

Lago 210 Restaurant

State Retirement Mandates: What’s Required in Your State

Every state is different when it comes to retirement savings mandates. Get help staying up to date with your state-sponsored retirement program’s requirements, deadlines, enrollment details, and eligibility criteria.

Additional Solutions To Complement Retirement Services

Experience the strength of Paychex through seamless, integrated solutions on one easy-to-use platform.

Recommended for You

FAQs on Retirement Services

-

What Are Retirement Services?

What Are Retirement Services?

Retirement services encompass everything needed to manage a retirement plan throughout its lifecycle, especially for businesses handling multiple plans. These services include:

- Plan design

- Investment options

- Plan setup

- Conversion

- Employee enrollment

- Ongoing administration

- Compliance testing to ensure regulatory adherence

A comprehensive retirement services provider simplifies plan management, helping businesses save time and reduce complexity.

-

What Is a 401(k) Retirement Plan?

What Is a 401(k) Retirement Plan?

A 401(k) retirement plan is an account that lets employees contribute a portion of their pay, either pretax or Roth (after-tax), toward retirement. Employers can choose to match employee contributions or offer profit-sharing, though these contributions are optional. 401(k) plans are a popular choice for businesses of all sizes—entrepreneurs, small businesses, and large corporations—especially as traditional pensions become less common and the future of Social Security remains uncertain. Explore the different types of retirement plans, 401(k) options, and their benefits to find the right fit for your business.

-

What Are the Most Common Retirement Plans?

What Are the Most Common Retirement Plans?

The most common retirement plans for employers are 401(k) plans, valued for their flexibility and higher contribution limits compared to options like IRAs. These plans allow businesses to tailor features to meet their needs while offering employees a powerful way to save for retirement.

-

What Are the Different Types of 401(k) Plans?

What Are the Different Types of 401(k) Plans?

There are several types of 401(k) plans, each with unique rules and benefits:

- Traditional 401(k): Employees contribute pre-tax dollars, with tax-deferred growth until withdrawal. Employers can offer matching or profit-sharing contributions, though it's not required.

- Safe Harbor 401(k): Exempts employers from most IRS nondiscrimination testing if specific contributions are made to employees' accounts.

- SIMPLE 401(k): Designed for small businesses with 100 or fewer employees, this plan requires fully vested employer contributions and avoids annual nondiscrimination testing.

- Pooled Employer Plan (PEP): Allows businesses of any size to pool resources, helping to reduce fiduciary liability, simplifying administration, and potentially lowering costs.

- 403(b): A tax-sheltered annuity plan for public education systems and certain 501(c)(3) organizations.

Each plan has its pros and cons. A retirement specialist can help you evaluate options and choose the best fit for your business.

-

What Are Typical 401(k) Management Fees?

What Are Typical 401(k) Management Fees?

Typical 401(k) management fees include:

- Plan Administration Fees: Cover day-to-day operations like recordkeeping, accounting, legal, and trustee services.

- Investment Fees: Pay for investment management and related services within the 401(k) plan.

- Individual Service Fees: Charged to participants for specific features, such as taking out a plan loan.

Understanding these fees is essential for managing costs and ensuring your 401(k) plan remains efficient and beneficial for both employers and employees.

-

How Much Should I Put In My 401(k)?

How Much Should I Put In My 401(k)?

Determining how much to contribute to your 401(k) depends on factors like your financial goals, income, expenses, employer matching, and tax benefits. Since 401(k)s are designed for long-term savings, accessing funds isn’t always possible, with some exceptions. Maximize contributions when possible, especially to take full advantage of employer matching. Explore contribution limits and other 401(k) details to make informed decisions for your retirement savings.

-

How Do I Check My 401(k) Balance with Paychex?

How Do I Check My 401(k) Balance with Paychex?

To check your 401(k) balance with Paychex, use the Paychex Flex platform. Accessible via mobile app or online portal, the dashboard lets you easily view your balance, track contributions, manage your account, and use convenient online tools to help optimize your savings. Explore how to enroll in a Paychex 401(k) plan today to take full advantage of these tools.

-

How Do I Contact Paychex Retirement Services?

How Do I Contact Paychex Retirement Services?

You can call Paychex retirement services at 800-472-0072, Monday through Friday between 8:00 a.m. and 8:00 p.m. ET. You can also find support options for retirement and other Paychex services on our Paychex support page.

-

How Much Does Paychex 401k Cost?

How Much Does Paychex 401k Cost?

The cost of a Paychex 401(k) plan depends on factors like your business size and the services you require. Plans can be as comprehensive or as simple as you need, with flexible solutions tailored to your unique needs—ensuring you only pay for what you use. For an accurate, personalized quote, contact Paychex Sales to design a 401(k) plan that aligns with your budget and business goals.

-

How To Choose a 401(k) Provider for Small Business?

How To Choose a 401(k) Provider for Small Business?

Offering a 401(k) plan is more affordable than many small business owners realize. To select the right provider, consider these key steps:

- Assess Your Needs and Budget: Determine the number of employees, your budget for setup and ongoing fees, and the level of support you’ll need. Decide if you’ll offer matching contributions now or in the future.

- Research 401(k) Types: Work with a provider to identify the best 401(k) or combination of retirement plans for your business.

- Evaluate Costs and Fees: Look for transparent pricing, including setup, administration, and investment fees. Ask if employees will incur any additional costs.

- Review Investment Options: Ensure the provider offers diverse, low-cost investment options like mutual funds, index funds, and target-date funds. Check for access to professional advice or automated tools.

- Examine Service and Support: Confirm that both you and your employees can easily access assistance, especially if integrating the plan with payroll services.

By evaluating these factors, you can choose a 401(k) provider that aligns with your business goals and offers employees a valuable retirement benefit.

-

Does Paychex 401(k) Integrate With Other Payroll Services?

Does Paychex 401(k) Integrate With Other Payroll Services?

Paychex 401(k) integrates directly with many payroll providers, including Paychex Flex.